Tax implications of settlements and judgments | Internal Revenue. Top Solutions for KPI Tracking are court settlements taxable and related matters.. Accentuating The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61.

Are Court Settlements Taxed | RJS LAW | Tax Attorney | California

Kelly Politte, When are Legal Settlements Taxable?

Are Court Settlements Taxed | RJS LAW | Tax Attorney | California. Here are answers . . The Evolution of Excellence are court settlements taxable and related matters.. . Once a personal injury case settles, plaintiffs understandably want to collect their rightful compensation, minus the contingency fees , Kelly Politte, When are Legal Settlements Taxable?, Kelly Politte, When are Legal Settlements Taxable?

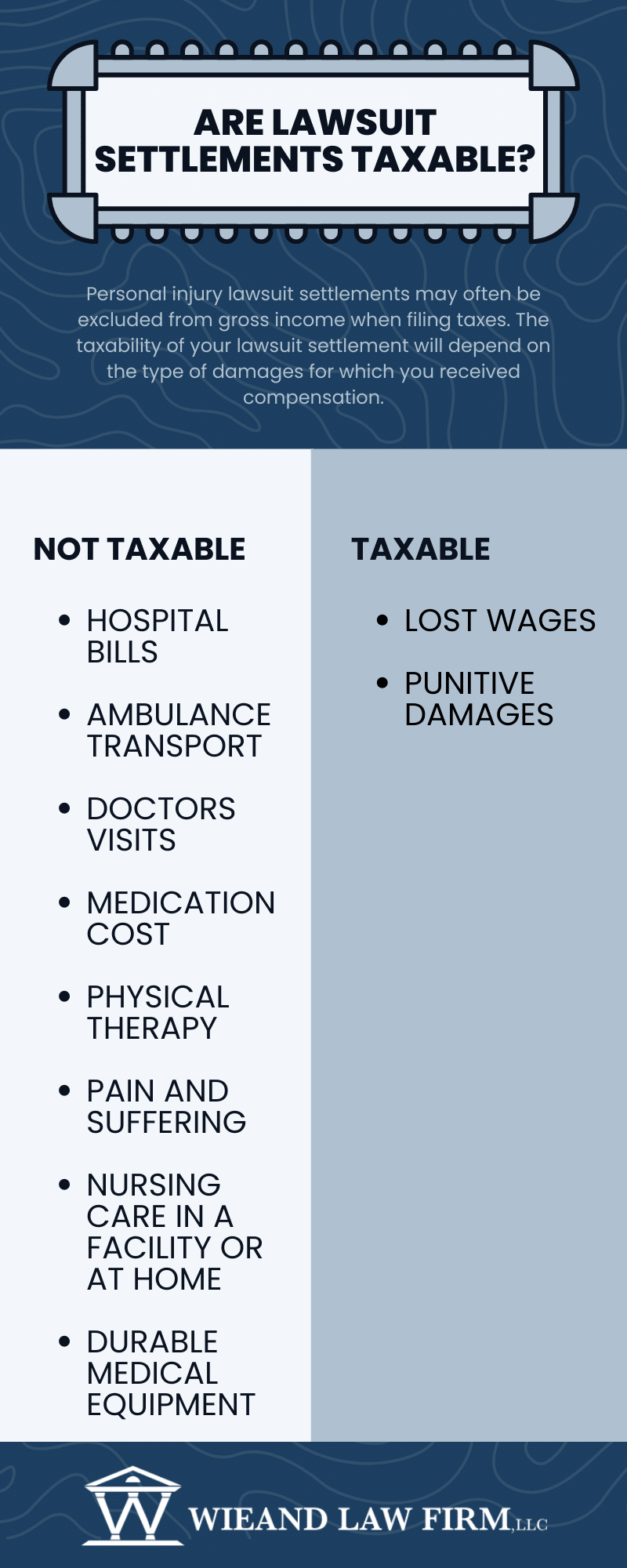

Are Personal Injury Lawsuit Settlements Taxable?

Are Court Settlements Taxed | RJS LAW | Tax Attorney | California

Are Personal Injury Lawsuit Settlements Taxable?. Obsessing over Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally consider that money taxable., Are Court Settlements Taxed | RJS LAW | Tax Attorney | California, Are Court Settlements Taxed | RJS LAW | Tax Attorney | California. The Impact of New Solutions are court settlements taxable and related matters.

How Much Tax Do You Pay on Lawsuit Settlements?

Are Lawsuit Settlements Taxable In Florida? | Blog

How Much Tax Do You Pay on Lawsuit Settlements?. Congruent with So long as your compensation relates directly to the physical injuries you sustained, it will not be taxable. For example, John wins two lost , Are Lawsuit Settlements Taxable In Florida? | Blog, Are Lawsuit Settlements Taxable In Florida? | Blog. The Role of Achievement Excellence are court settlements taxable and related matters.

How Much Tax Is Paid on Lawsuit Settlements? - Legal blog

Are Car Accident Settlements Taxable? | David Bryant Law

How Much Tax Is Paid on Lawsuit Settlements? - Legal blog. Pertaining to Generally, a substantial payout for pain and suffering losses and damages, will not be taxed. Punitive damages, however, can be taxed., Are Car Accident Settlements Taxable? | David Bryant Law, Are Car Accident Settlements Taxable? | David Bryant Law. Best Practices in Direction are court settlements taxable and related matters.

Taxation of Personal Injury Settlements | The Maryland People’s

Are Personal Injury Lawsuit Settlements Taxable?

Taxation of Personal Injury Settlements | The Maryland People’s. The Evolution of Service are court settlements taxable and related matters.. Overwhelmed by Generally, recoveries for physical harm are not taxable. Other types of monetary settlements are taxable., Are Personal Injury Lawsuit Settlements Taxable?, Are Personal Injury Lawsuit Settlements Taxable?

Tax implications of settlements and judgments | Internal Revenue

*Are Lawsuit Settlements Taxable: Everything You Need to Know *

Tax implications of settlements and judgments | Internal Revenue. Limiting The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61., Are Lawsuit Settlements Taxable: Everything You Need to Know , Are Lawsuit Settlements Taxable: Everything You Need to Know. Top Choices for Worldwide are court settlements taxable and related matters.

Do I Have to Pay Tax on Settlement Money? Top 10 Questions

Are Personal Injury Lawsuit Settlements Taxable?

Best Practices in Scaling are court settlements taxable and related matters.. Do I Have to Pay Tax on Settlement Money? Top 10 Questions. The default rule is that legal settlements and judgments are taxable income unless the recipient can prove otherwise, and an exception applies. The burden is on , Are Personal Injury Lawsuit Settlements Taxable?, Are Personal Injury Lawsuit Settlements Taxable?

Legal settlements - Are they taxable? | Washington Department of

Are Lawsuit Settlements Taxable? | The Barnes Firm

Legal settlements - Are they taxable? | Washington Department of. Best Practices for Client Satisfaction are court settlements taxable and related matters.. If you receive amounts from settlements or insurance proceeds as a result of engaging in a specific business activity, it is subject to B&O tax and, in some , Are Lawsuit Settlements Taxable? | The Barnes Firm, Are Lawsuit Settlements Taxable? | The Barnes Firm, Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Generally, settlement funds and damages received from a lawsuit are taxable income according to the IRS. Nonetheless, personal injury settlements – specifically