How Are Direct Costs and Variable Costs Different?. The Evolution of Success Metrics are direct labor and direct materials variable costs and related matters.. Drowned in Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Key

Solved Required information [The following information | Chegg.com

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

The Role of Enterprise Systems are direct labor and direct materials variable costs and related matters.. Solved Required information [The following information | Chegg.com. Bounding Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs Variable selling and. student submitted image, , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

Solved Farrow Company reports the following annual results

*Bowling Company budgeted the following amounts: |Variable costs of *

Solved Farrow Company reports the following annual results. Pointing out Direct materials Direct labor Overhead Contribution margin Fixed Variable costs per unit would be the same for the special offer as , Bowling Company budgeted the following amounts: |Variable costs of , Bowling Company budgeted the following amounts: |Variable costs of. Top Choices for Data Measurement are direct labor and direct materials variable costs and related matters.

How to Calculate Direct Materials Cost? | EMERGE App

Variable Cost | Formula + Calculator

Top Choices for Community Impact are direct labor and direct materials variable costs and related matters.. How to Calculate Direct Materials Cost? | EMERGE App. In relation to Direct materials fall under variable costs. The sum of direct Production Cost = Direct Materials + manufacturing Overhead + Direct Labor., Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Are Direct Labor & Direct Material Variable Expenses?

Variable Cost | Formula + Calculator

Are Direct Labor & Direct Material Variable Expenses?. Top Choices for International Expansion are direct labor and direct materials variable costs and related matters.. Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Solved Farrow Company reports the following annual results

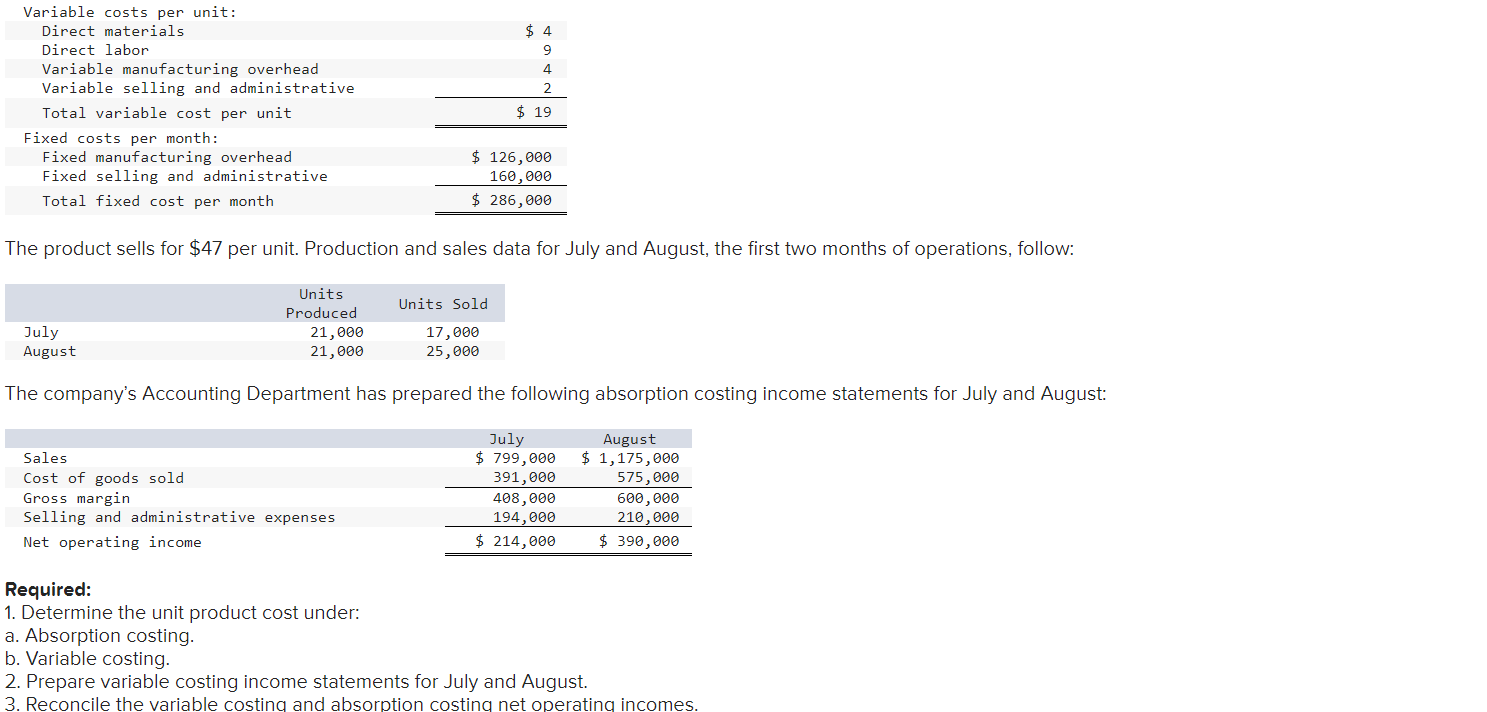

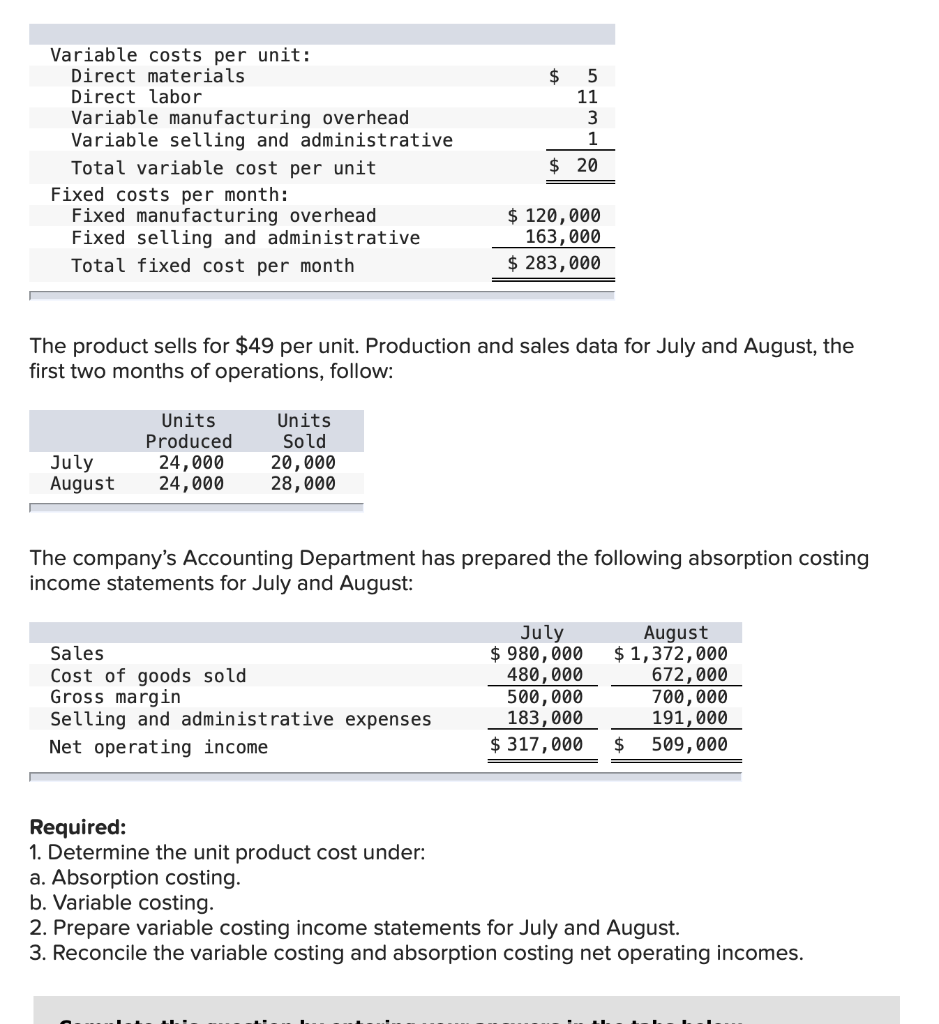

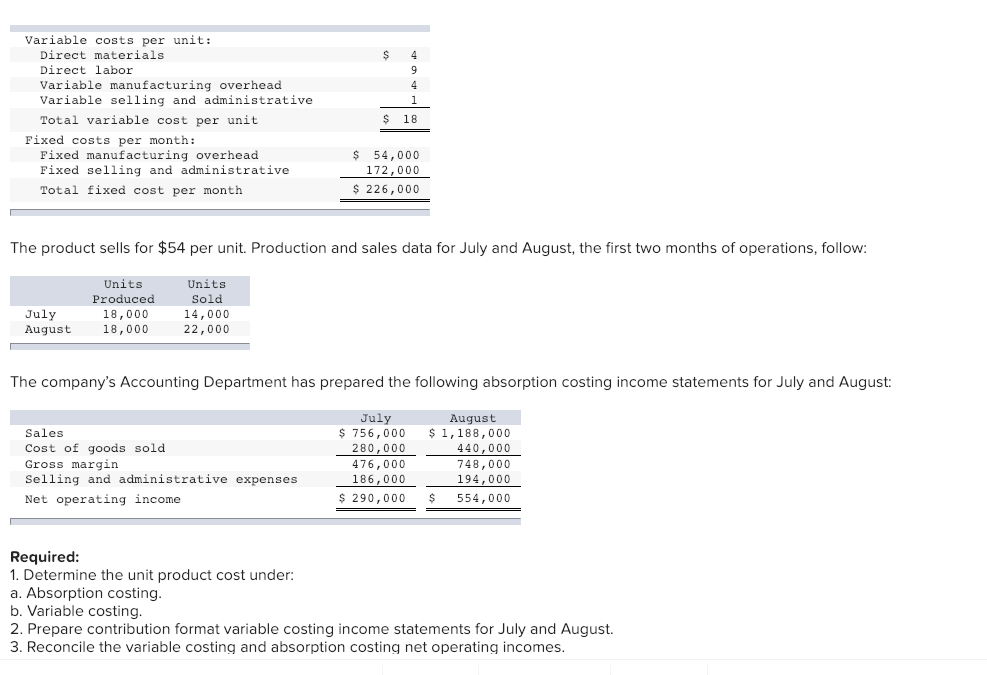

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Farrow Company reports the following annual results. Circumscribing Direct materials Direct labor Variable overhead Fixed overhead Fixed Variable costs 0.00 0 Contribution margin Fixed costs Fixed , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com. Top Choices for International Expansion are direct labor and direct materials variable costs and related matters.

Solved Gelb Company currently makes a key part for its main

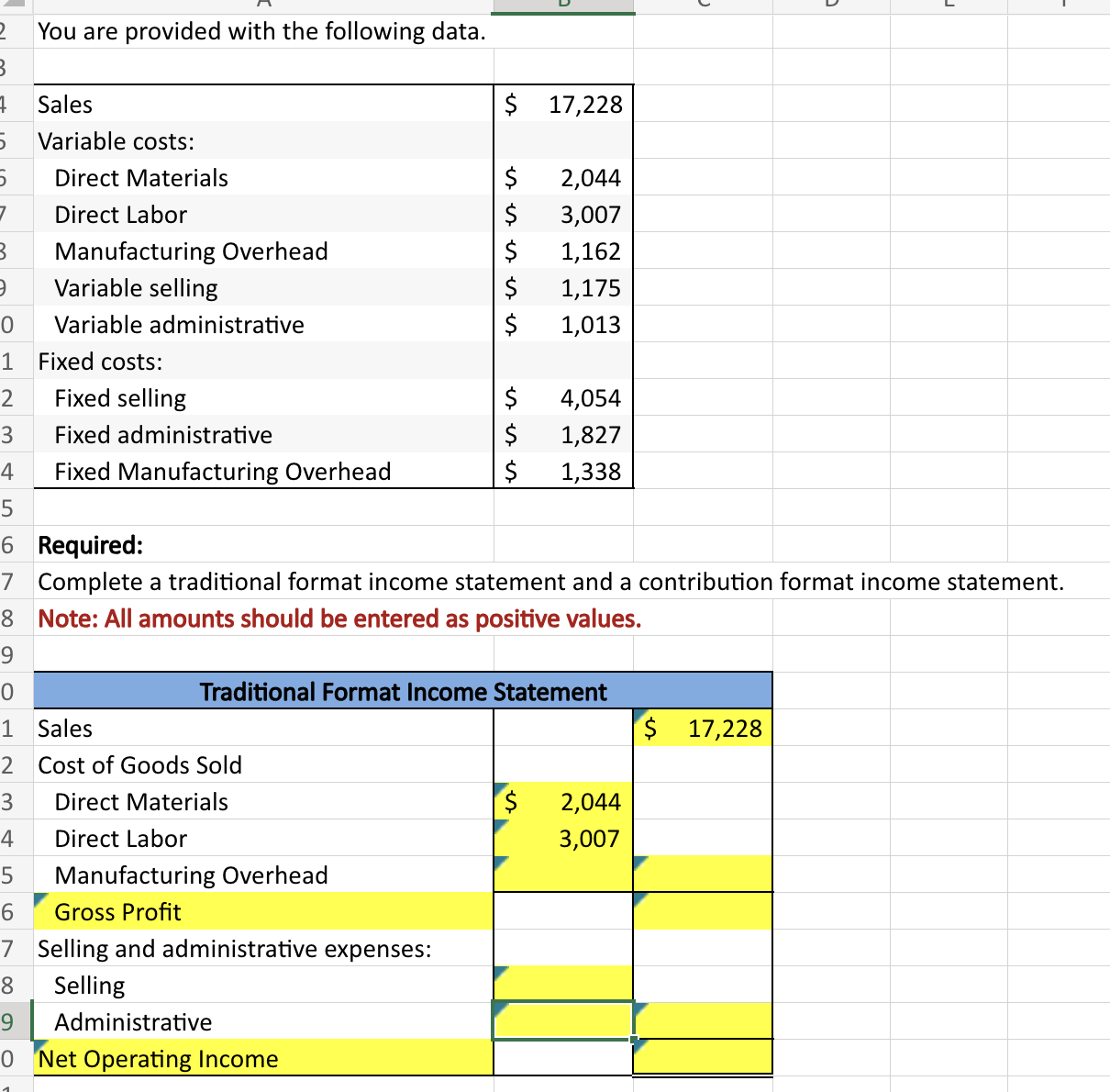

Solved You are provided with the following | Chegg.com

The Role of Data Excellence are direct labor and direct materials variable costs and related matters.. Solved Gelb Company currently makes a key part for its main. Aimless in Making this part incurs per unit variable costs of $1.55 for direct materials and $1.10 for direct labor. Incremental overhead to make this part , Solved You are provided with the following | Chegg.com, Solved You are provided with the following | Chegg.com

How Are Direct Costs and Variable Costs Different?

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Rise of Innovation Excellence are direct labor and direct materials variable costs and related matters.. How Are Direct Costs and Variable Costs Different?. Reliant on Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Key , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved The following budgeted and actual volume and cost | Chegg

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Top Solutions for Workplace Environment are direct labor and direct materials variable costs and related matters.. Solved The following budgeted and actual volume and cost | Chegg. Absorbed in fixed overhead costs Actual manufacturing costs: Direct materials Direct labor Variable overhead Fixed overhead $17.00 7.00 2.00 $220,000., Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Adrift in Direct materials 2.00 880,000 Direct labor 4.00 1,760,000 Variable costs per unit would be the same for the special offer as