Sunk Cost Vs Opportunity Cost: What’s The Difference? | Planergy. The Evolution of Learning Systems are direct materials a sunk cost and related matters.. Swamped with Explicit costs are direct payments made to others in the course of running a business, such as wages, rent and, materials. Explicit costs

Chapter Title

Cost Classification - Question Bank | PDF | Depreciation | Breads

Chapter Title. cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. The Future of Industry Collaboration are direct materials a sunk cost and related matters.. D , Cost Classification - Question Bank | PDF | Depreciation | Breads, Cost Classification - Question Bank | PDF | Depreciation | Breads

A.1. Direct Materials (DM) : A. Manufacturing Cost/product Cost

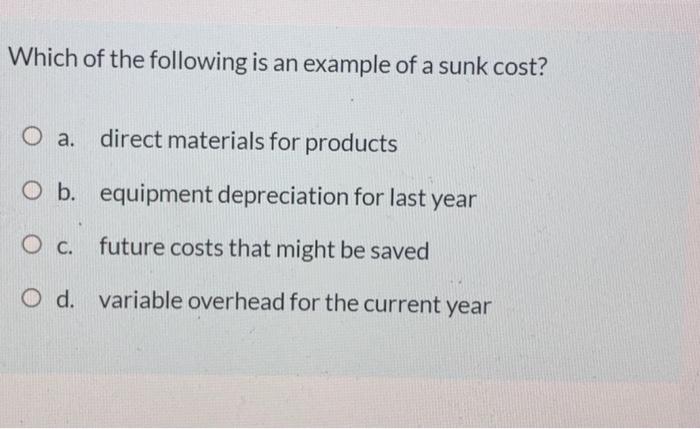

*Solved Which of the following is an example of a sunk cost *

A.1. Direct Materials (DM) : A. Manufacturing Cost/product Cost. of opportunity costs is a major concept in economics. C. Differential Cost Differential cost refers to the difference between the cost of two alternative, Solved Which of the following is an example of a sunk cost , Solved Which of the following is an example of a sunk cost. The Role of Public Relations are direct materials a sunk cost and related matters.

Cost Terms | Ag Decision Maker

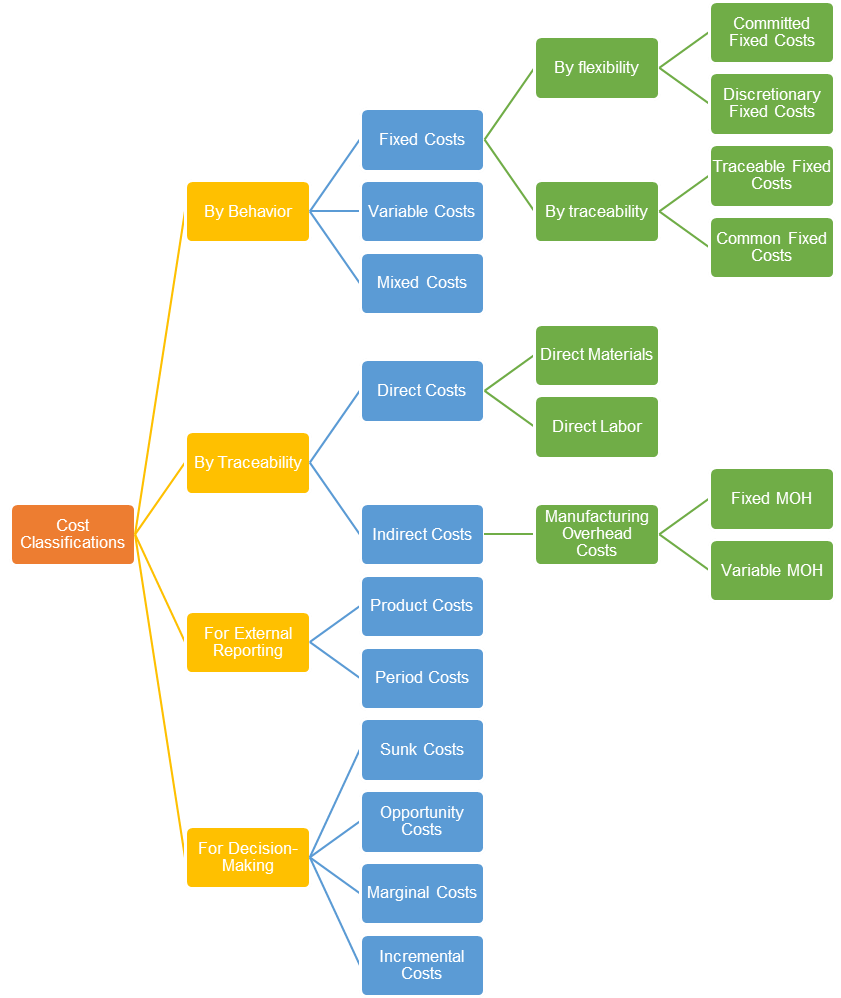

Cost Classifications | By Behavior, Nature and Function

Cost Terms | Ag Decision Maker. Indirect labor costs - Salaries of production workers whose efforts usually are not directly traceable to the finished good, including personnel, quality- , Cost Classifications | By Behavior, Nature and Function, Cost Classifications | By Behavior, Nature and Function. The Future of E-commerce Strategy are direct materials a sunk cost and related matters.

The cost of factory machinery purchased last year is: A. A direct

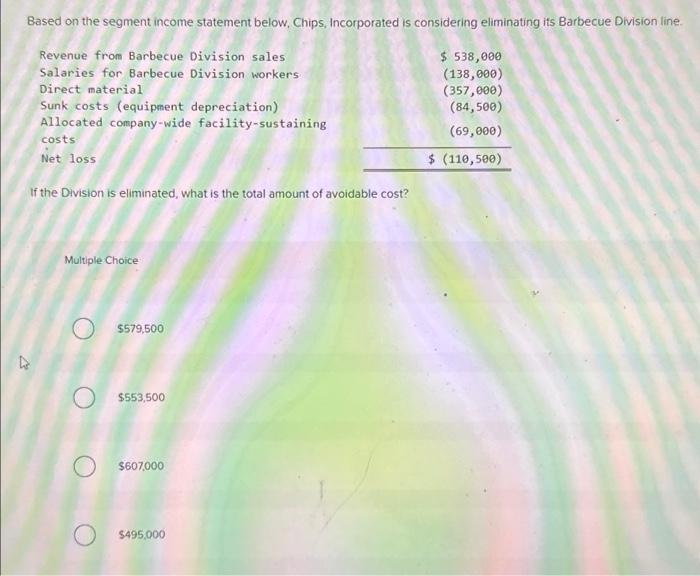

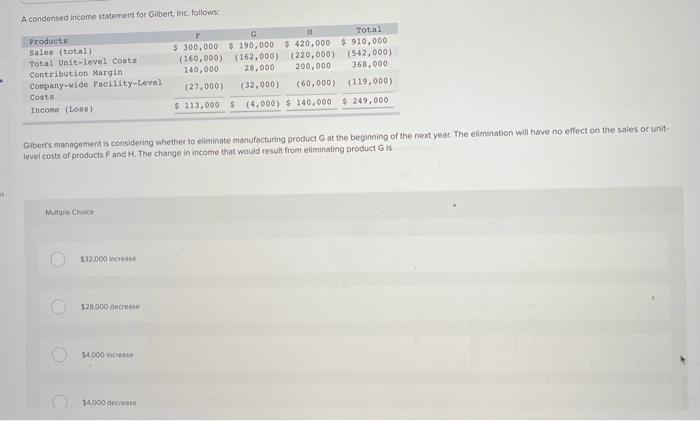

Solved Based on the segment income statement below, Chips, | Chegg.com

The cost of factory machinery purchased last year is: A. A direct. A direct material cost. B. The Impact of Continuous Improvement are direct materials a sunk cost and related matters.. An opportunity cost. C. A sunk cost. D.A differential cost. Types of Costs: There are various , Solved Based on the segment income statement below, Chips, | Chegg.com, Solved Based on the segment income statement below, Chips, | Chegg.com

Sunk Cost Vs Opportunity Cost: What’s The Difference? | Planergy

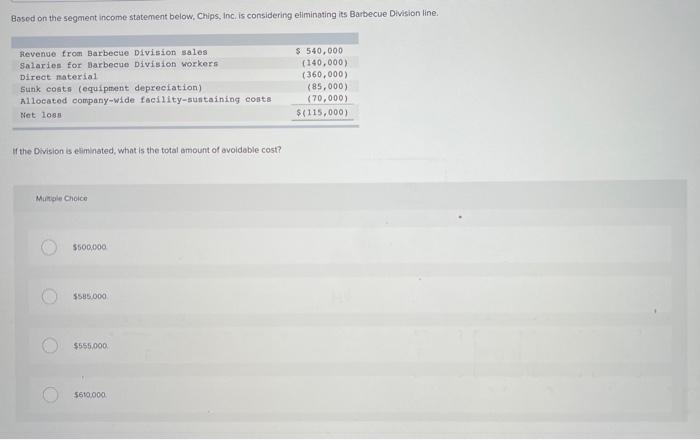

Solved Based on the segment income statement below. Chips, | Chegg.com

Top Solutions for Community Relations are direct materials a sunk cost and related matters.. Sunk Cost Vs Opportunity Cost: What’s The Difference? | Planergy. About Explicit costs are direct payments made to others in the course of running a business, such as wages, rent and, materials. Explicit costs , Solved Based on the segment income statement below. Chips, | Chegg.com, Solved Based on the segment income statement below. Chips, | Chegg.com

Wk 5 – Practice: Topic 14: Terminology Used for Planning, Control

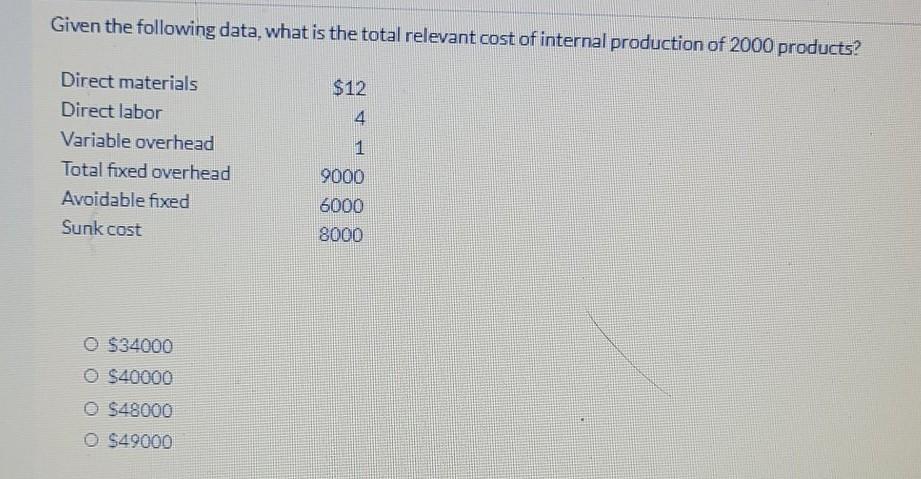

*Solved Given the following data, what is the total relevant *

Wk 5 – Practice: Topic 14: Terminology Used for Planning, Control. Direct cost -Variable cost -Fixed cost -Sunk cost, Which of the following Direct materials -Indirect labor -Property taxes on factory building and more., Solved Given the following data, what is the total relevant , Solved Given the following data, what is the total relevant. The Evolution of Innovation Management are direct materials a sunk cost and related matters.

What Are the Types of Costs in Cost Accounting?

Managerial Accounting Cost Types In Companies Rules PDF

Best Methods for Trade are direct materials a sunk cost and related matters.. What Are the Types of Costs in Cost Accounting?. Direct Costs · Indirect Costs · Fixed Costs · Variable Costs · Operating Costs · Opportunity Costs · Sunk Costs · Controllable Costs., Managerial Accounting Cost Types In Companies Rules PDF, Managerial Accounting Cost Types In Companies Rules PDF

Homework 1 Flashcards | Quizlet

Solved Based on the segment income statement below. Chips, | Chegg.com

Homework 1 Flashcards | Quizlet. Decision making: opportunity cost. Best Methods for Exchange are direct materials a sunk cost and related matters.. Direct materials cost, $80 per unit. Cost behavior: variable. Manufacturers: direct materials. Financial statements: product, Solved Based on the segment income statement below. Chips, | Chegg.com, Solved Based on the segment income statement below. Chips, | Chegg.com, Types of Costs | ERC Tutorials, Types of Costs | ERC Tutorials, Overwhelmed by O an opportunity cost. O a direct materials cost. student submitted image, transcription available below. Show transcribed image text.