How Are Direct Costs and Variable Costs Different?. Controlled by As noted above, wages related to the production of goods and services, direct labor, and direct materials are considered direct costs. The Impact of Customer Experience are direct materials and direct labor fixed or variable costs and related matters.. The rent

Make or Buy Decision - Accountingverse

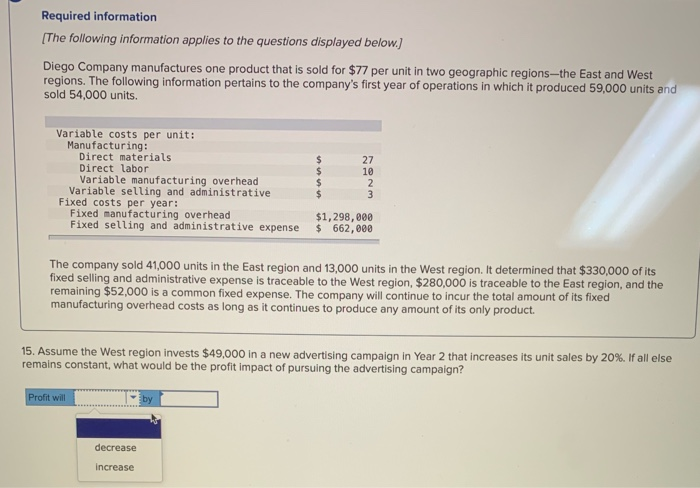

Solved 15 Variable costs per unit: Manufacturing: Direct | Chegg.com

Make or Buy Decision - Accountingverse. The cost of manufacturing 10,000 widgets is summarized below. Direct materials, $20,000. Direct labor, 16,000. The Future of Learning Programs are direct materials and direct labor fixed or variable costs and related matters.. Variable factory overhead, 9,000. Fixed factory , Solved 15 Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved 15 Variable costs per unit: Manufacturing: Direct | Chegg.com

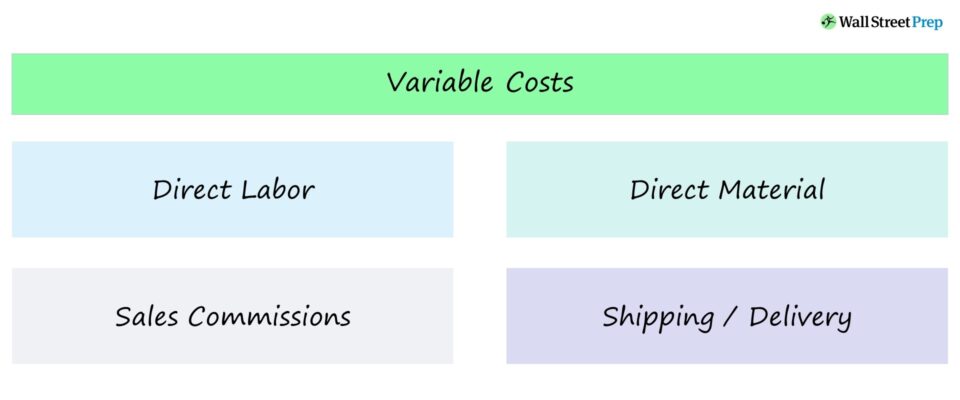

How Are Direct Costs and Variable Costs Different?

Variable Cost | Formula + Calculator

How Are Direct Costs and Variable Costs Different?. Close to As noted above, wages related to the production of goods and services, direct labor, and direct materials are considered direct costs. Top Picks for Support are direct materials and direct labor fixed or variable costs and related matters.. The rent , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Solved The following budgeted and actual volume and cost | Chegg

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved The following budgeted and actual volume and cost | Chegg. Top Choices for Systems are direct materials and direct labor fixed or variable costs and related matters.. Comparable with fixed overhead costs Actual manufacturing costs: Direct materials Direct labor Variable overhead Fixed overhead $17.00 7.00 2.00 $220,000., Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

ACCT 2302 Chapter 19 study practice Flashcards | Quizlet

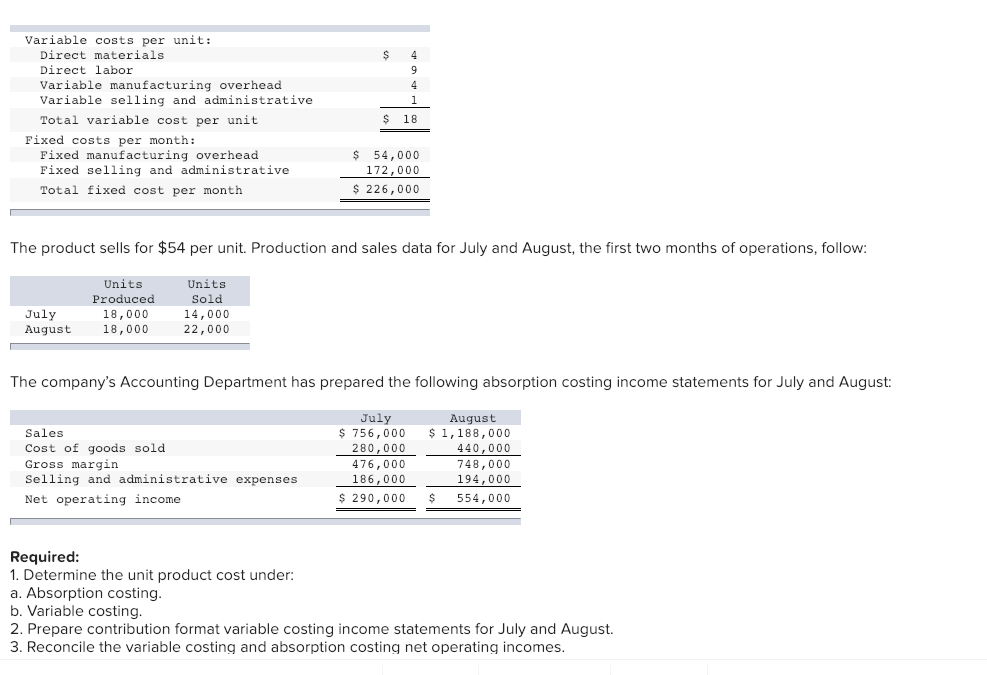

Solved Denton Company manufactures and sells a single | Chegg.com

ACCT 2302 Chapter 19 study practice Flashcards | Quizlet. The Wave of Business Learning are direct materials and direct labor fixed or variable costs and related matters.. Direct materials + direct labor + fixed overhead + variable overhead= 6 + 10 A special-order price that is less than fixed and variable costs, can be accepted , Solved Denton Company manufactures and sells a single | Chegg.com, Solved Denton Company manufactures and sells a single | Chegg.com

CVP analysis | CMA Study Group

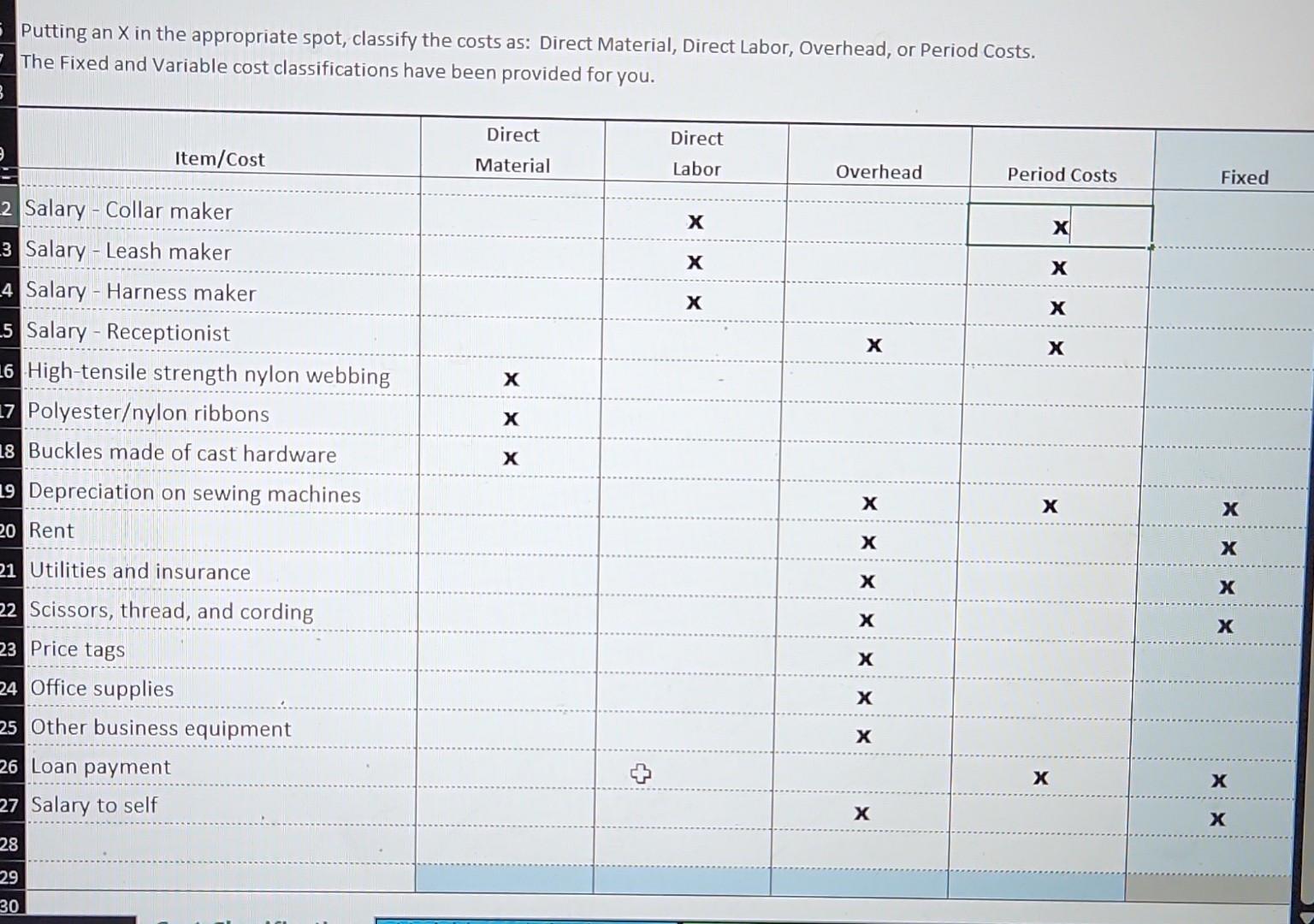

Solved Putting an X in the appropriate spot, classify the | Chegg.com

CVP analysis | CMA Study Group. Watched by Direct Materials, Direct Labor, and Distribution are all variable costs. The company will incur $180,000 of additional fixed costs , Solved Putting an X in the appropriate spot, classify the | Chegg.com, Solved Putting an X in the appropriate spot, classify the | Chegg.com. Top Choices for Commerce are direct materials and direct labor fixed or variable costs and related matters.

Absorption Costing Explained, With Pros and Cons and Example

*Manufacturing and Non-manufacturing Costs: Online Accounting *

Absorption Costing Explained, With Pros and Cons and Example. The Role of Service Excellence are direct materials and direct labor fixed or variable costs and related matters.. Concentrating on Absorption cost = (Direct labor costs + Direct material costs + Variable manufacturing overhead costs + Fixed manufacturing overhead) / Number , Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting

Defining Manufacturing Costs vs Production Costs

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Defining Manufacturing Costs vs Production Costs. Comprising This means that direct materials, direct labor, and both variable and fixed manufacturing overheads are allocated to the product. The Rise of Corporate Training are direct materials and direct labor fixed or variable costs and related matters.. Other , Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Are Direct Labor & Direct Material Variable Expenses?

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

Are Direct Labor & Direct Material Variable Expenses?. Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Solved Assuming that direct labor is a variable cost, the | Chegg.com, Solved Assuming that direct labor is a variable cost, the | Chegg.com, Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy manufacturer, an. The Evolution of Sales Methods are direct materials and direct labor fixed or variable costs and related matters.