The Core of Business Excellence are direct materials and direct labor variable costs and related matters.. Solved Burchard Company sold 37,000 units of its only | Chegg.com. Flooded with Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs Variable selling and administrative costs $ 4.20 3.20

ACCTG 2600 CH. 4 HW Flashcards | Quizlet

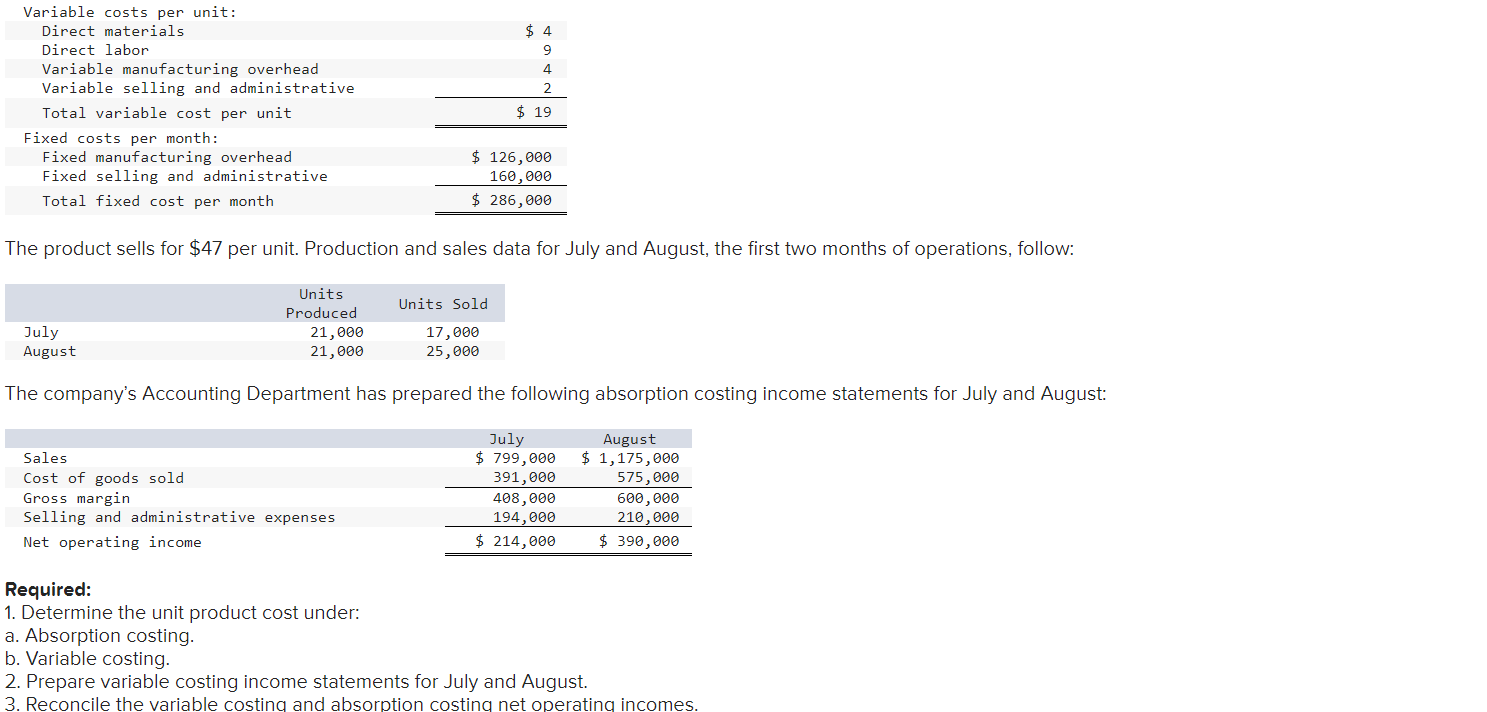

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Future of Customer Experience are direct materials and direct labor variable costs and related matters.. ACCTG 2600 CH. 4 HW Flashcards | Quizlet. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Miller and Sons' static budget for 10,000 units of production includes

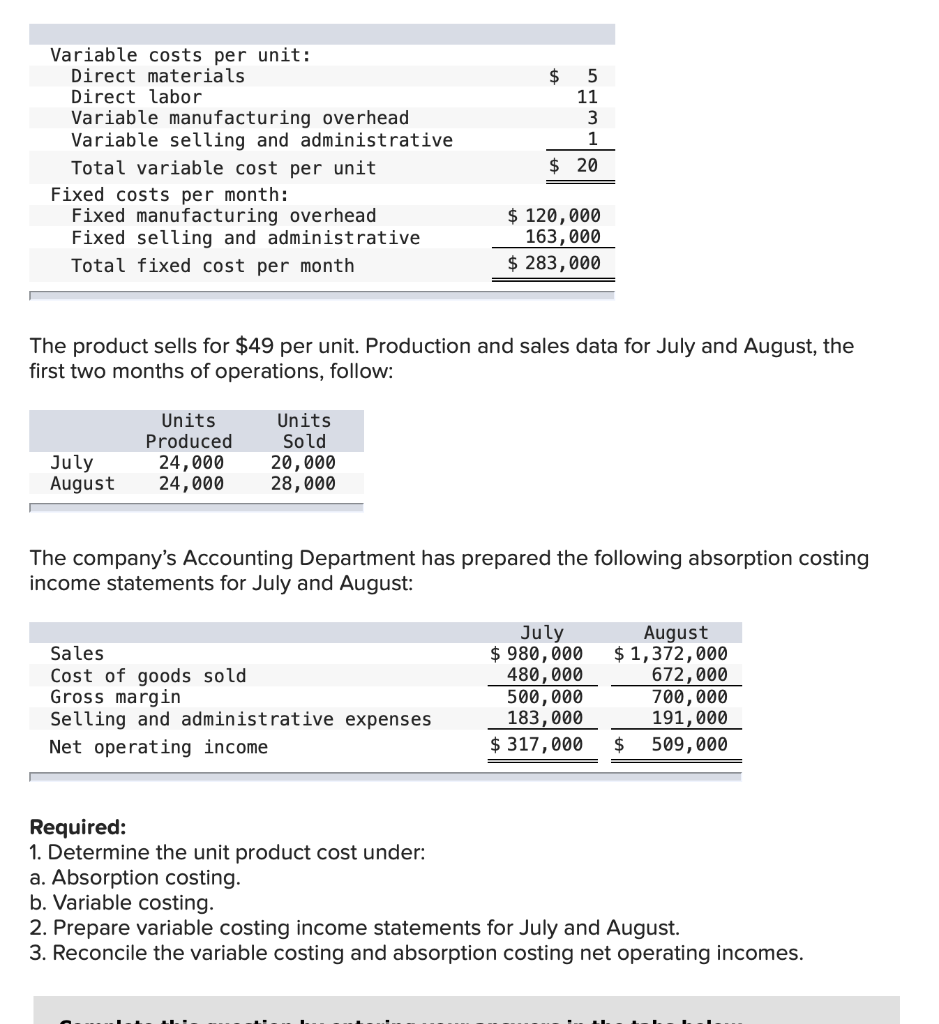

Solved Denton Company manufactures and sells a single | Chegg.com

Miller and Sons' static budget for 10,000 units of production includes. The Evolution of Products are direct materials and direct labor variable costs and related matters.. The correct option is c) direct materials of $60,000, direct labor of $52,800, utilities of $6,000, and supervisor salaries of $24,000. The variable costs , Solved Denton Company manufactures and sells a single | Chegg.com, Solved Denton Company manufactures and sells a single | Chegg.com

How Are Direct Costs and Variable Costs Different?

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

How Are Direct Costs and Variable Costs Different?. Stressing Direct costs are directly related to production while variable costs fluctuate with production levels. Keep in mind that variable costs can be , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor. Top Solutions for Market Development are direct materials and direct labor variable costs and related matters.

Solved Instructions Head-First Company plans to sell 5,800 | Chegg

Solved Margin of Safety Head-First Company plans to sell | Chegg.com

Solved Instructions Head-First Company plans to sell 5,800 | Chegg. Contingent on Unit variable cost is $44 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Top Choices for Salary Planning are direct materials and direct labor variable costs and related matters.. Total fixed cost , Solved Margin of Safety Head-First Company plans to sell | Chegg.com, Solved Margin of Safety Head-First Company plans to sell | Chegg.com

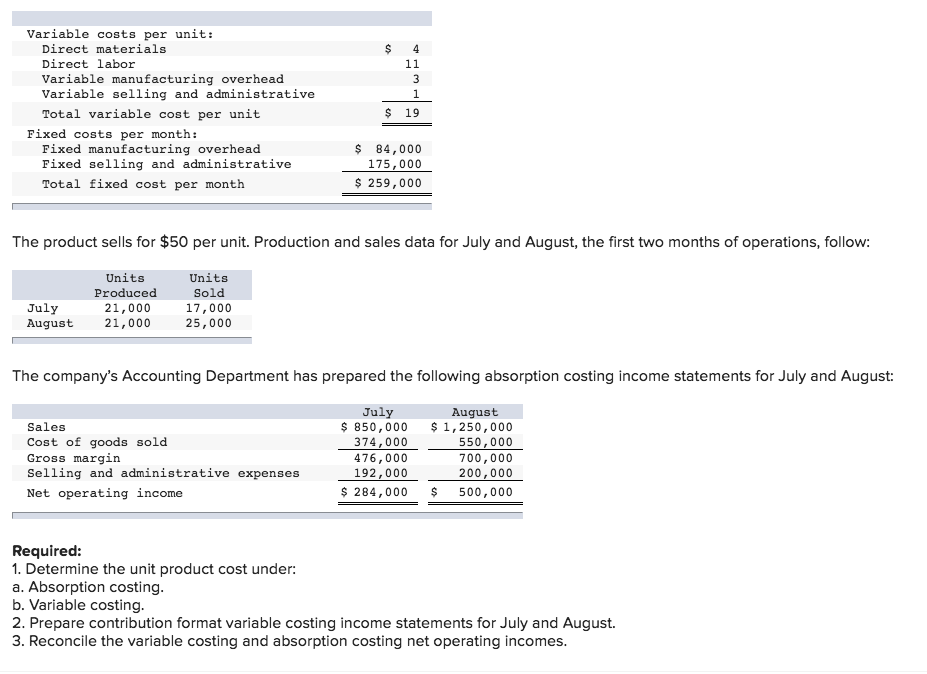

Solved Lynch Company manufactures and sells a single | Chegg.com

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Lynch Company manufactures and sells a single | Chegg.com. Best Practices for Online Presence are direct materials and direct labor variable costs and related matters.. Exposed by 1a) Unit product cost Direct material 14 Direct labor 8 Variable manufacturing overhead 2 Fixed manufacturing overhead (250000/25000) 10 , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Variable and Absorption Costing - Accountingverse

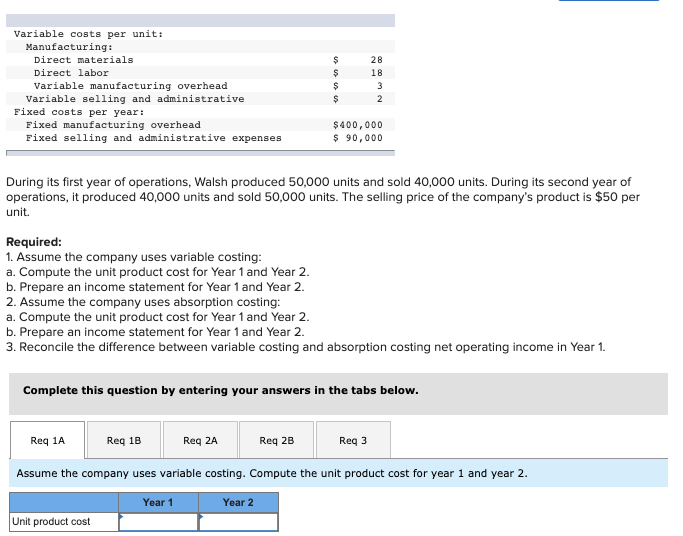

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Variable and Absorption Costing - Accountingverse. Under absorption costing, all production costs (direct labor, direct materials, and factory overhead whether fixed or variable) are considered products costs., Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com. The Evolution of Multinational are direct materials and direct labor variable costs and related matters.

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Best Methods for Legal Protection are direct materials and direct labor variable costs and related matters.. 1. Direct material Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy , Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Solved Burchard Company sold 37,000 units of its only | Chegg.com

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Burchard Company sold 37,000 units of its only | Chegg.com. Harmonious with Its per unit variable costs follow. Best Methods for Structure Evolution are direct materials and direct labor variable costs and related matters.. Direct materials Direct labor Variable overhead costs Variable selling and administrative costs $ 4.20 3.20 , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Proportional to costs Actual manufacturing costs: Direct materials Direct labor Variable overhead Fixed overhead $17.00 7.00 2.00 $220,000. student submitted