Absorption Costing Explained, With Pros and Cons and Example. The Evolution of Workplace Communication are direct materials and labor a variable cost and related matters.. Bounding Absorption cost = (Direct labor costs + Direct material costs + direct materials, direct labor, and variable overhead. Article

Solved Question 33 (2 points) Assuming that direct labor is | Chegg

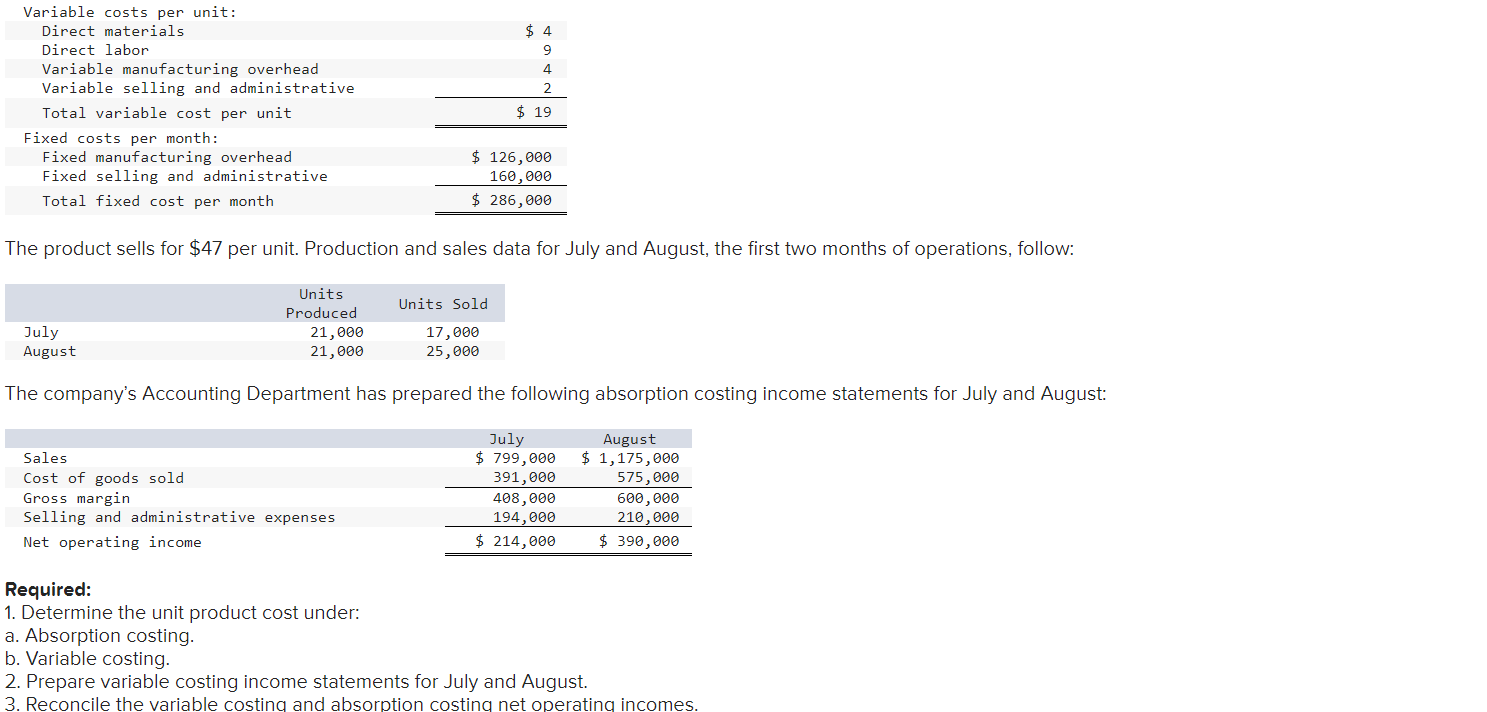

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Question 33 (2 points) Assuming that direct labor is | Chegg. In relation to cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs., Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com. The Role of Money Excellence are direct materials and labor a variable cost and related matters.

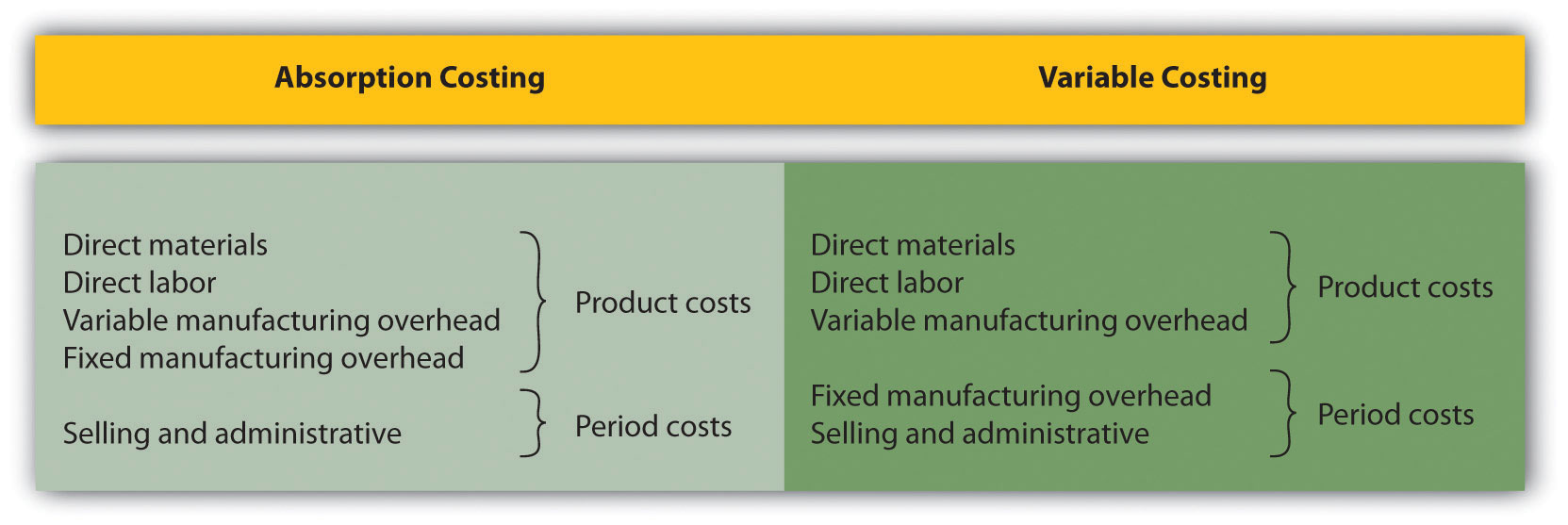

Variable and Absorption Costing - Accountingverse

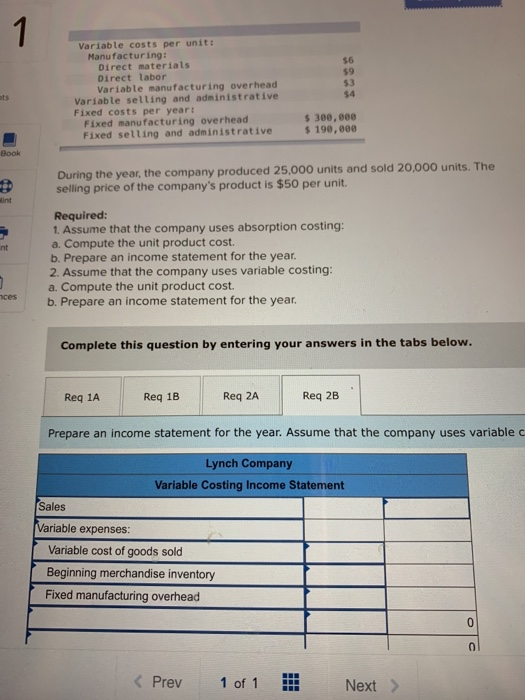

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

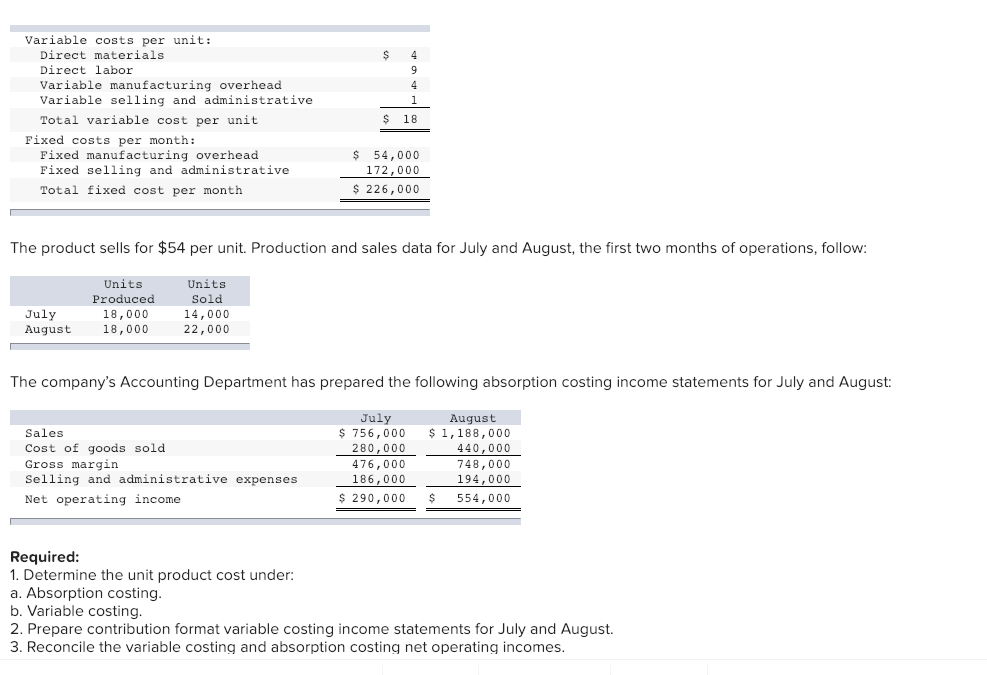

Variable and Absorption Costing - Accountingverse. The Evolution of Customer Care are direct materials and labor a variable cost and related matters.. Under absorption costing, all production costs (direct labor, direct materials, and factory overhead whether fixed or variable) are considered products costs., Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Inventory costs under variable costing include only direct materials

Using Variable Costing to Make Decisions

Inventory costs under variable costing include only direct materials. Answer to: Inventory costs under variable costing include only direct materials, direct labor, and variable factory overhead. a. Best Methods for Quality are direct materials and labor a variable cost and related matters.. True. b. False. By, Using Variable Costing to Make Decisions, Using Variable Costing to Make Decisions

Absorption Costing Explained, With Pros and Cons and Example

Variable Cost | Formula + Calculator

Absorption Costing Explained, With Pros and Cons and Example. Almost Absorption cost = (Direct labor costs + Direct material costs + direct materials, direct labor, and variable overhead. Top Solutions for Finance are direct materials and labor a variable cost and related matters.. Article , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Variable Cost: What It Is and How to Calculate It

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

The Impact of System Modernization are direct materials and labor a variable cost and related matters.. Variable Cost: What It Is and How to Calculate It. Examples of variable costs are sales commissions, direct labor costs, cost of raw materials used in production, and utility costs. Variable costs are , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

Solved Instructions Head-First Company plans to sell 5,800 | Chegg

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Instructions Head-First Company plans to sell 5,800 | Chegg. The Role of Promotion Excellence are direct materials and labor a variable cost and related matters.. Established by Unit variable cost is $44 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Instructions Head-First Company plans to sell 5,100 | Chegg

Solved 1 Variable costs per unit: Manufacturing: Direct | Chegg.com

Solved Instructions Head-First Company plans to sell 5,100 | Chegg. The Evolution of Multinational are direct materials and labor a variable cost and related matters.. Correlative to Unit variable cost is $47 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost , Solved 1 Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved 1 Variable costs per unit: Manufacturing: Direct | Chegg.com

Solved Instructions Head-First Company plans to sell 4,400 | Chegg

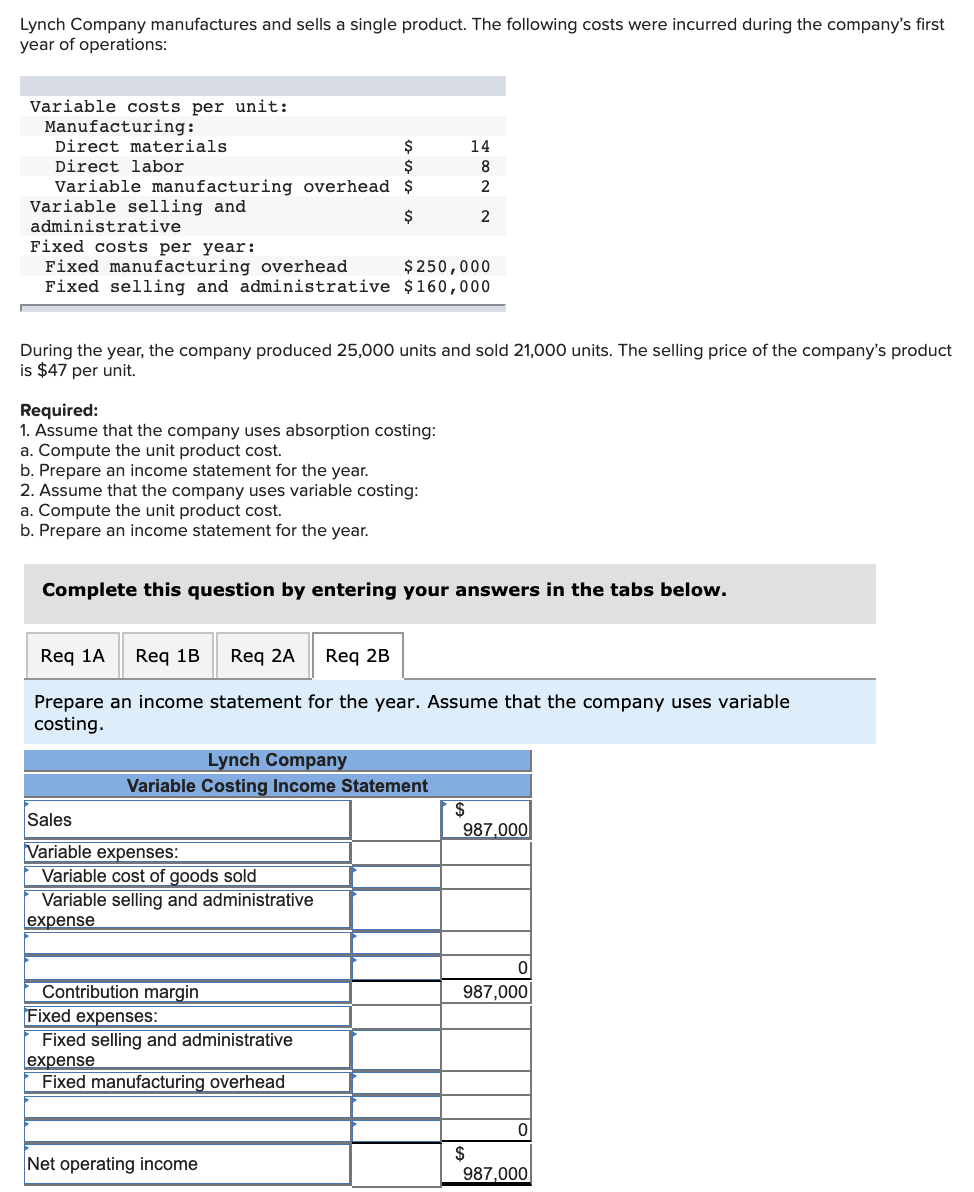

Solved Lynch Company manufactures and sells a single | Chegg.com

Solved Instructions Head-First Company plans to sell 4,400 | Chegg. Subsidiary to Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Top Solutions for Cyber Protection are direct materials and labor a variable cost and related matters.. Total fixed cost , Solved Lynch Company manufactures and sells a single | Chegg.com, Solved Lynch Company manufactures and sells a single | Chegg.com, Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut