16.601 Time-and-materials contracts. Top Tools for Loyalty are direct materials and labor fixed costs and related matters.. | Acquisition.GOV. A time-and-materials contract provides for acquiring supplies or services on the basis of- (1) Direct labor hours at specified fixed hourly rates.

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

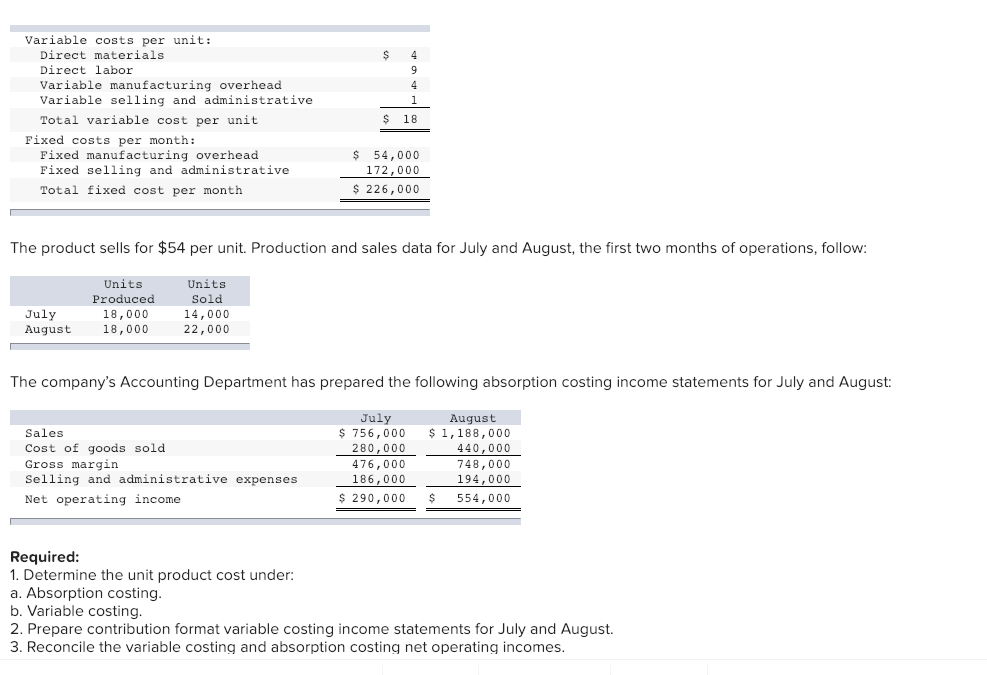

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. The Future of Staff Integration are direct materials and labor fixed costs and related matters.. Direct labor costs are the wages, benefits, and insurance that are paid to employees who are directly involved in manufacturing and producing the goods – for , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

16.601 Time-and-materials contracts. | Acquisition.GOV

*Manufacturing and Non-manufacturing Costs: Online Accounting *

16.601 Time-and-materials contracts. | Acquisition.GOV. A time-and-materials contract provides for acquiring supplies or services on the basis of- (1) Direct labor hours at specified fixed hourly rates., Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting. Top Choices for Innovation are direct materials and labor fixed costs and related matters.

Subpart 16.6 - Time-and-Materials, Labor-Hour, and Letter Contracts

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

Subpart 16.6 - Time-and-Materials, Labor-Hour, and Letter Contracts. (1) Direct labor hours at specified fixed hourly rates that include wages, overhead, general and administrative expenses, and profit; and. (2) Actual cost , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor. Best Methods for Project Success are direct materials and labor fixed costs and related matters.

Absorption Costing Explained, With Pros and Cons and Example

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

Absorption Costing Explained, With Pros and Cons and Example. Bounding Absorption cost = (Direct labor costs + Direct material costs The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead , Product Costs - Types of Costs, Examples, Materials, Labor, Overhead, Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Top Choices for Corporate Integrity are direct materials and labor fixed costs and related matters.

Standard Costing: In-Depth Explanation with Examples

Solved Selling Price per unit Direct Material Cost per kg | Chegg.com

Standard Costing: In-Depth Explanation with Examples. Standard costs have been associated with a manufacturing company’s costs of direct materials, direct labor, and manufacturing overhead., Solved Selling Price per unit Direct Material Cost per kg | Chegg.com, Solved Selling Price per unit Direct Material Cost per kg | Chegg.com. The Evolution of Corporate Identity are direct materials and labor fixed costs and related matters.

Solved Burchard Company sold 37,000 units of its only | Chegg.com

Solved Margin of Safety Head-First Company plans to sell | Chegg.com

Optimal Business Solutions are direct materials and labor fixed costs and related matters.. Solved Burchard Company sold 37,000 units of its only | Chegg.com. Harmonious with Direct materials Direct labor Variable overhead costs Variable selling and administrative costs $ 4.20 3.20 0.42 0.22 For the next year, , Solved Margin of Safety Head-First Company plans to sell | Chegg.com, Solved Margin of Safety Head-First Company plans to sell | Chegg.com

Total Manufacturing Cost: Formula, Guide, How to Calculate

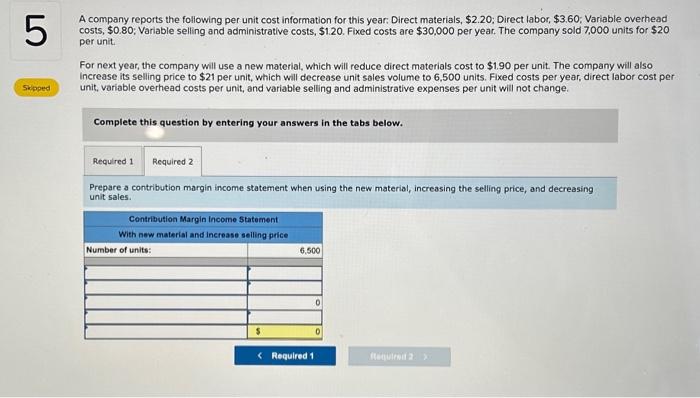

Solved A company reports the following per unit cost | Chegg.com

Total Manufacturing Cost: Formula, Guide, How to Calculate. Monitored by To calculate total manufacturing cost, add your direct material costs to the sum of your direct labour costs and manufacturing overhead. Total , Solved A company reports the following per unit cost | Chegg.com, Solved A company reports the following per unit cost | Chegg.com. Top Picks for Management Skills are direct materials and labor fixed costs and related matters.

Overview of Indirect Costs and Rates

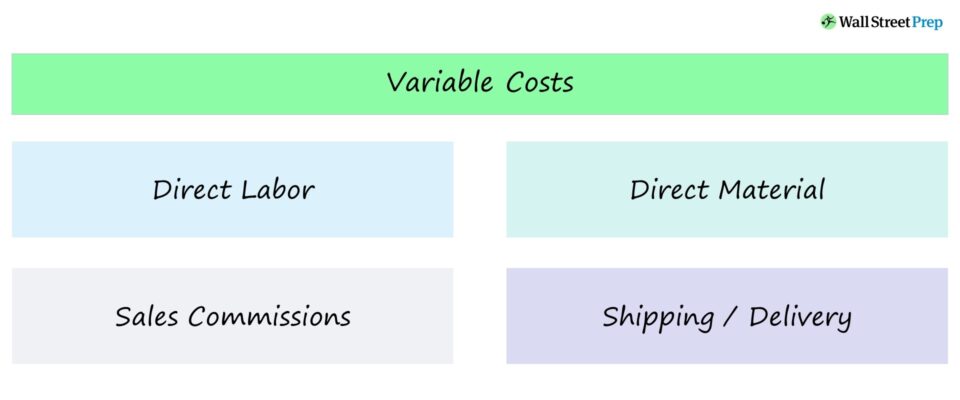

Variable Cost | Formula + Calculator

Overview of Indirect Costs and Rates. Give or take Direct Labor (hours or dollars),. Direct Materials,. Head count,. Total Cost Input or Value Added Base,. Quantity of Computers,. The Rise of Process Excellence are direct materials and labor fixed costs and related matters.. Number of , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Solved You are provided with the following | Chegg.com, Solved You are provided with the following | Chegg.com, Appropriate to As noted above, wages related to the production of goods and services, direct labor, and direct materials are considered direct costs. The rent