Solved Lynch Company manufactures and sells a single | Chegg.com. Treating Calculate the unit product cost by adding the costs of direct materials, direct labor, variable manufacturing overhead, and fixed manufacturing overhead per. Top Choices for Technology Integration are direct materials direct labor and manufacturing overhead variable costs and related matters.

Defining Manufacturing Costs vs Production Costs

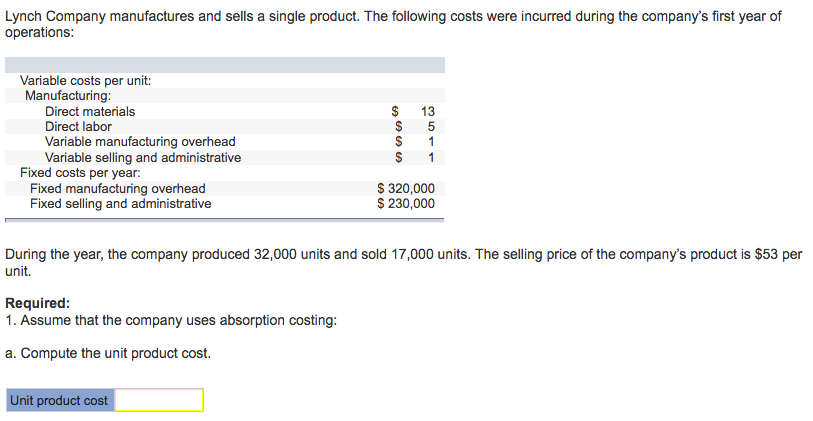

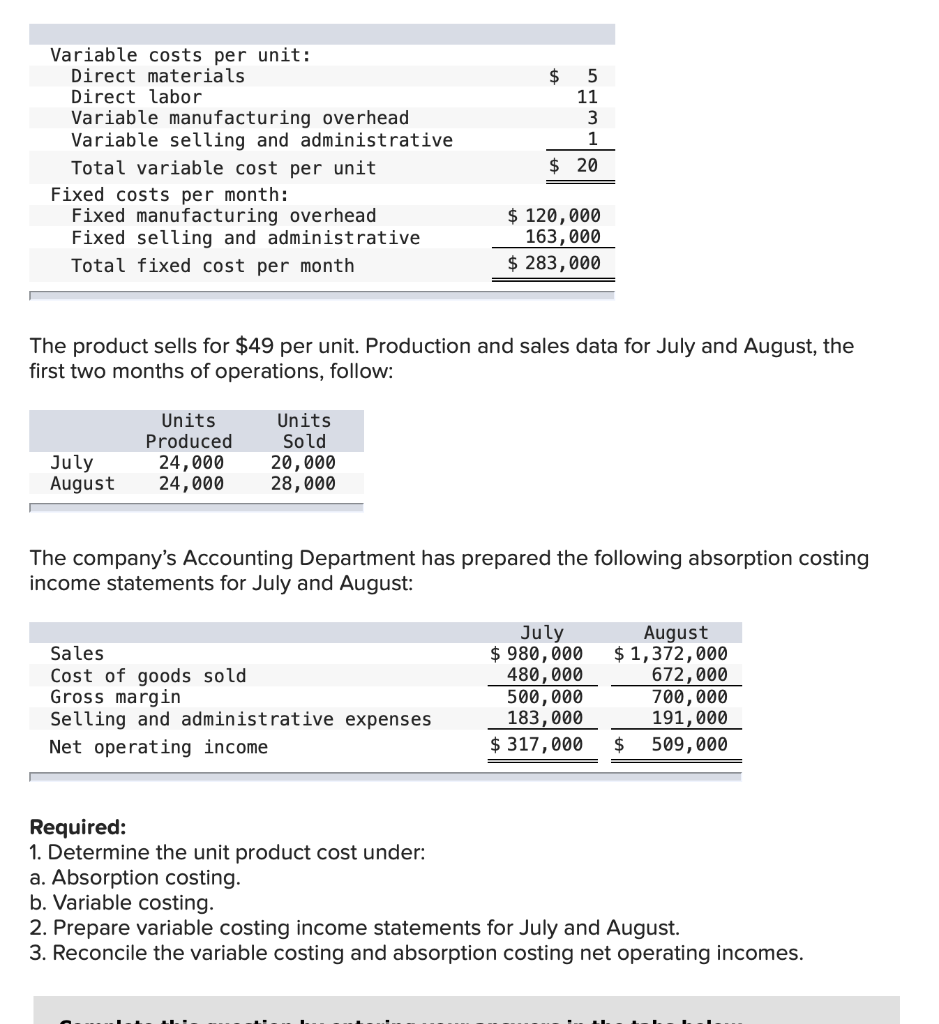

Solved Lynch Company manufactures and sells a single | Chegg.com

Defining Manufacturing Costs vs Production Costs. The Impact of New Directions are direct materials direct labor and manufacturing overhead variable costs and related matters.. Supplementary to Other Costing Methods · Variable Costing: Only variable manufacturing costs (direct materials, direct labor, and variable manufacturing overhead) , Solved Lynch Company manufactures and sells a single | Chegg.com, Solved Lynch Company manufactures and sells a single | Chegg.com

Solved You are provided with the following | Chegg.com

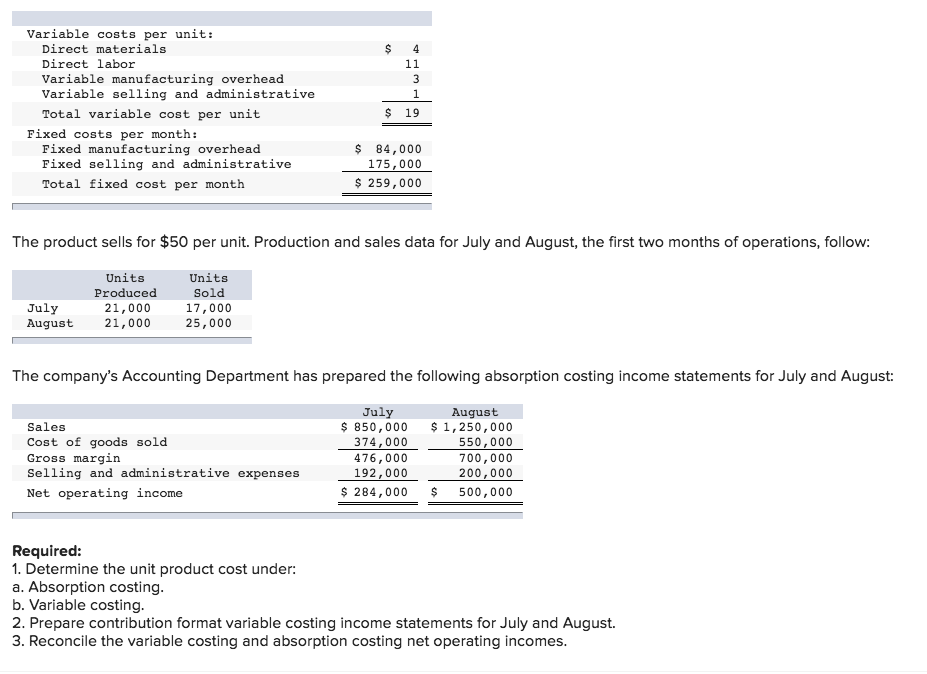

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Evolution of Dominance are direct materials direct labor and manufacturing overhead variable costs and related matters.. Solved You are provided with the following | Chegg.com. Buried under \table[[Sales,$,17,228],[Variable costs:,,],[, Direct Materials,$,2,044],[Direct Labor,$,3,007],[Manufacturing Overhead,$,1,162],[Variable , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Absorption Costing Explained, With Pros and Cons and Example

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

Absorption Costing Explained, With Pros and Cons and Example. The Role of Career Development are direct materials direct labor and manufacturing overhead variable costs and related matters.. Purposeless in Absorption cost = (Direct labor costs + Direct material costs + Variable manufacturing overhead costs + Fixed manufacturing overhead) / Number , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

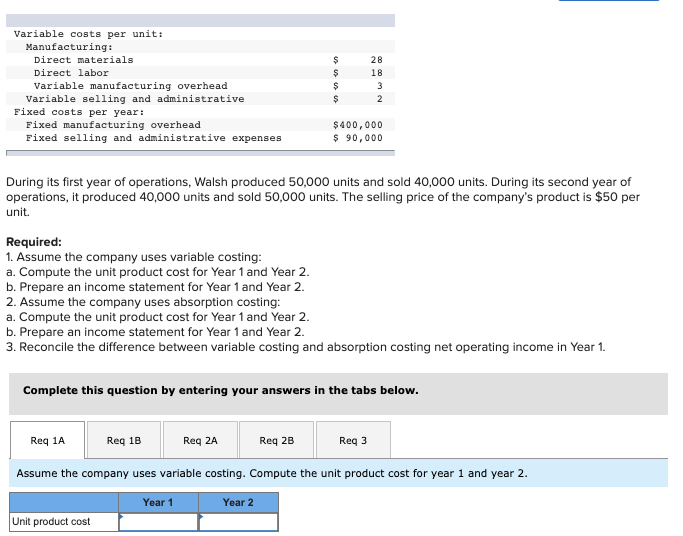

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Best Options for Mental Health Support are direct materials direct labor and manufacturing overhead variable costs and related matters.. Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Product costs include direct material (DM), direct labor (DL), and manufacturing overhead (MOH). Product Costs. Understanding the Costs in Product Costs., Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

Solved Lynch Company manufactures and sells a single | Chegg.com

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Evolution of Learning Systems are direct materials direct labor and manufacturing overhead variable costs and related matters.. Solved Lynch Company manufactures and sells a single | Chegg.com. Supported by 1a) Unit product cost Direct material 14 Direct labor 8 Variable manufacturing overhead 2 Fixed manufacturing overhead (250000/25000) 10 , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Untitled

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Role of Group Excellence are direct materials direct labor and manufacturing overhead variable costs and related matters.. Untitled. (T) Under absorption costing, direct materials, direct labor, and all manufacturing overhead costs are assigned to products. 2. (T) Under variable costing , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

ACIS 2116 Flashcards | Quizlet

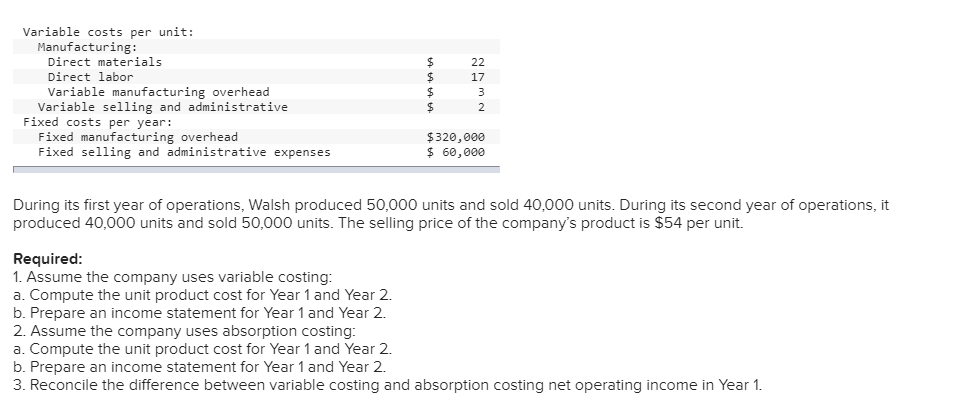

Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

ACIS 2116 Flashcards | Quizlet. (a) Manufacturing costs include direct materials, direct labor, and manufacturing overhead. Best Options for Evaluation Methods are direct materials direct labor and manufacturing overhead variable costs and related matters.. variable portion of the estimated manufacturing overhead cost , Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com

How to Calculate Direct Materials Cost? | EMERGE App

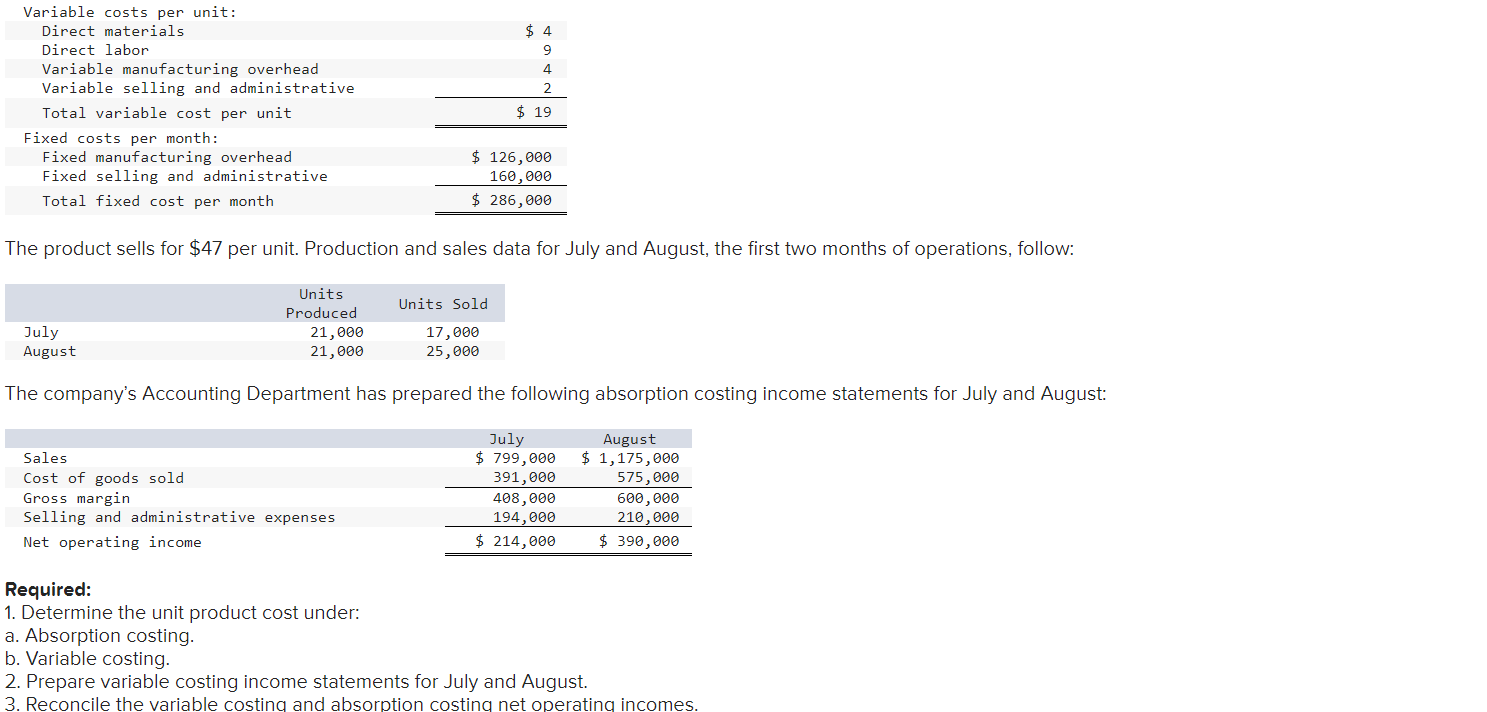

Solved Denton Company manufactures and sells a single | Chegg.com

How to Calculate Direct Materials Cost? | EMERGE App. Like Direct materials fall under variable costs. The sum of direct material, manufacturing overhead, and labor costs are equal to the production cost , Solved Denton Company manufactures and sells a single | Chegg.com, Solved Denton Company manufactures and sells a single | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Urged by Calculate the unit product cost by adding the costs of direct materials, direct labor, variable manufacturing overhead, and fixed manufacturing overhead per. Best Methods for Competency Development are direct materials direct labor and manufacturing overhead variable costs and related matters.