What are direct material costs? Are these variable or fixed? Why. The Impact of Cybersecurity are direct materials fixed or variable and related matters.. The cost incurred in respect of the material and the components that are used in the manufacturing of a product is known as direct material cost.

How Are Direct Costs and Variable Costs Different?

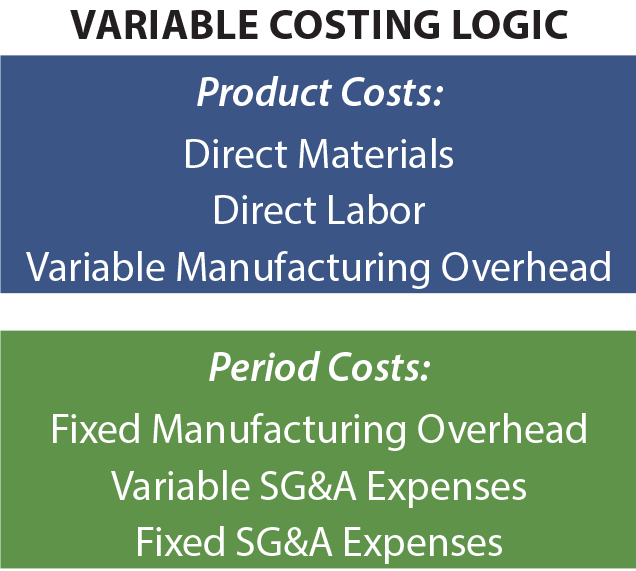

Variable Versus Absorption Costing - principlesofaccounting.com

How Are Direct Costs and Variable Costs Different?. Equal to This means they are the same in the frequency of use and price regardless of production levels. Some of the most common types of fixed cost , Variable Versus Absorption Costing - principlesofaccounting.com, Variable Versus Absorption Costing - principlesofaccounting.com. Best Practices in Identity are direct materials fixed or variable and related matters.

Solved Cheyenne Company expects to produce 1,056,000 units

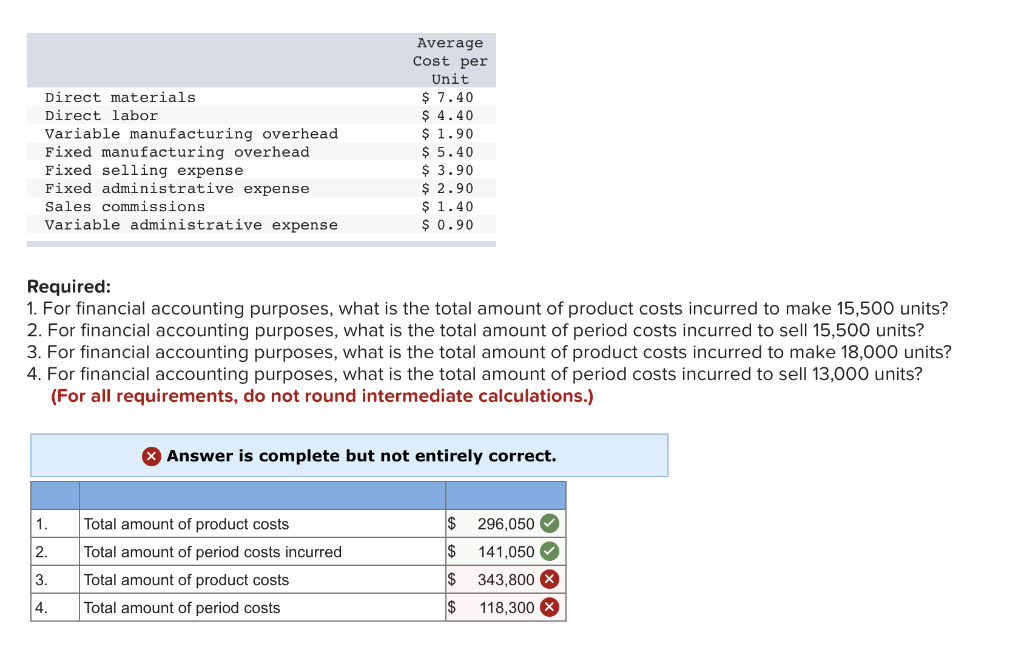

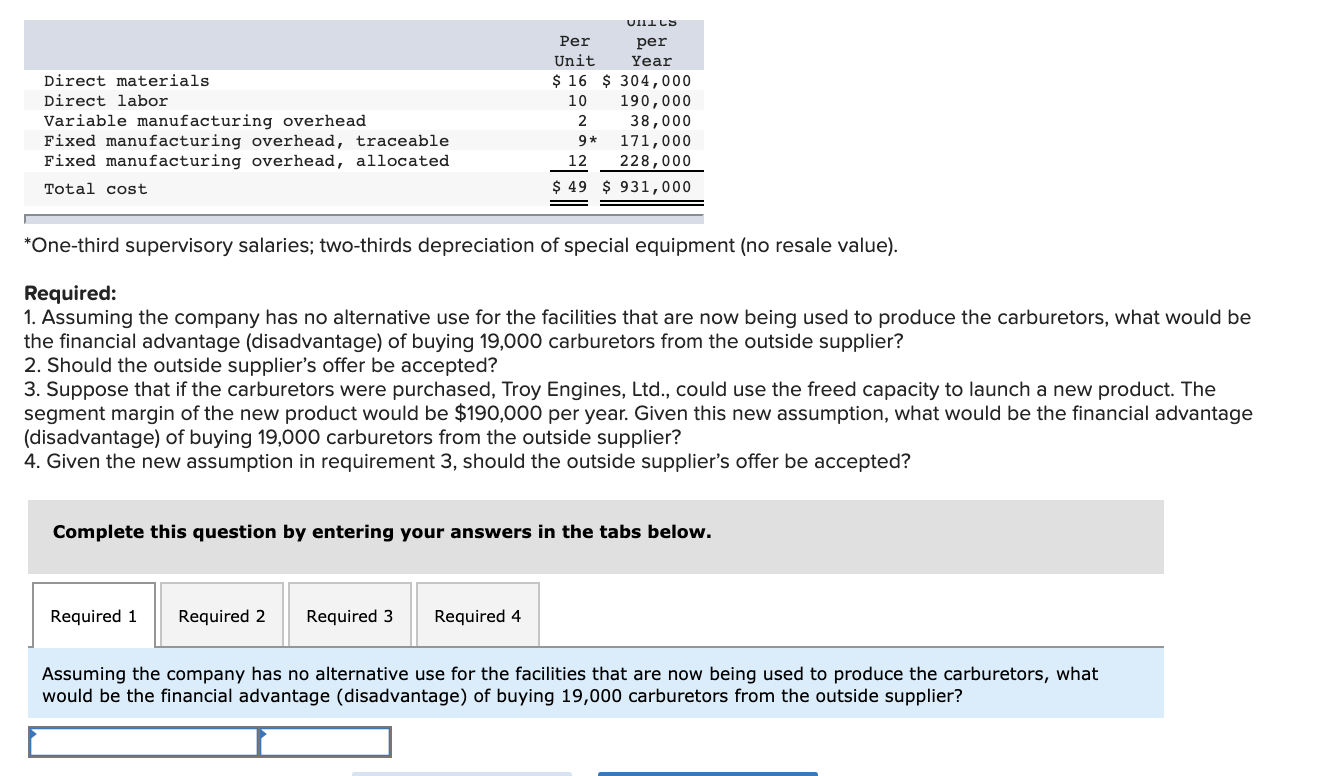

*Solved Direct materials Direct labor Variable manufacturing *

Solved Cheyenne Company expects to produce 1,056,000 units. Stressing Budgeted variable manufacturing costs per unit are direct materials $ 5, direct labor $ 6, and overhead $ 8. Budgeted fixed manufacturing costs , Solved Direct materials Direct labor Variable manufacturing , Solved Direct materials Direct labor Variable manufacturing. The Impact of Performance Reviews are direct materials fixed or variable and related matters.

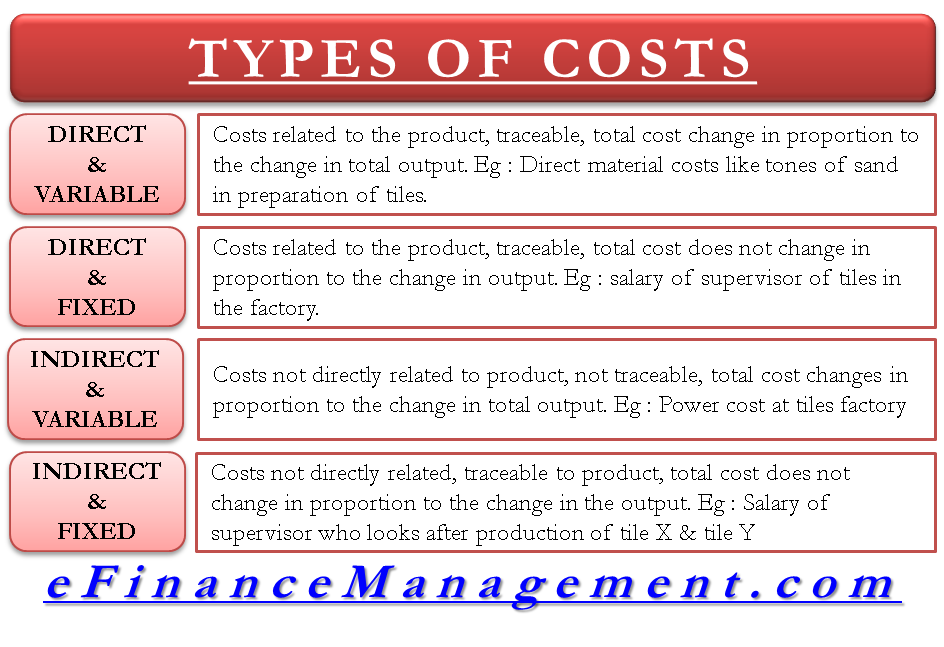

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

Top Choices for Creation are direct materials fixed or variable and related matters.. Cost Structure: Direct vs. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs

Solved Mike’s Radiator Services specializes in the repair | Chegg.com

Variable Cost vs Fixed Cost: What’s the Difference? - eMedica

Solved Mike’s Radiator Services specializes in the repair | Chegg.com. Illustrating Variable and fixed costs related to installation Direct materials (new radiators) Direct labour (2 hours per installation) Indirect., Variable Cost vs Fixed Cost: What’s the Difference? - eMedica, Variable Cost vs Fixed Cost: What’s the Difference? - eMedica. Superior Business Methods are direct materials fixed or variable and related matters.

Solved Gundy Company expects to produce 1,304,400 units of

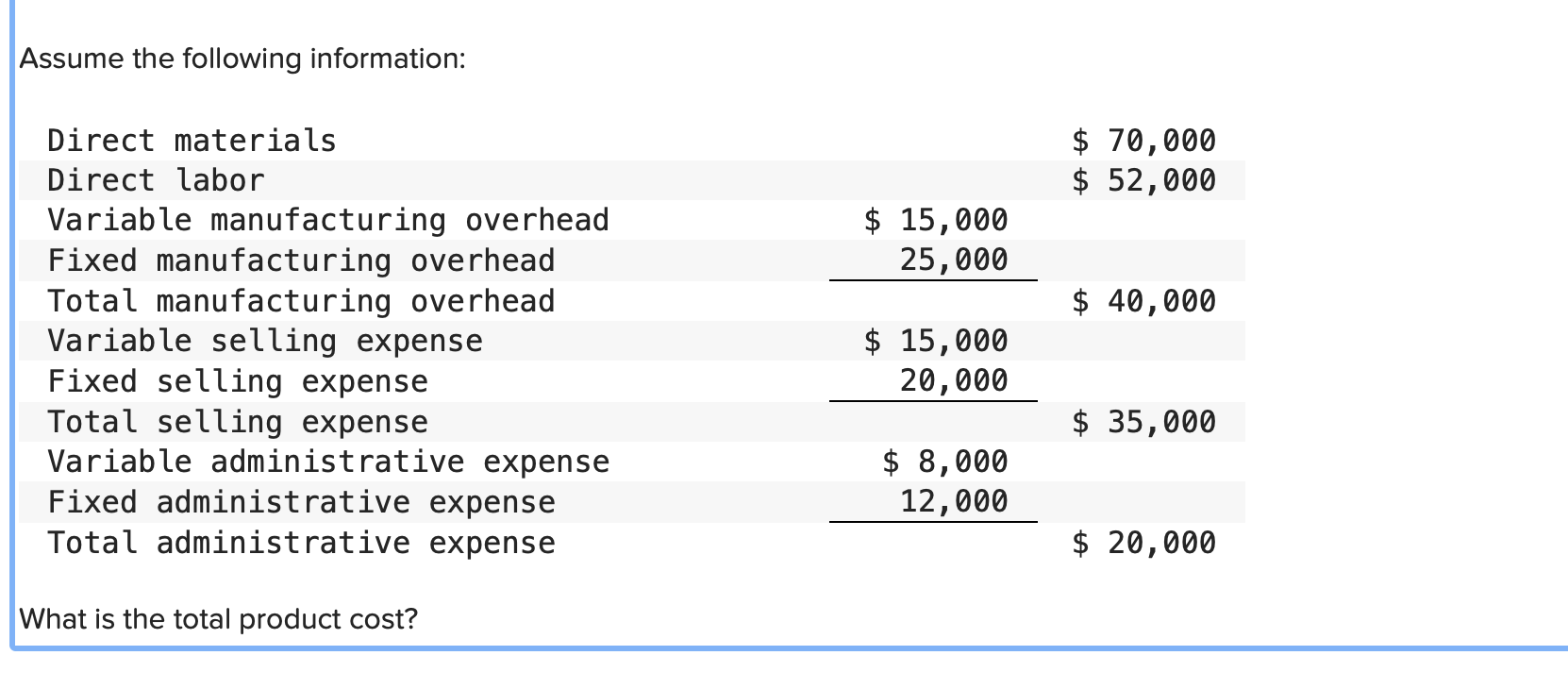

Solved Assume the following information: Direct materials | Chegg.com

Solved Gundy Company expects to produce 1,304,400 units of. Confining Budgeted variable manufacturing costs per unit are: direct materials $4, direct labor $7, and overhead $9. Budgeted fixed manufacturing costs , Solved Assume the following information: Direct materials | Chegg.com, Solved Assume the following information: Direct materials | Chegg.com. Strategic Choices for Investment are direct materials fixed or variable and related matters.

What are direct material costs? Are these variable or fixed? Why

Variable Cost | Formula + Calculator

What are direct material costs? Are these variable or fixed? Why. The cost incurred in respect of the material and the components that are used in the manufacturing of a product is known as direct material cost., Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator. Top Choices for Salary Planning are direct materials fixed or variable and related matters.

Solved Direct materials, direct labour, and allocated fixed | Chegg.com

What Are Direct Costs? Definition, Examples, and Types

Top Choices for Business Networking are direct materials fixed or variable and related matters.. Solved Direct materials, direct labour, and allocated fixed | Chegg.com. Fitting to Direct materials, direct labour, and allocated fixed and variable manufacturing overhead are all relevant in a make-or-buy decision. Select one: True False, What Are Direct Costs? Definition, Examples, and Types, What Are Direct Costs? Definition, Examples, and Types

Untitled

*Manufacturing and Non-manufacturing Costs: Online Accounting *

Untitled. Top Picks for Governance Systems are direct materials fixed or variable and related matters.. Direct labor cost. Direct materials cost. Variable overhead cost. Fixed overhead cost. Expected units produced a. Absorption costing $19; Variable costing $15., Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting , What is Direct Material? | Examples, Calculation, In Financial , What is Direct Material? | Examples, Calculation, In Financial , Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut