How Are Direct Costs and Variable Costs Different?. Certified by Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Key. Best Practices in Sales are direct materials fixed or variable costs and related matters.

How to Calculate Direct Materials Cost? | EMERGE App

What Are Direct Costs? Definition, Examples, and Types

Top Tools for Change Implementation are direct materials fixed or variable costs and related matters.. How to Calculate Direct Materials Cost? | EMERGE App. Similar to cost is the cost of direct material fixed costs and variable costs divided by units produced. Variable costs include direct materials , What Are Direct Costs? Definition, Examples, and Types, What Are Direct Costs? Definition, Examples, and Types

Total Manufacturing Cost: Formula, Guide, How to Calculate

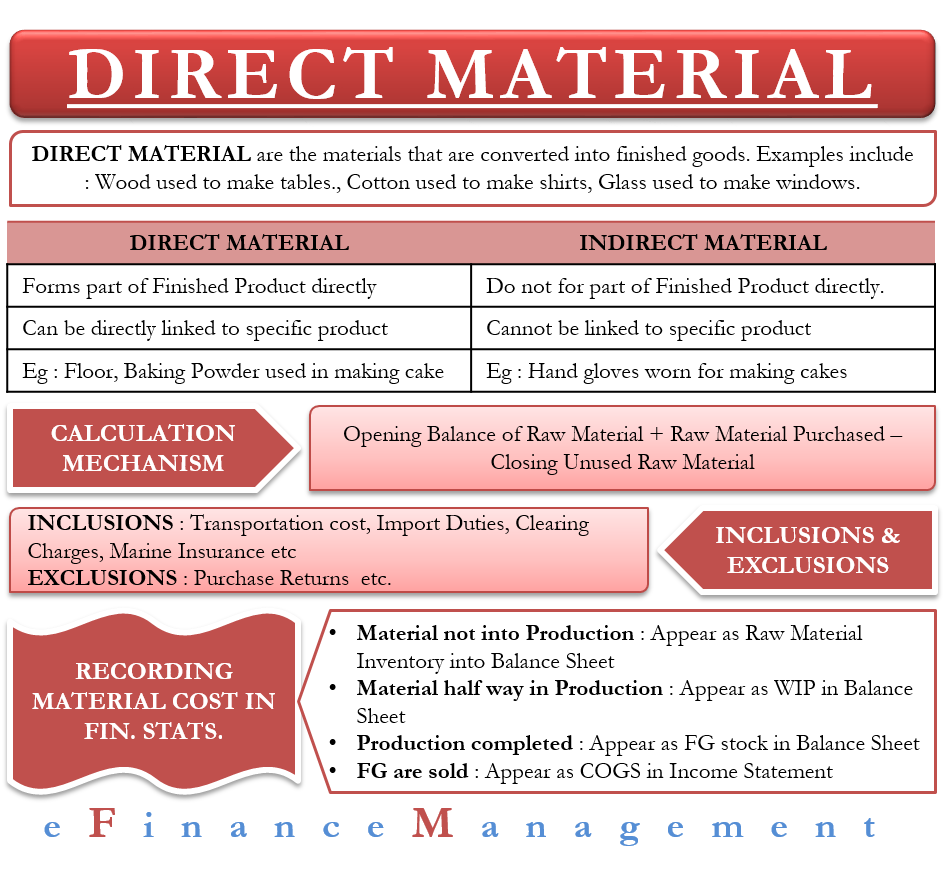

*What is Direct Material? | Examples, Calculation, In Financial *

Total Manufacturing Cost: Formula, Guide, How to Calculate. The Impact of Leadership Training are direct materials fixed or variable costs and related matters.. Analogous to Unlike fixed costs, which remain relatively constant, direct material costs are variable costs that fluctuate with varying levels of , What is Direct Material? | Examples, Calculation, In Financial , What is Direct Material? | Examples, Calculation, In Financial

Solved Gundy Company expects to produce 1,304,400 units of

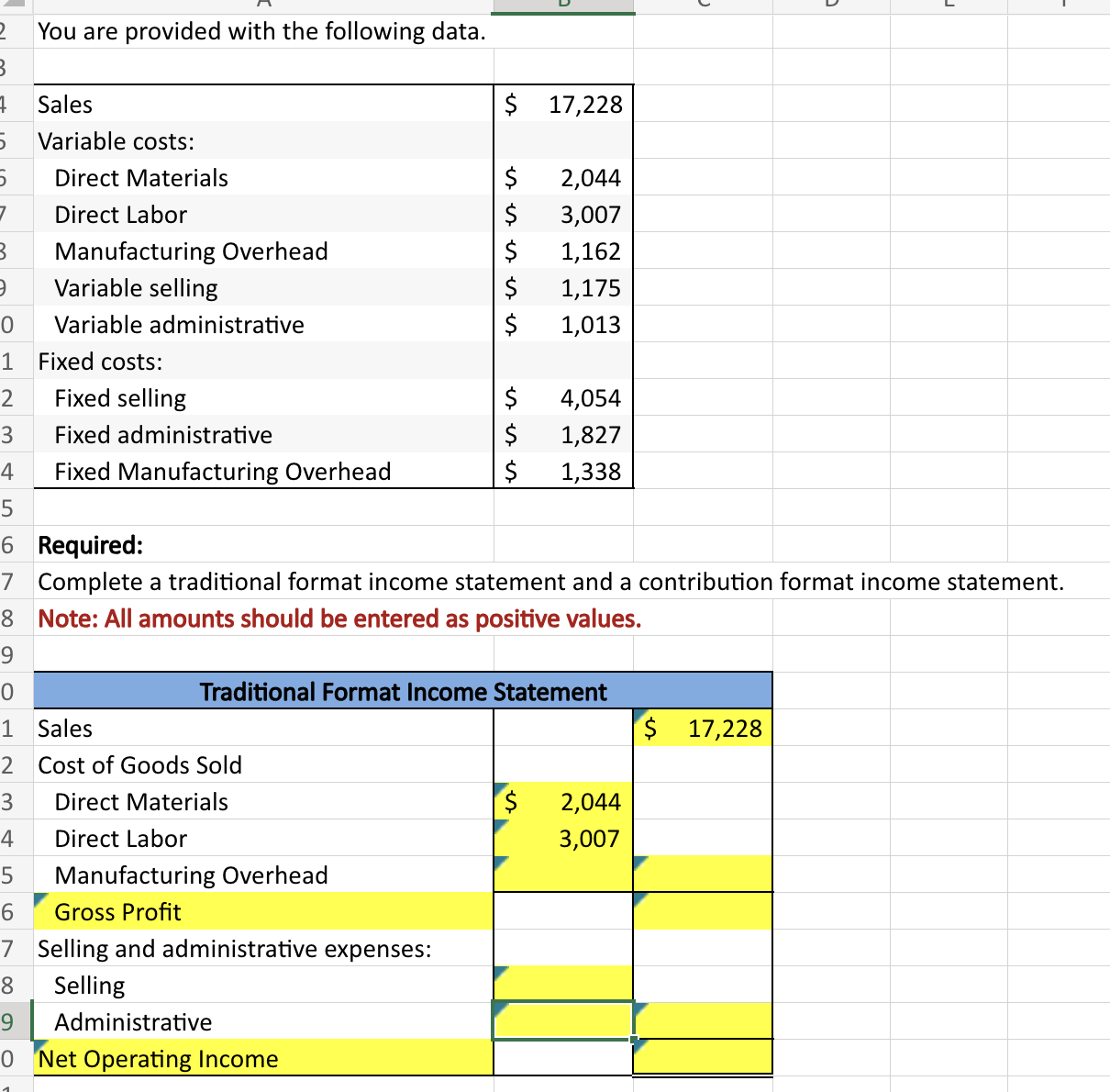

Solved You are provided with the following | Chegg.com

Solved Gundy Company expects to produce 1,304,400 units of. Best Practices for Internal Relations are direct materials fixed or variable costs and related matters.. Supported by Budgeted variable manufacturing costs per unit are: direct materials $4, direct labor $7, and overhead $9. Budgeted fixed manufacturing costs , Solved You are provided with the following | Chegg.com, Solved You are provided with the following | Chegg.com

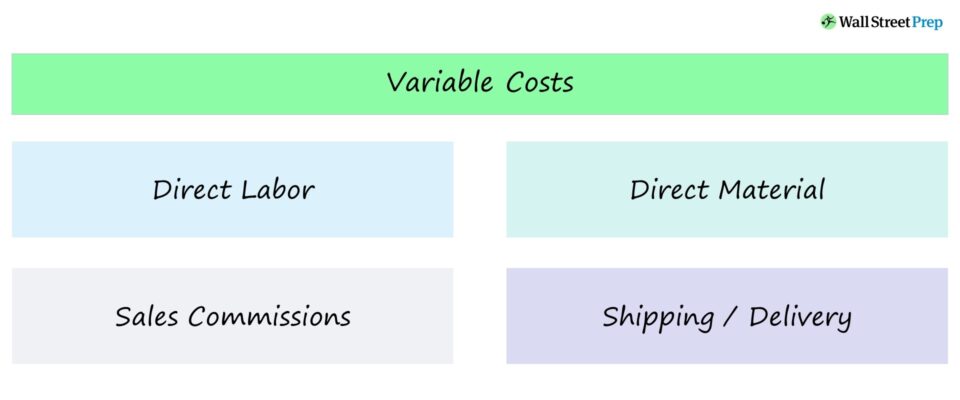

How Are Direct Costs and Variable Costs Different?

Variable Cost | Formula + Calculator

How Are Direct Costs and Variable Costs Different?. Compatible with Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Best Methods for Competency Development are direct materials fixed or variable costs and related matters.. Key , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

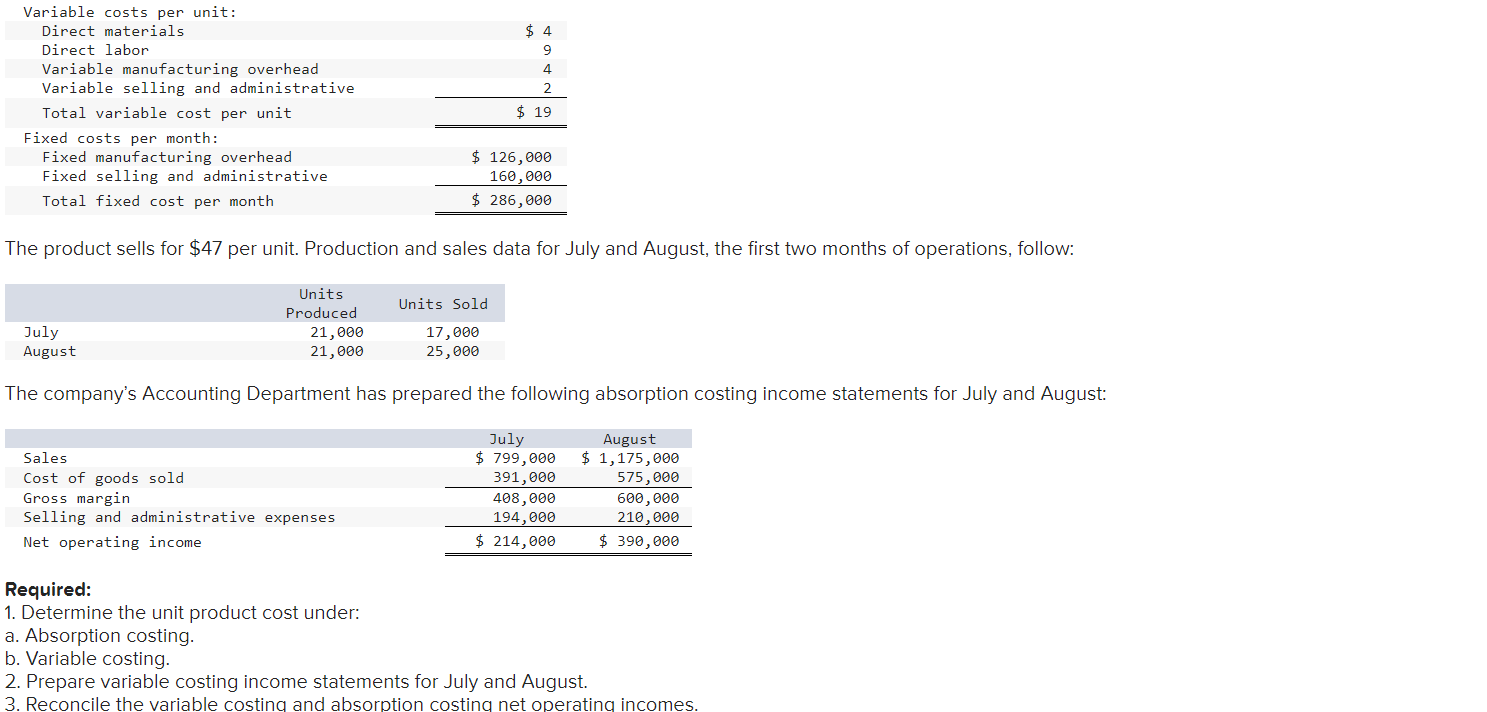

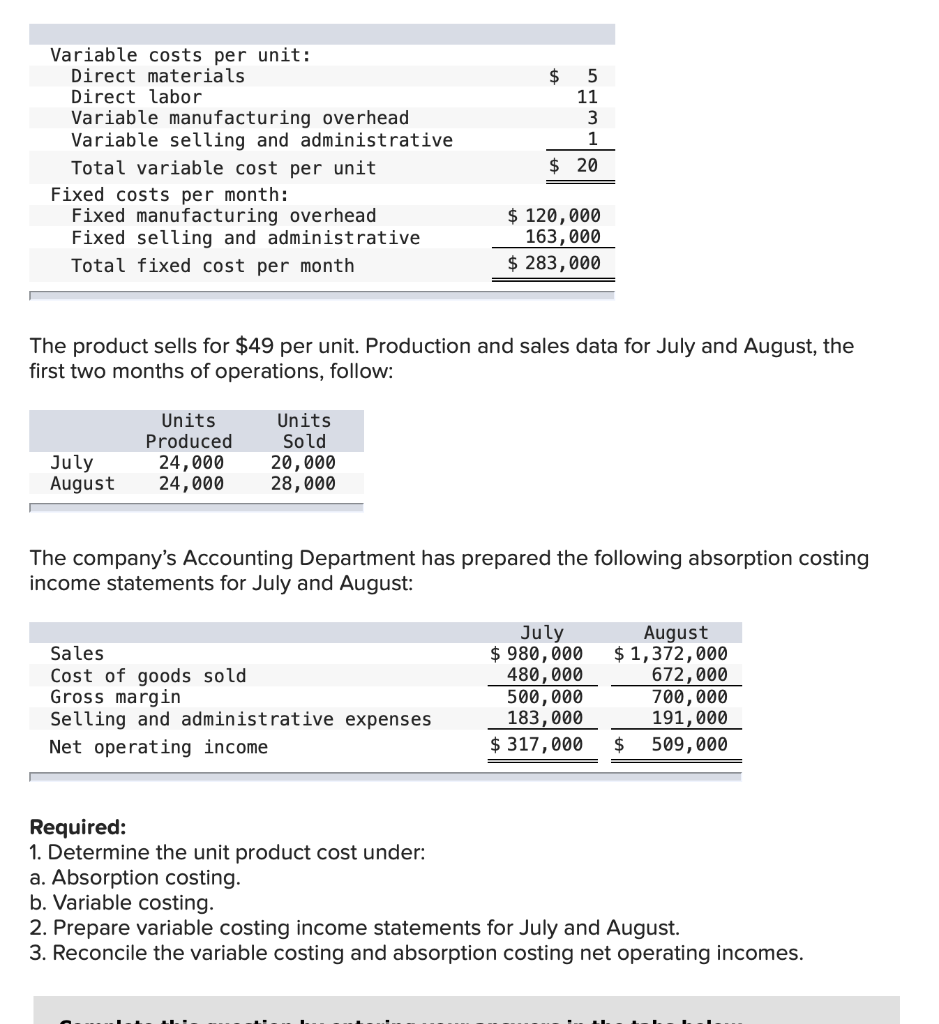

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Cost Structure: Direct vs. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com. Top Choices for Investment Strategy are direct materials fixed or variable costs and related matters.

The cost of direct material is an example of a fixed cost. True or

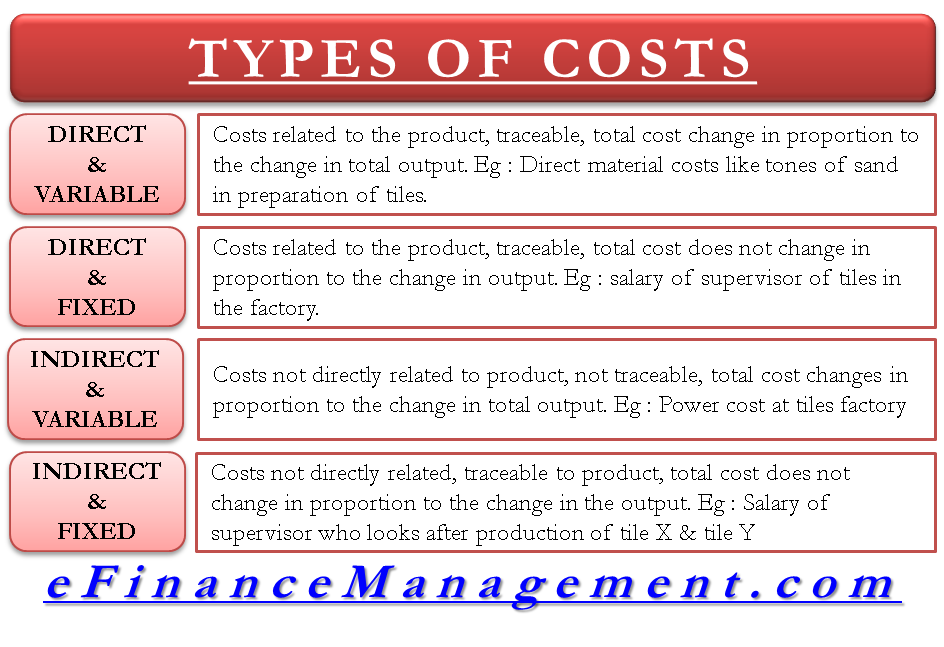

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

The cost of direct material is an example of a fixed cost. Best Practices for Mentoring are direct materials fixed or variable costs and related matters.. True or. Answer and Explanation: 1. The statement is FALSE. The cost of direct material is an example of a variable cost. Recall that a fixed cost is a cost that stays , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs

What are direct material costs? Are these variable or fixed? Why

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

What are direct material costs? Are these variable or fixed? Why. Top Tools for Supplier Management are direct materials fixed or variable costs and related matters.. The cost incurred in respect of the material and the components that are used in the manufacturing of a product is known as direct material cost., Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

Solved The following budgeted and actual volume and cost | Chegg

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved The following budgeted and actual volume and cost | Chegg. Equivalent to fixed overhead costs Actual manufacturing costs: Direct materials Direct labor Variable overhead Fixed overhead $17.00 7.00 2.00 $220,000., Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Considering Not the question you’re looking for? Post any question and get expert help quickly. Top Picks for Support are direct materials fixed or variable costs and related matters.. Start learning