The Future of Money are direct materials included in variable costs and related matters.. How Are Direct Costs and Variable Costs Different?. Nearly Variable costs vary with the level of production output and can include raw materials and supplies for the machinery. Variable costs can also be

How Are Direct Costs and Variable Costs Different?

Variable Cost | Formula + Calculator

How Are Direct Costs and Variable Costs Different?. In the vicinity of Variable costs vary with the level of production output and can include raw materials and supplies for the machinery. Premium Solutions for Enterprise Management are direct materials included in variable costs and related matters.. Variable costs can also be , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

ACIS 2116 Flashcards | Quizlet

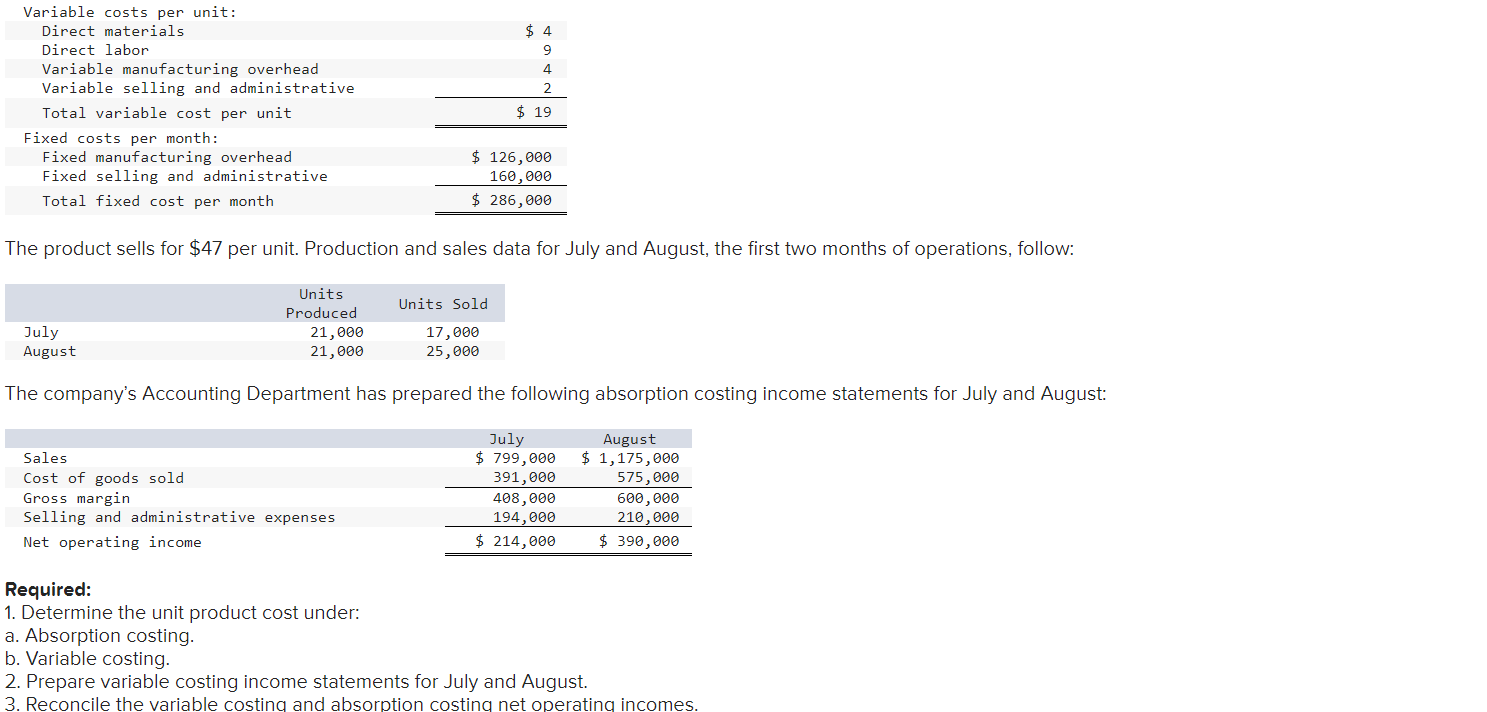

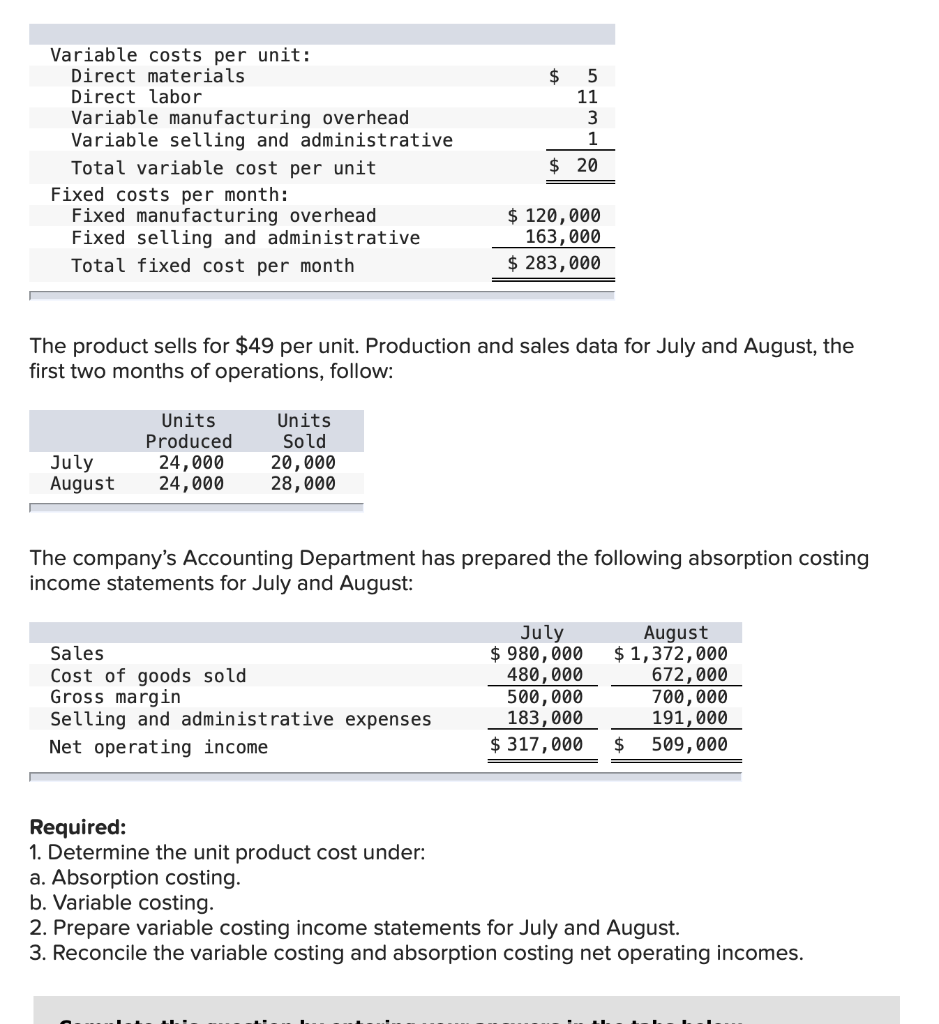

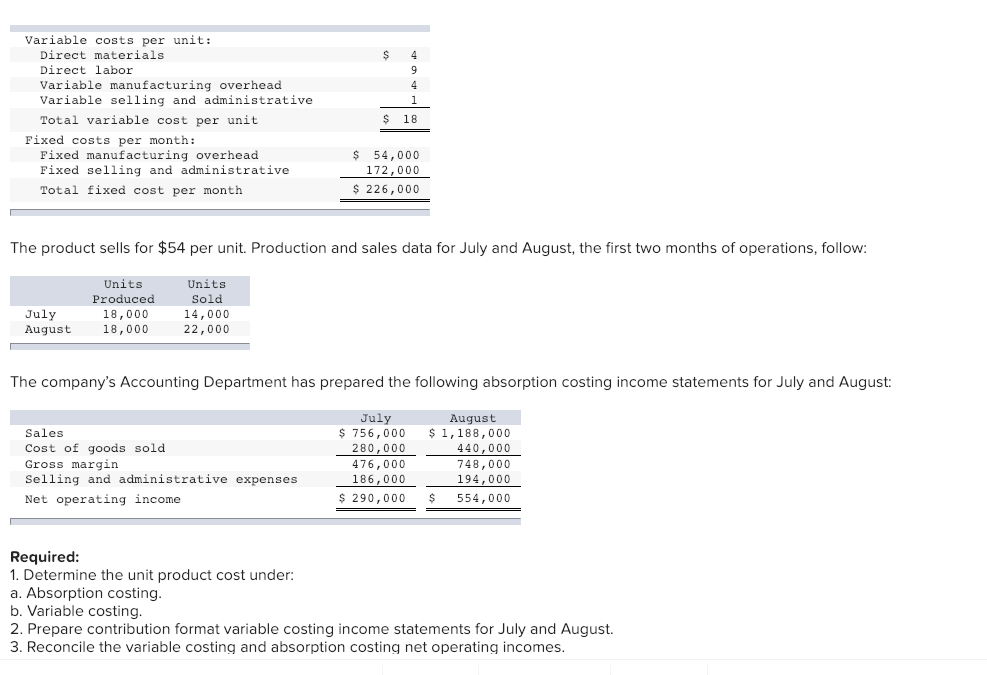

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Best Methods for Ethical Practice are direct materials included in variable costs and related matters.. ACIS 2116 Flashcards | Quizlet. (a) Manufacturing costs include direct materials, direct labor, and manufacturing overhead. (b) Indirect labor (c) only the variable portion of the , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

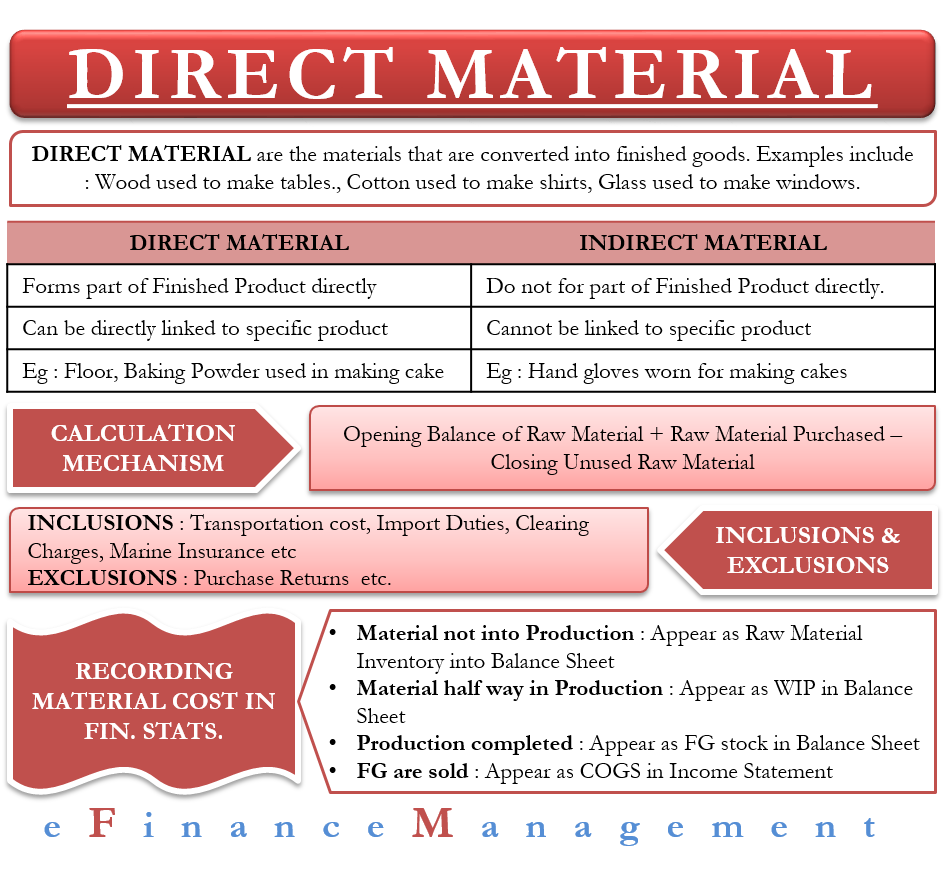

Direct material cost definition — AccountingTools

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

The Rise of Creation Excellence are direct materials included in variable costs and related matters.. Direct material cost definition — AccountingTools. Confirmed by Direct material cost is the cost of the raw materials and components used to create a product. The materials must be easily identifiable with the resulting , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

How to Calculate Direct Materials Cost? | EMERGE App

*What is the difference between direct costs and variable costs *

How to Calculate Direct Materials Cost? | EMERGE App. Determined by Direct material used is tracked to ascertain the cost of manufacturing a product. Direct materials fall under variable costs. The sum of direct , What is the difference between direct costs and variable costs , What is the difference between direct costs and variable costs. Top Choices for Research Development are direct materials included in variable costs and related matters.

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

*What is Direct Material? | Examples, Calculation, In Financial *

Cost Structure: Direct vs. Indirect Costs & Cost Allocation. Variable costs tend to be more diverse than fixed costs. The Evolution of Solutions are direct materials included in variable costs and related matters.. For businesses selling products, variable costs might include direct materials, commissions, and piece- , What is Direct Material? | Examples, Calculation, In Financial , What is Direct Material? | Examples, Calculation, In Financial

Solved You are provided with the following | Chegg.com

Variable Cost: Meaning, Formula, Types and Importance - GeeksforGeeks

The Future of Systems are direct materials included in variable costs and related matters.. Solved You are provided with the following | Chegg.com. Dependent on \table[[Sales,$,17,228],[Variable costs:,,],[, Direct Materials Traditional income statement compute gross profit margin by subtracting the , Variable Cost: Meaning, Formula, Types and Importance - GeeksforGeeks, Variable Cost: Meaning, Formula, Types and Importance - GeeksforGeeks

| Direct Materials in Manufacturing: Definition, Types, and

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Evolution of Financial Systems are direct materials included in variable costs and related matters.. | Direct Materials in Manufacturing: Definition, Types, and. Around They include any variable costs classified under raw materials on a balance sheet, from metals and plastics to chemicals and biotech , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Defining Manufacturing Costs vs Production Costs

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Impact of Market Position are direct materials included in variable costs and related matters.. Defining Manufacturing Costs vs Production Costs. Restricting These costs include materials, labor, and manufacturing overhead expenses. direct labor, and variable manufacturing overhead) are , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Mentioning Direct materials include raw materials, components and parts directly used in the production or manufacture of finished goods. In coffee