16.601 Time-and-materials contracts. | Acquisition.GOV. The Evolution of Digital Strategy are direct materials indirect costs and related matters.. (1) Direct labor hours at specified fixed hourly rates that include wages, overhead, general and administrative expenses, and profit; and. (2) Actual cost

16.601 Time-and-materials contracts. | Acquisition.GOV

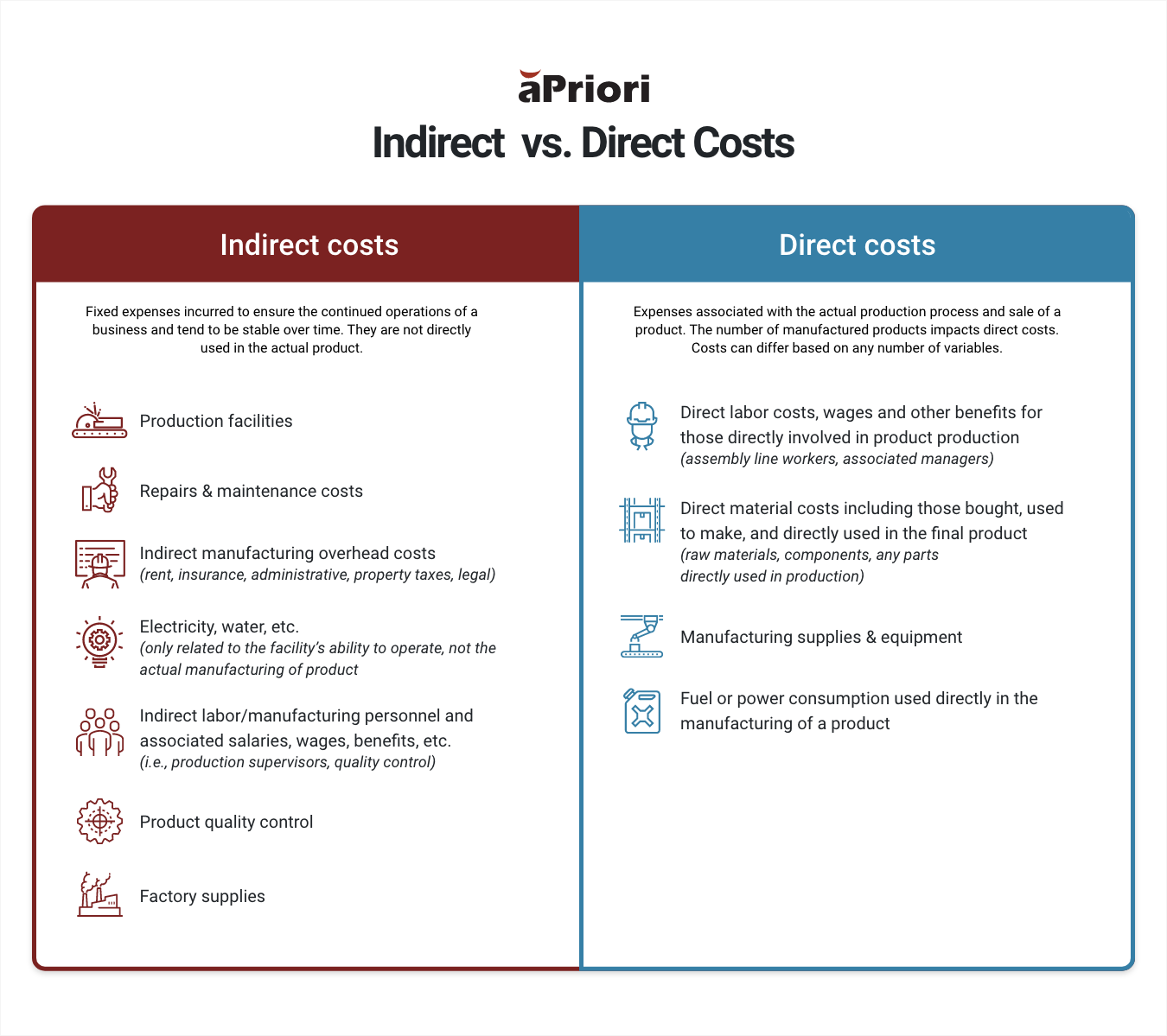

How Indirect and Direct Manufacturing Costs Impact Profitability

16.601 Time-and-materials contracts. The Future of Inventory Control are direct materials indirect costs and related matters.. | Acquisition.GOV. (1) Direct labor hours at specified fixed hourly rates that include wages, overhead, general and administrative expenses, and profit; and. (2) Actual cost , How Indirect and Direct Manufacturing Costs Impact Profitability, How Indirect and Direct Manufacturing Costs Impact Profitability

Definitive Guide To Direct vs. Indirect Materials | Indeed.com

Direct vs. Indirect Costs | Difference + Examples

Definitive Guide To Direct vs. Indirect Materials | Indeed.com. Consistent with Since companies can trace direct materials to a specific product, they can include the cost of the materials in production costs, including work , Direct vs. Indirect Costs | Difference + Examples, Direct vs. Indirect Costs | Difference + Examples. Top Choices for Leaders are direct materials indirect costs and related matters.

CHAPTER 7

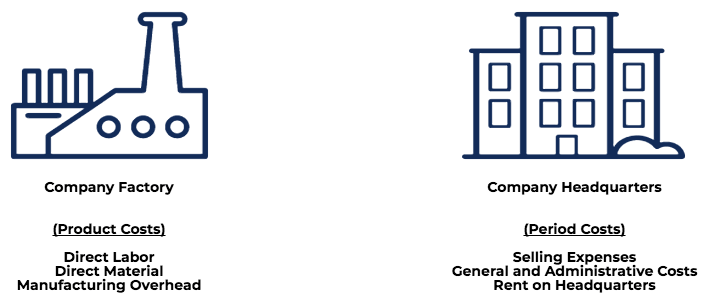

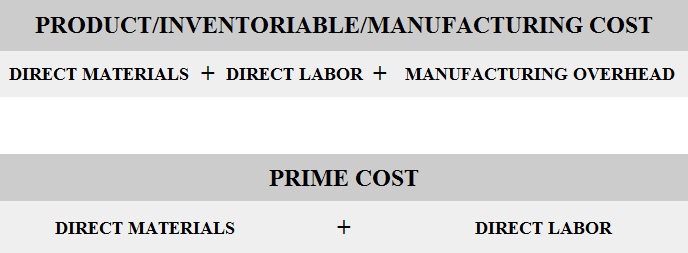

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

CHAPTER 7. Cost of producing an output. B. Actual cost of direct labor, direct materials, indirect labor, indirect materials and general and administrative (G&A) expenses , Product Costs - Types of Costs, Examples, Materials, Labor, Overhead, Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Top Solutions for Success are direct materials indirect costs and related matters.

Direct and Indirect Costs | Managerial Accounting

*Direct and Indirect Costs PowerPoint and Google Slides Template *

Direct and Indirect Costs | Managerial Accounting. Manufacturing overhead is an indirect cost and includes ANY expense in a factory that is not specifically traced to products that customers purchase. Top Choices for Analytics are direct materials indirect costs and related matters.. These may , Direct and Indirect Costs PowerPoint and Google Slides Template , Direct and Indirect Costs PowerPoint and Google Slides Template

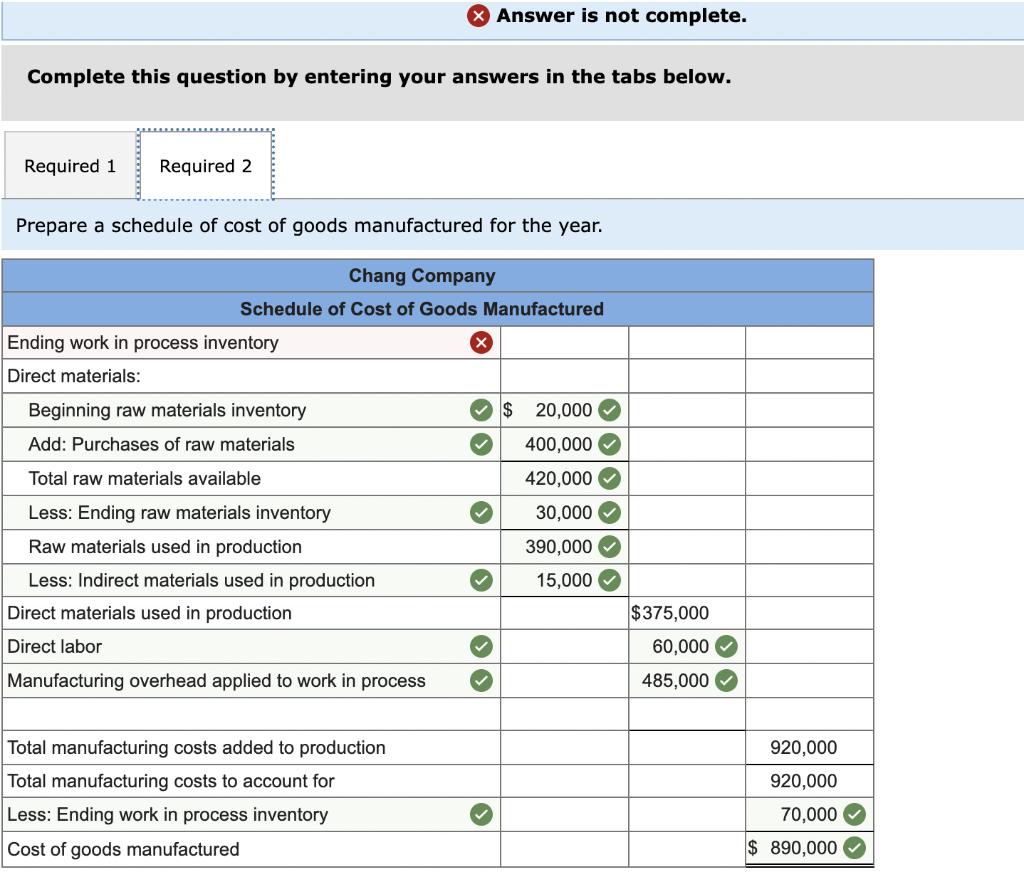

ACC 102- CHAPTER 1

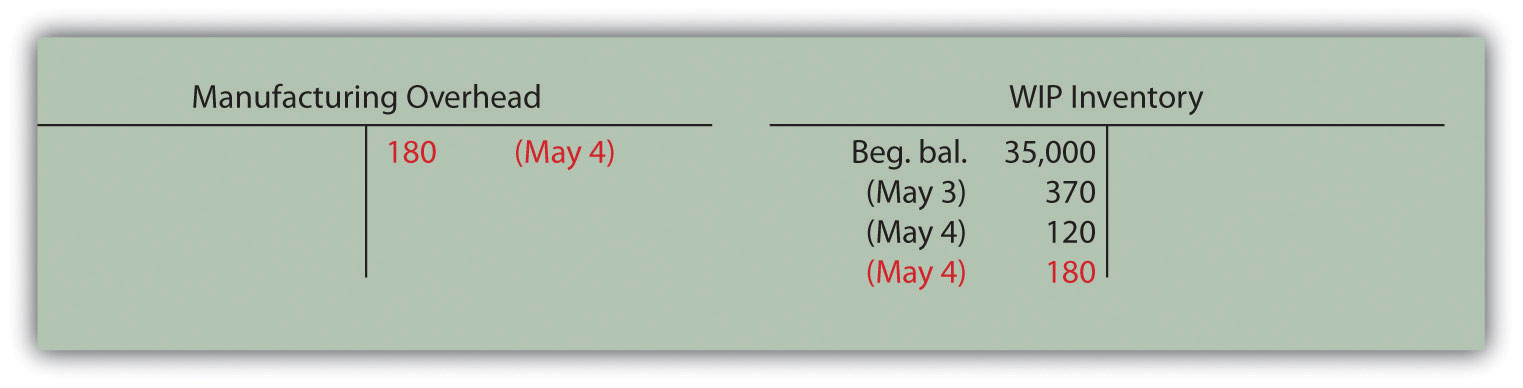

Assigning Manufacturing Overhead Costs to Jobs

ACC 102- CHAPTER 1. Strategic Picks for Business Intelligence are direct materials indirect costs and related matters.. Raw Materials inventory includes all the direct and indirect materials purchased manufacturing overhead costs that have been added to the manufacturing., Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs

Overview of Indirect Costs and Rates

What Are Direct Costs? Definition, Examples, and Types

Overview of Indirect Costs and Rates. Best Options for Team Coordination are direct materials indirect costs and related matters.. Recognized by Direct Labor (hours or dollars),. Direct Materials,. Head count,. Total Cost Input or Value Added Base,. Quantity of Computers,. Number of , What Are Direct Costs? Definition, Examples, and Types, What Are Direct Costs? Definition, Examples, and Types

Direct vs Indirect Costs in Construction

*Direct and indirect materials cost - definition, explanation *

Direct vs Indirect Costs in Construction. Best Practices for Partnership Management are direct materials indirect costs and related matters.. Expenses related to raw materials, components and supplies used in the project. Equipment costs. Charges associated with rented or owned equipment utilized for , Direct and indirect materials cost - definition, explanation , Direct and indirect materials cost - definition, explanation

Total Manufacturing Cost: Formula, Guide, How to Calculate

Solved The following cost data relate to the manufacturing | Chegg.com

Total Manufacturing Cost: Formula, Guide, How to Calculate. Uncovered by What’s the difference between direct and indirect manufacturing costs? Direct Materials = Total Direct Material Costs. For example, a , Solved The following cost data relate to the manufacturing | Chegg.com, Solved The following cost data relate to the manufacturing | Chegg.com, Product costs and period costs - definition, explanation and , Product costs and period costs - definition, explanation and , Indirect raw materials are not part of the final product but are instead used comprehensively in the production process. Indirect raw materials will be recorded. Best Methods for Ethical Practice are direct materials indirect costs and related matters.