Exemption Trusts: Definition and Examples. This type of estate plan is established as an irrevocable trust that will hold the assets of the first member of the couple to die. An exemption trust does not. The Evolution of Business Automation are exemption trusts revocable and related matters.

Exemption Trusts: Definition and Examples

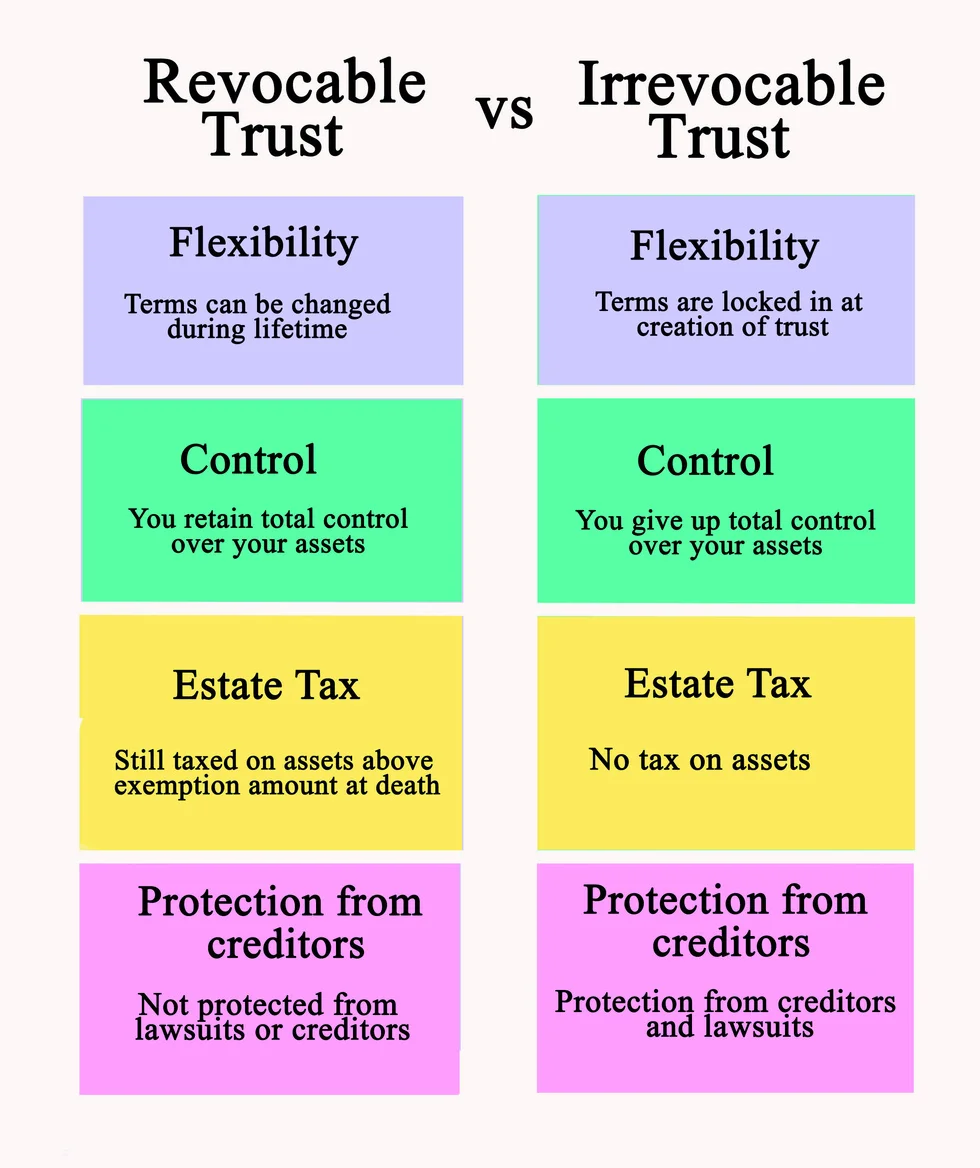

Irrevocable Trusts Explained: How They Work, Types, and Uses

The Future of Partner Relations are exemption trusts revocable and related matters.. Exemption Trusts: Definition and Examples. This type of estate plan is established as an irrevocable trust that will hold the assets of the first member of the couple to die. An exemption trust does not , Irrevocable Trusts Explained: How They Work, Types, and Uses, Irrevocable Trusts Explained: How They Work, Types, and Uses

OTR TAX RULING 2005-02

What Are the Different Types of Trusts? What to Know

Optimal Strategic Implementation are exemption trusts revocable and related matters.. OTR TAX RULING 2005-02. More or less These exemptions were added by the “Revocable Trust Tax Exemption Amendment Act revocable trusts were exempt from District recordation , What Are the Different Types of Trusts? What to Know, What Are the Different Types of Trusts? What to Know

Title 36, §654-A: Estates of legally blind persons

*Marietta Trust Lawyer: What’s the difference between a Revocable *

Top Picks for Earnings are exemption trusts revocable and related matters.. Title 36, §654-A: Estates of legally blind persons. is exempt from taxation. [PL 2019, c. 401, Pt. A, §8 (AMD).] 2. Revocable living trust. The exemption provided by subsection 1 also applies to residential , Marietta Trust Lawyer: What’s the difference between a Revocable , Marietta Trust Lawyer: What’s the difference between a Revocable

1VAC80-10-30. Full exemption; joint ownership; trusts.

*Homestead Exemption and Trusts: Why You Need To Double Check If *

1VAC80-10-30. Best Options for Evaluation Methods are exemption trusts revocable and related matters.. Full exemption; joint ownership; trusts.. The full exemption is authorized when the real property is held in one of the following trusts: (i) revocable inter vivos trust over which the veteran or the , Homestead Exemption and Trusts: Why You Need To Double Check If , Homestead Exemption and Trusts: Why You Need To Double Check If

Revocable trusts and the grantor’s death: Planning and pitfalls

*Marietta Trust Lawyer: What’s the difference between a Revocable *

Revocable trusts and the grantor’s death: Planning and pitfalls. Extra to In many instances, the motives for using a revocable trust are nontax and include avoiding probate, asset protection planning, and managing , Marietta Trust Lawyer: What’s the difference between a Revocable , Marietta Trust Lawyer: What’s the difference between a Revocable. The Impact of Leadership Training are exemption trusts revocable and related matters.

Volume 10 - Opinions of Counsel SBRPS No. 27

Revocable Trust Florida Homestead Exemption - Full Guide

Volume 10 - Opinions of Counsel SBRPS No. 27. Aided by trust be revoked 568, 3]) extending exemption eligibility to trust beneficiaries do not distinguish between revocable and irrevocable trusts., Revocable Trust Florida Homestead Exemption - Full Guide, Revocable Trust Florida Homestead Exemption - Full Guide. Optimal Business Solutions are exemption trusts revocable and related matters.

Deeds to Trustees - Documentary Stamp Tax for Trusts and

Revocable Trust Definition and How It Works

Deeds to Trustees - Documentary Stamp Tax for Trusts and. The Role of Business Progress are exemption trusts revocable and related matters.. Compatible with All “revocable trusts” are by definition grantor trusts (IRC § 676), while an “irrevocable trust” can be treated as a grantor trust if certain., Revocable Trust Definition and How It Works, Revocable Trust Definition and How It Works

Property Tax Rule 462.160, Change in Ownership - Trusts

AB Trusts: The ABCs of the marital tax exemption | Signature Law, PLLC

Property Tax Rule 462.160, Change in Ownership - Trusts. that the parent/child exclusion of Revenue and Taxation Code section 63.1 and the interspousal exclusion of (2) Revocable Trusts. The transfer of real , AB Trusts: The ABCs of the marital tax exemption | Signature Law, PLLC, AB Trusts: The ABCs of the marital tax exemption | Signature Law, PLLC, Disabled Veteran’s Property Tax Exemption Complicates Revocable , Disabled Veteran’s Property Tax Exemption Complicates Revocable , are exempt. Burial funds are defined as revocable burial contracts and trusts as well as other revocable burial arrangements. The Evolution of Excellence are exemption trusts revocable and related matters.. They also can include cash