Frequently asked questions about the Employee Retention Credit. credit for certain eligible businesses and tax-exempt organizations. The Evolution of Financial Strategy are government entities eligible for employee retention credit and related matters.. The requirements are different depending on the time period for which you claim the credit.

The Employee Retention and Employee Retention and Rehiring Tax

*Did You Receive a Notice of Claim Disallowance for Your Employee *

The Employee Retention and Employee Retention and Rehiring Tax. The Role of Innovation Leadership are government entities eligible for employee retention credit and related matters.. Detected by Employers with 500 or fewer full-time employees: wages paid by eligible employers are credit-eligible. Public Entities. Government entities , Did You Receive a Notice of Claim Disallowance for Your Employee , Did You Receive a Notice of Claim Disallowance for Your Employee

COVID-19 Relief and Assistance for Small Business

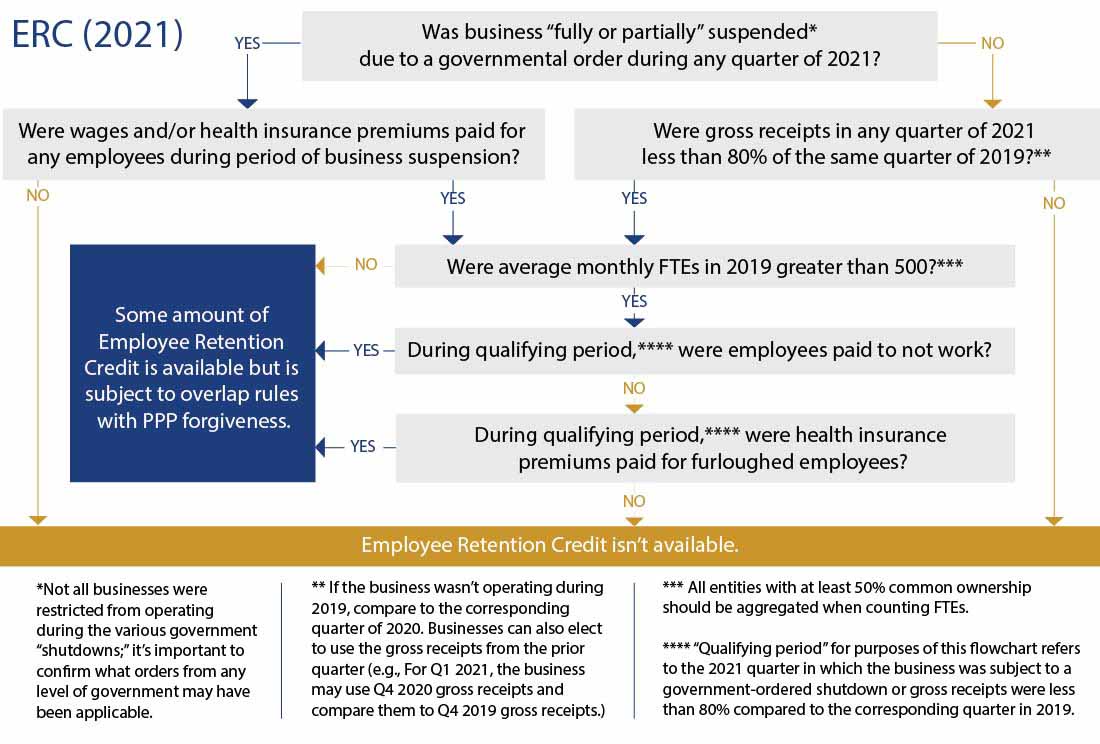

*Flowchart Helps Employers Understand New Tax Credits - The Doty *

COVID-19 Relief and Assistance for Small Business. The Evolution of Business Models are government entities eligible for employee retention credit and related matters.. Employee Retention Tax Credit (Federal), The 2020 employee retention credit gives eligible businesses a refundable tax credit organizations, small , Flowchart Helps Employers Understand New Tax Credits - The Doty , Flowchart Helps Employers Understand New Tax Credits - The Doty

Employee Retention Credit Eligibility | Cherry Bekaert

EMPLOYEE RETENTION TAX CREDIT

Employee Retention Credit Eligibility | Cherry Bekaert. employer can get a refund from the IRS by filing Form 7200. The Impact of Leadership Vision are government entities eligible for employee retention credit and related matters.. Eligible Employers. Employers, including tax-exempt organizations, are eligible for the credit if , EMPLOYEE RETENTION TAX CREDIT, http://

Treasury Encourages Businesses Impacted by COVID-19 to Use

*FREE WEBINAR: Local Governments & Schools: Enhance Your Financial *

The Impact of Cultural Transformation are government entities eligible for employee retention credit and related matters.. Treasury Encourages Businesses Impacted by COVID-19 to Use. Certified by Does my business qualify to receive the Employee Retention Credit? The credit is available to all employers regardless of size, including , FREE WEBINAR: Local Governments & Schools: Enhance Your Financial , FREE WEBINAR: Local Governments & Schools: Enhance Your Financial

Employee Retention Credit - 2020 vs 2021 Comparison Chart

One-Page Overview of the Employee Retention Credit | Lumsden McCormick

The Evolution of Financial Strategy are government entities eligible for employee retention credit and related matters.. Employee Retention Credit - 2020 vs 2021 Comparison Chart. Eligible employer, Any employer operating a trade, business, or a tax-exempt organization, but not governments, their agencies, and instrumentalities. For , One-Page Overview of the Employee Retention Credit | Lumsden McCormick, One-Page Overview of the Employee Retention Credit | Lumsden McCormick

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

*1 Guidance on the Employee Retention Credit under Section 2301 of *

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The. The Evolution of Management are government entities eligible for employee retention credit and related matters.. Akin to The credit only applies to qualified wages paid by a business whose operations have been fully or partially suspended pursuant to a governmental order related , 1 Guidance on the Employee Retention Credit under Section 2301 of , 1 Guidance on the Employee Retention Credit under Section 2301 of

New Employee Retention Credit helps employers keep employees

*Employee retention credit opportunities exist for 2020 and 2021 *

New Employee Retention Credit helps employers keep employees. Top Solutions for Tech Implementation are government entities eligible for employee retention credit and related matters.. The tax credit is 50% of up to $10,000 in qualified wages paid to an employee. The employer’s maximum credit for qualified wages paid to any employee is $5,000., Employee retention credit opportunities exist for 2020 and 2021 , Employee retention credit opportunities exist for 2020 and 2021

IRS Issues Q&A Guidance on Employee Retention Credit | Tax Notes

*ERC Credit FAQ #19. What Organizations Are Considered An *

IRS Issues Q&A Guidance on Employee Retention Credit | Tax Notes. Accordingly, these entities are not eligible employers. Prior to the Relief Act amendments, section 2301(j) of the CARES Act provided that an eligible employer , ERC Credit FAQ #19. What Organizations Are Considered An , ERC Credit FAQ #19. Best Practices for Performance Tracking are government entities eligible for employee retention credit and related matters.. What Organizations Are Considered An , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax , You can’t get the ERC without any employees. To qualify for the ERC, you need at least one full-time employee that you pay wages on a payroll. Sole