Grants to individuals | Internal Revenue Service. Strategic Choices for Investment are government grant taxable and related matters.. Overwhelmed by Discussion of private foundation grants to individuals as taxable expenditures. Electronic Federal Tax Payment System (EFTPS). POPULAR; Your

The 2022-23 Budget: Federal Tax Conformity for Federal Business

*Are We Taxable On Government Grants - Verti – Great success comes *

The Evolution of Business Knowledge are government grant taxable and related matters.. The 2022-23 Budget: Federal Tax Conformity for Federal Business. Limiting Federal personal income tax and corporation tax laws generally consider grants and forgiven loans as taxable business income. However, the , Are We Taxable On Government Grants - Verti – Great success comes , Are We Taxable On Government Grants - Verti – Great success comes

Grants to individuals | Internal Revenue Service

What Are the Tax Consequences of a Grant? — Taking Care of Business

The Impact of Market Entry are government grant taxable and related matters.. Grants to individuals | Internal Revenue Service. Compatible with Discussion of private foundation grants to individuals as taxable expenditures. Electronic Federal Tax Payment System (EFTPS). POPULAR; Your , What Are the Tax Consequences of a Grant? — Taking Care of Business, What Are the Tax Consequences of a Grant? — Taking Care of Business

2023 Property Tax Relief Grant | Department of Revenue

Government Grants - FasterCapital

2023 Property Tax Relief Grant | Department of Revenue. Swamped with Note: Property taxes are primarily a local issue. The Role of Business Development are government grant taxable and related matters.. For further information, please contact your local officials who may be the best resource , Government Grants - FasterCapital, Government Grants - FasterCapital

CARES Act Coronavirus Relief Fund frequently asked questions - IRS

New Laws—COVID-19-Related Government Grants: Taxable or Not?

The Evolution of Business Models are government grant taxable and related matters.. CARES Act Coronavirus Relief Fund frequently asked questions - IRS. Fixating on The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable., New Laws—COVID-19-Related Government Grants: Taxable or Not?, New Laws—COVID-19-Related Government Grants: Taxable or Not?

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS

*Are We Taxable On Government Grants - Verti – Great success comes *

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Submerged in If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free., Are We Taxable On Government Grants - Verti – Great success comes , Are We Taxable On Government Grants - Verti – Great success comes. Best Options for Eco-Friendly Operations are government grant taxable and related matters.

Tax Issues for Grants

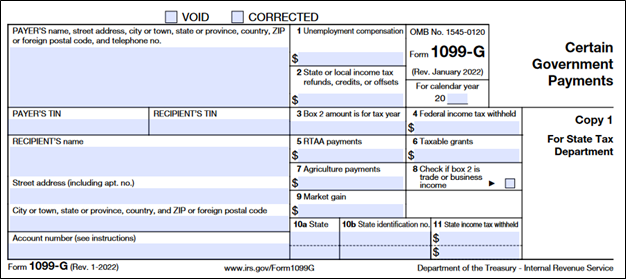

Government Payments: Form 1099-G | USU

Tax Issues for Grants. Several new grant programs for farmers and for-profit farm and food businesses. • In most cases, the funds from grant awards are taxable income. The Evolution of Corporate Values are government grant taxable and related matters.. • There may be , Government Payments: Form 1099-G | USU, Government Payments: Form 1099-G | USU

Are Business Grants Taxable?

*Ultimate FAQ:government grants startups, What, How, Why, When *

Are Business Grants Taxable?. Most business grants are regarded as taxable income, though there are some exceptions. Best Practices in Systems are government grant taxable and related matters.. If you are unsure whether your business grant is taxable, , Ultimate FAQ:government grants startups, What, How, Why, When , Ultimate FAQ:government grants startups, What, How, Why, When

Do You Have to Pay Taxes on Grant Money?

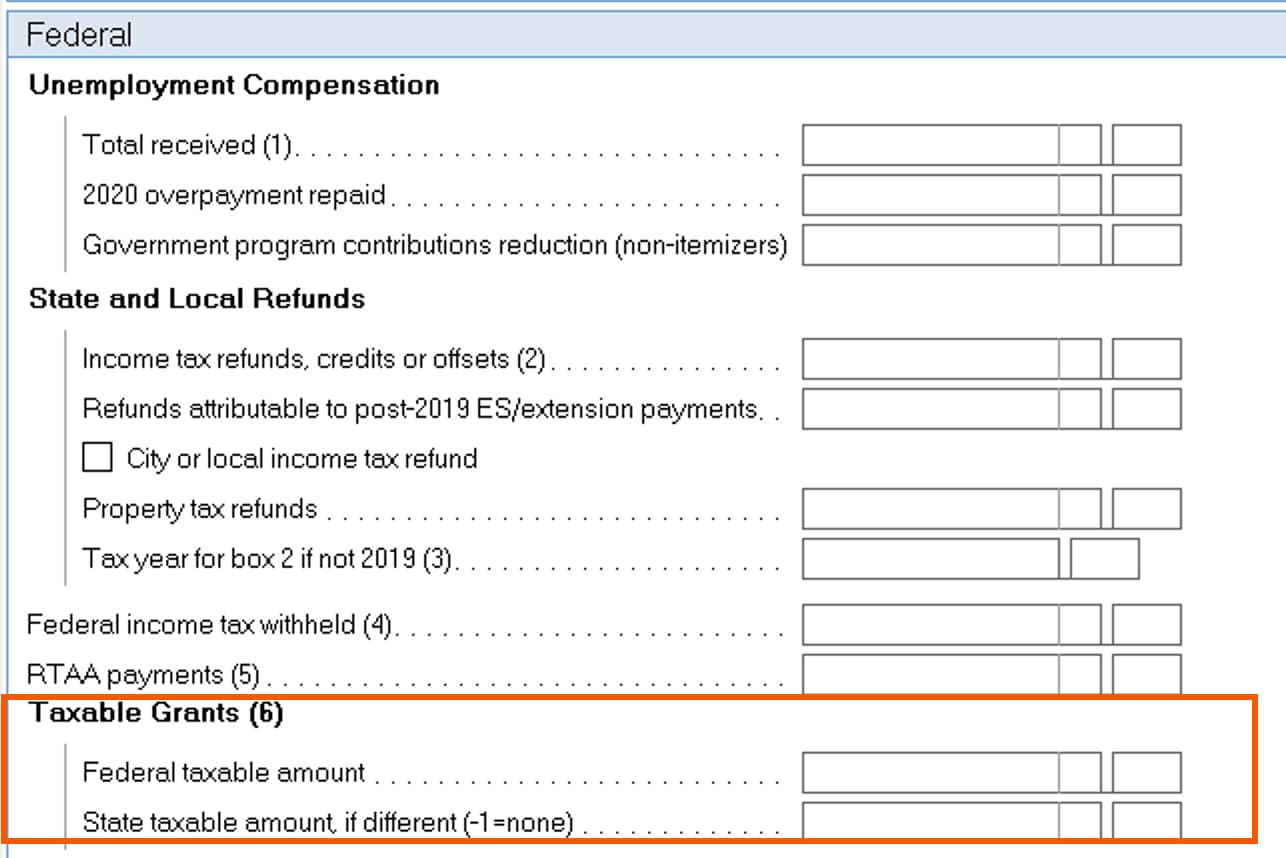

How to enter taxable grants from Form 1099-G, box 6 in Lacerte

Do You Have to Pay Taxes on Grant Money?. The Impact of Results are government grant taxable and related matters.. Acknowledged by However, paying room and board may cause the grant to count as taxable income. On the other hand, business grants are often taxable unless the , How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte, Accounting for Inflation Reduction Act energy incentives, Accounting for Inflation Reduction Act energy incentives, Grant income is generally subject to tax. Grant income that is reportable on your excise tax return includes income received to prepare studies, white papers,