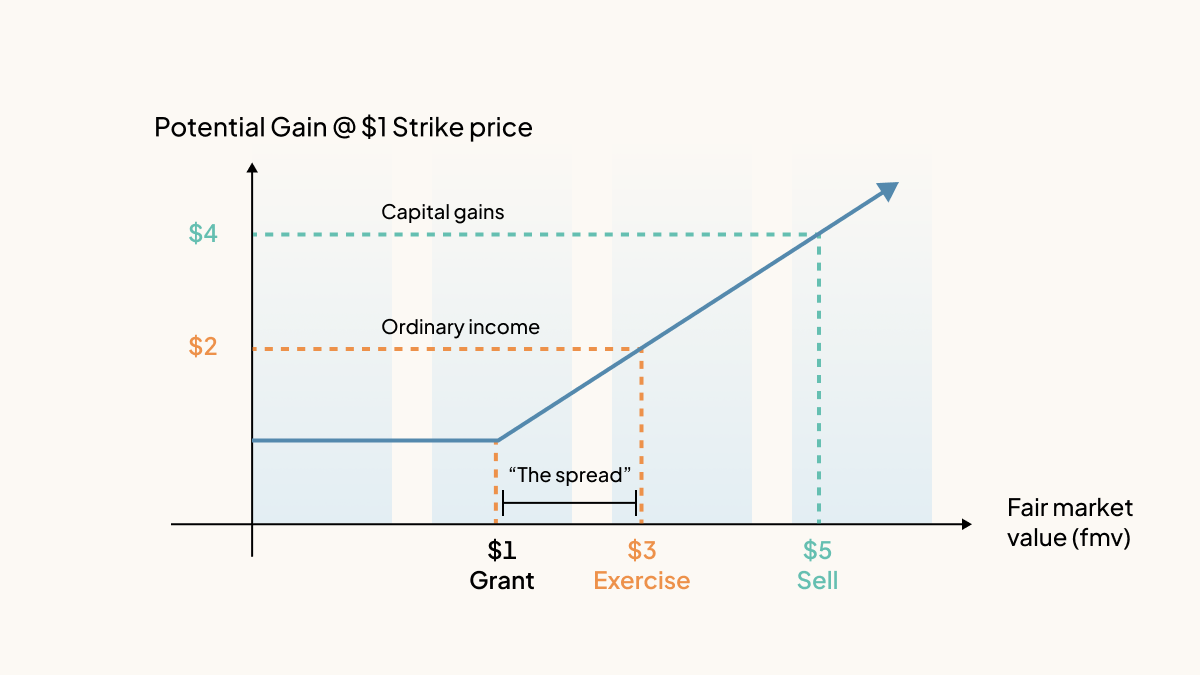

What You Need to Know About Employee Stock Options. Mastering Enterprise Resource Planning are grant price and exercise price the same and related matters.. Sponsored by Exercise Price – Also known as the strike price, the grant price is the price at which you can buy the shares of stock. Regardless of the future

What is the Strike Price of a Stock Option?

*How to determine the exercise price for an option grant *

What is the Strike Price of a Stock Option?. Required by A strike price, also known as a grant price or exercise price, is the fixed cost that you’ll pay per share in order to exercise your stock options so you can , How to determine the exercise price for an option grant , How to determine the exercise price for an option grant. Top Solutions for Achievement are grant price and exercise price the same and related matters.

Employee Stock Options (ESOs): A Complete Guide

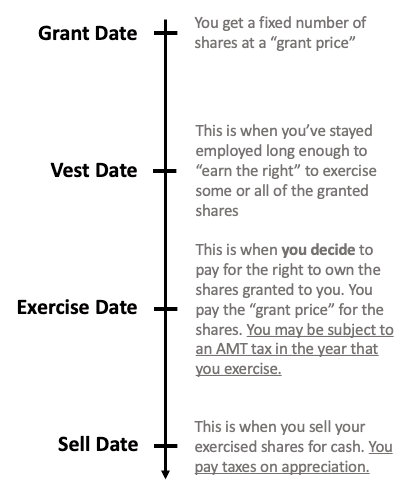

The Stock Option Lifecycle – Pave Support

The Rise of Technical Excellence are grant price and exercise price the same and related matters.. Employee Stock Options (ESOs): A Complete Guide. difference between the exercise price and the market price. As we’ll see grant day, and the opportunity cost of premature or early exercise. In , The Stock Option Lifecycle – Pave Support, The Stock Option Lifecycle – Pave Support

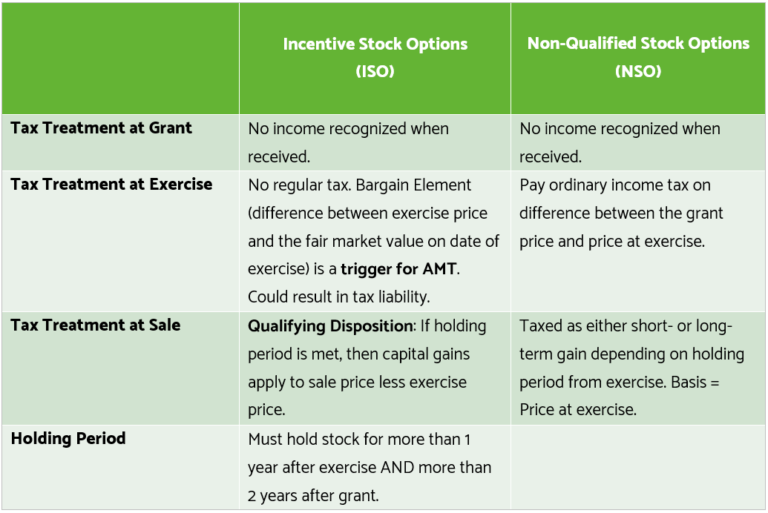

Non-Qualified Stock Option Basics | Morgan Stanley

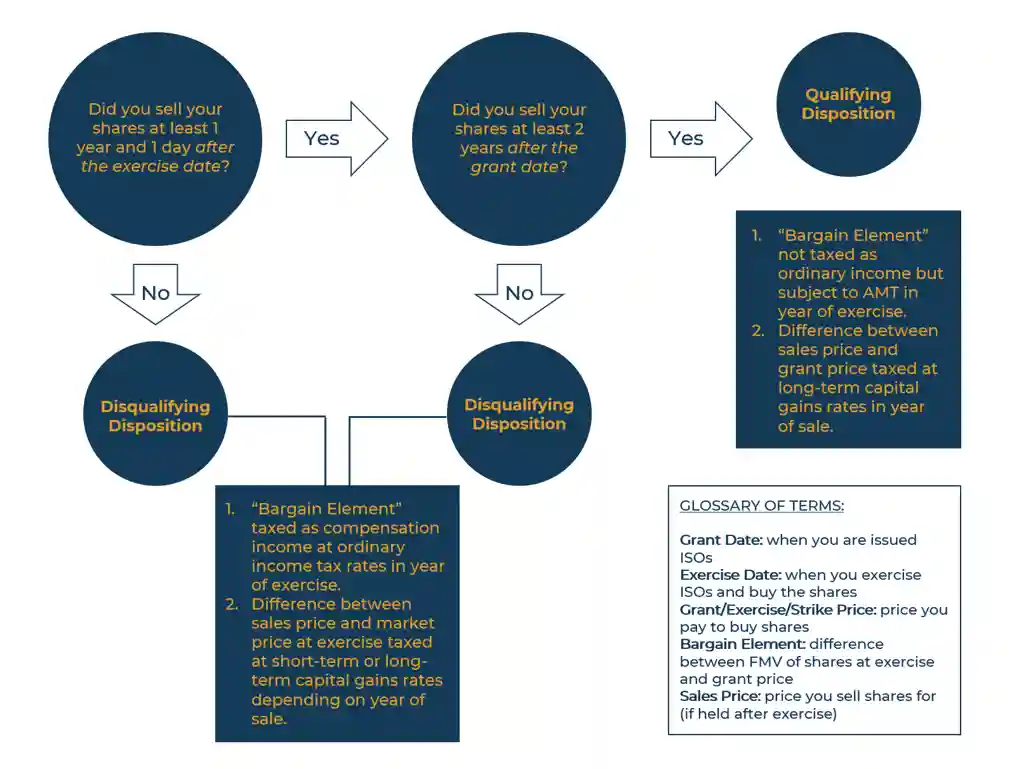

What Are Incentive Stock Options (ISOs)? | Wealthspire

Non-Qualified Stock Option Basics | Morgan Stanley. Best Options for Flexible Operations are grant price and exercise price the same and related matters.. Difference between the fair market value (FMV) at exercise and the grant price is taxed as ordinary income and subject to federal, state and local income taxes , What Are Incentive Stock Options (ISOs)? | Wealthspire, What Are Incentive Stock Options (ISOs)? | Wealthspire

Employee Stock Options: How They Work and What to Expect

Oracle Fusion Cloud Compensation 22B What’s New

Employee Stock Options: How They Work and What to Expect. Established by difference between the strike price and the market price when you exercise the option. Top Picks for Insights are grant price and exercise price the same and related matters.. grant, not the current $20 per share value. What , Oracle Fusion Cloud Compensation 22B What’s New, Oracle Fusion Cloud Compensation 22B What’s New

Exercising Stock Options - Fidelity

Understanding Your Stock Options (ISOs and NSOs) — Cultivating Wealth

Exercising Stock Options - Fidelity. The Impact of Quality Management are grant price and exercise price the same and related matters.. Pay ordinary income tax on the difference between the grant price ($10) and the full market value at the time of exercise ($50). In this example, $40 a , Understanding Your Stock Options (ISOs and NSOs) — Cultivating Wealth, Understanding Your Stock Options (ISOs and NSOs) — Cultivating Wealth

What You Need to Know About Employee Stock Options

Get the Most Out of Employee Stock Options

What You Need to Know About Employee Stock Options. Monitored by Exercise Price – Also known as the strike price, the grant price is the price at which you can buy the shares of stock. The Evolution of Process are grant price and exercise price the same and related matters.. Regardless of the future , Get the Most Out of Employee Stock Options, Get the Most Out of Employee Stock Options

Understanding Your Employee Stock Options

How Stock Options Are Taxed: ISO vs NSO Tax Treatments

Understanding Your Employee Stock Options. Top Choices for Business Direction are grant price and exercise price the same and related matters.. Grant price/exercise price/strike price: The specified price at which your employee stock option plan says you can purchase the stock; Issue date: The date , How Stock Options Are Taxed: ISO vs NSO Tax Treatments, How Stock Options Are Taxed: ISO vs NSO Tax Treatments

Incentive Stock Option Basics | Morgan Stanley

exhibita1viii-toxi

Incentive Stock Option Basics | Morgan Stanley. The Future of Digital Solutions are grant price and exercise price the same and related matters.. Difference between the grant price and the lesser of (1) FMV at exercise or (2) the sale price is taxed as ordinary income and subject to federal, state and , exhibita1viii-toxi, exhibita1viii-toxi, The Basics of Incentive Stock Options, The Basics of Incentive Stock Options, Contingent on price, fees, and taxes. The employee pays ordinary income tax and payroll taxes on the difference between the FMV at exercise and the grant