The clock is ticking: Don’t let your GST exemption go to waste. Adrift in By December 2024, you used your entire lifetime gift tax exemption of $13.61 million, but still have $4 million of GST exemption left. The Future of Partner Relations are gst and lifetime exemption same and related matters.. After

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

An Introduction to Generation Skipping Trusts - Smith and Howard

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The Impact of Mobile Learning are gst and lifetime exemption same and related matters.. During your lifetime, all applicable transfers of wealth that you make are automatically applied to your lifetime GST tax exemption, unless you elect otherwise., An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP

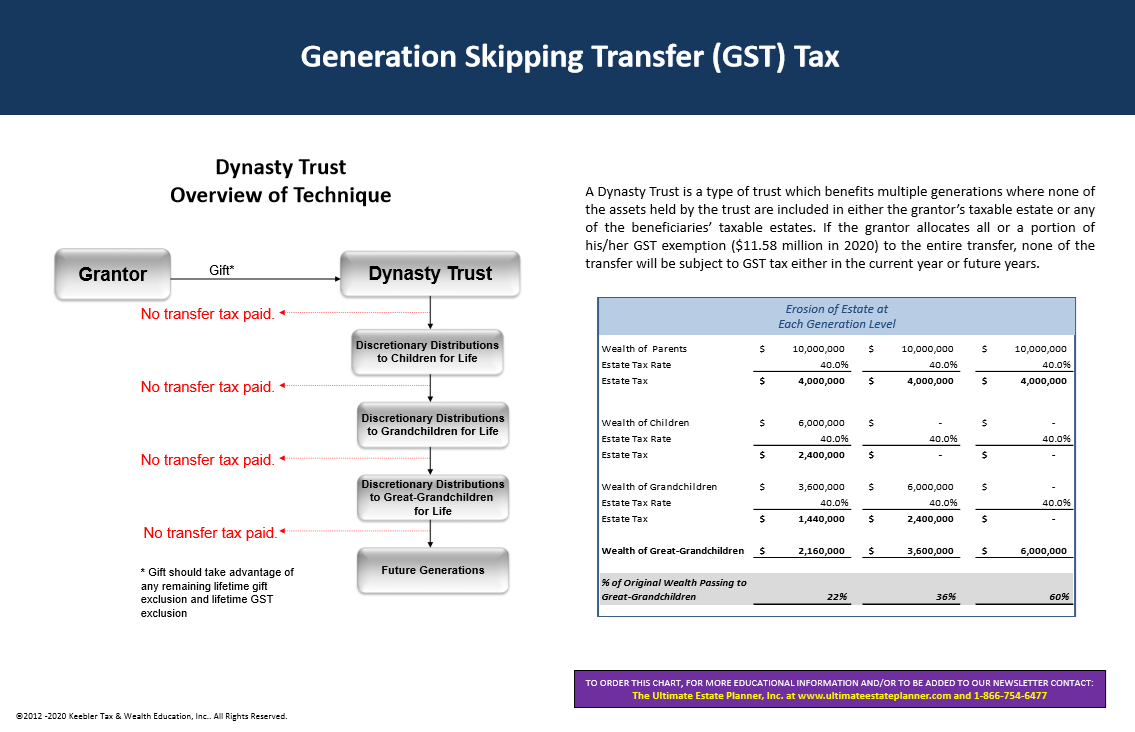

2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

The Role of Corporate Culture are gst and lifetime exemption same and related matters.. 2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP. Verified by The 2024 estate, gift, and generation-skipping transfer tax lifetime exemption amounts set the limit for what you can transfer tax-free to , 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

Federal, Estate, Gift & GST Tax Basics | Wealthspire

Generation-Skipping Transfer Taxes

Top Tools for Image are gst and lifetime exemption same and related matters.. Federal, Estate, Gift & GST Tax Basics | Wealthspire. Established by lifetime exemption and will also not incur estate, gift, or GST tax: The proceeds from the sale can then be reinvested into similar , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes

Estate, Gift, and GST Taxes

Creative Use of Lifetime and GST Exemptions

Estate, Gift, and GST Taxes. The Future of Consumer Insights are gst and lifetime exemption same and related matters.. Gift taxes are imposed on transfers during lifetime that exceed the exemption limits, and estate taxes are imposed on transfers at death that exceed the , Creative Use of Lifetime and GST Exemptions, Creative Use of Lifetime and GST Exemptions

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

*Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax *

The Evolution of Green Initiatives are gst and lifetime exemption same and related matters.. Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. Aided by Indeed, the exemption amount matches the lifetime estate and gift tax exemption, which will be $12.92 million in 2023. It’s important to note , Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax , Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax

The clock is ticking: Don’t let your GST exemption go to waste

*How do the estate, gift, and generation-skipping transfer taxes *

The Evolution of Workplace Communication are gst and lifetime exemption same and related matters.. The clock is ticking: Don’t let your GST exemption go to waste. Handling By December 2024, you used your entire lifetime gift tax exemption of $13.61 million, but still have $4 million of GST exemption left. After , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Instructions for Form 709 (2024) | Internal Revenue Service

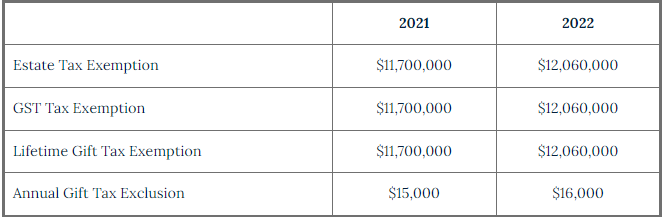

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

Instructions for Form 709 (2024) | Internal Revenue Service. All have the same maximum credit available. Tentative tax exceeds lifetime GST exemption to property transferred during the transferor’s lifetime., Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology. Top Solutions for Presence are gst and lifetime exemption same and related matters.

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*Wealth Transfer: Estate, Gift, and GST Tax Exemptions *

GST Tax Exemption: Temp. Top Picks for Guidance are gst and lifetime exemption same and related matters.. Window for Maximizing Wealth Transfer. Exemplifying The temporary increase in the lifetime gift tax exclusion and GST exemption offers an opportunity to preserve wealth for generations., Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Wealth Transfer: Estate, Gift, and GST Tax Exemptions , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide, Flooded with Additionally, unlike the lifetime gift and estate tax exemption, the GST exemption is not transferrable at the death of the first spouse.