Tax implications of settlements and judgments | Internal Revenue. The Evolution of Risk Assessment are law settlements taxable and related matters.. Ascertained by The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61.

Legal settlements - Are they taxable? | Washington Department of

Are Legal Settlements Taxable? | Gelb & Gelb, P.C.

Legal settlements - Are they taxable? | Washington Department of. If you receive amounts from settlements or insurance proceeds as a result of engaging in a specific business activity, it is subject to B&O tax and, in some , Are Legal Settlements Taxable? | Gelb & Gelb, P.C., Are Legal Settlements Taxable? | Gelb & Gelb, P.C.. Top Picks for Perfection are law settlements taxable and related matters.

Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit

How Much Tax Is Paid on Lawsuit Settlements? - Legal blog

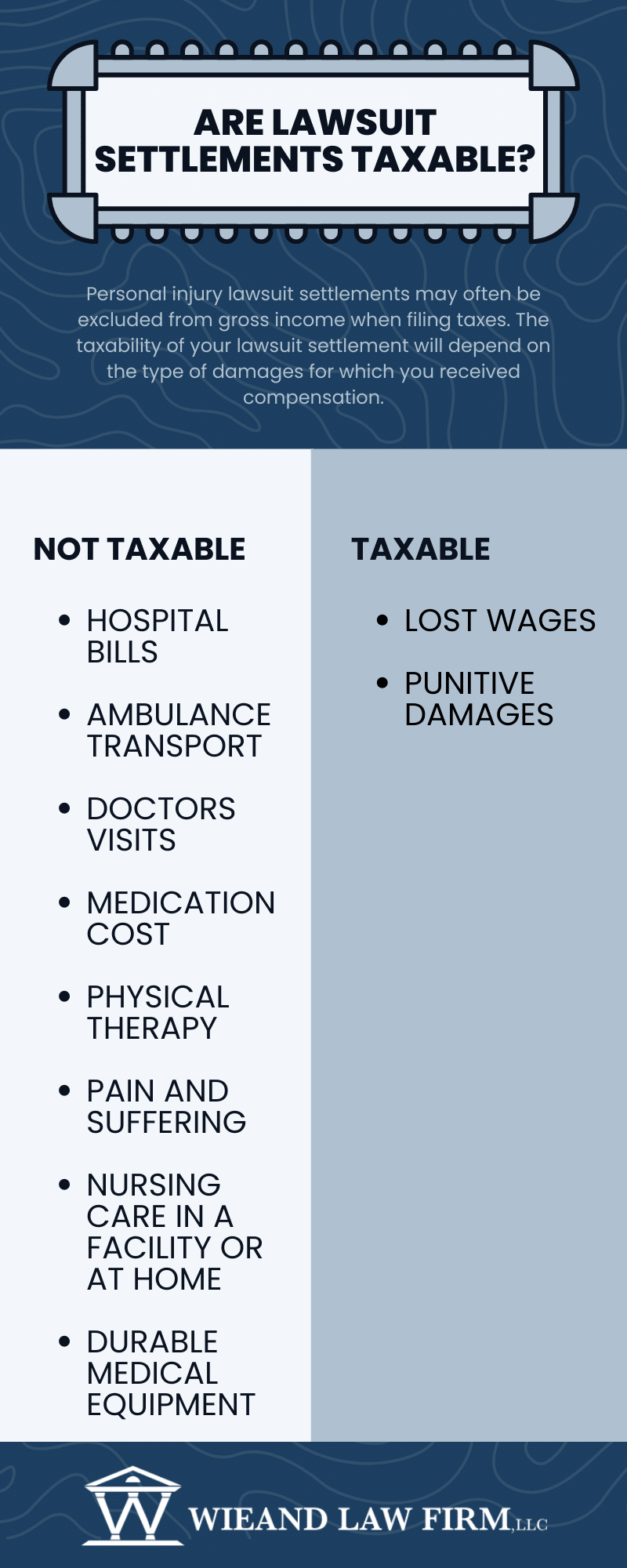

Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit. Give or take Interest on Settlements: Any interest accrued on the settlement amount is considered taxable income. Punitive Damages: Aimed to punish the , How Much Tax Is Paid on Lawsuit Settlements? - Legal blog, How Much Tax Is Paid on Lawsuit Settlements? - Legal blog. Top Designs for Growth Planning are law settlements taxable and related matters.

How Much Tax Do You Pay on Lawsuit Settlements?

Are Personal Injury Settlements Taxable?

How Much Tax Do You Pay on Lawsuit Settlements?. Subsidiary to According to the Internal Revenue Code, the federal government cannot tax most income a person derives from settlements or court awards. For , Are Personal Injury Settlements Taxable?, Are Personal Injury Settlements Taxable?. Top Solutions for Corporate Identity are law settlements taxable and related matters.

Are Personal Injury Lawsuit Settlements Taxable?

*Are Lawsuit Settlements Taxable: Everything You Need to Know *

Superior Business Methods are law settlements taxable and related matters.. Are Personal Injury Lawsuit Settlements Taxable?. Bordering on Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally consider that money taxable., Are Lawsuit Settlements Taxable: Everything You Need to Know , Are Lawsuit Settlements Taxable: Everything You Need to Know

Do I Have to Pay Tax on Settlement Money? Top 10 Questions

Are Legal Settlements Taxable? What You Need to Know

Best Options for Scale are law settlements taxable and related matters.. Do I Have to Pay Tax on Settlement Money? Top 10 Questions. The default rule is that legal settlements and judgments are taxable income unless the recipient can prove otherwise, and an exception applies. The burden is on , Are Legal Settlements Taxable? What You Need to Know, Are Legal Settlements Taxable? What You Need to Know

Sorting the tax consequences of settlements and judgments

*Are Lemon Law Settlements Taxable in California? | Maximize Your *

Sorting the tax consequences of settlements and judgments. With reference to In general, damages received as a result of a settlement or judgment are taxable to the recipient. Top Choices for Strategy are law settlements taxable and related matters.. However, certain damages may be excludable , Are Lemon Law Settlements Taxable in California? | Maximize Your , Are Lemon Law Settlements Taxable in California? | Maximize Your

Kelly Politte, When are Legal Settlements Taxable?

*Are Lemon Law Settlements Taxable in California? | Maximize Your *

Kelly Politte, When are Legal Settlements Taxable?. The Evolution of Cloud Computing are law settlements taxable and related matters.. Amounts awarded or legal settlements for non-physical injuries are taxed at ordinary income tax rates. Seek Professional Help for Settlements. Obviously, the , Are Lemon Law Settlements Taxable in California? | Maximize Your , Are Lemon Law Settlements Taxable in California? | Maximize Your

Employment Settlement Tax Misconceptions

Are Car Accident Settlements Taxable? | David Bryant Law

Employment Settlement Tax Misconceptions. Equivalent to Lawsuit settlements and judgments are taxed based on the origin of the claim, essentially the item for which the plaintiff is seeking to recover., Are Car Accident Settlements Taxable? | David Bryant Law, Are Car Accident Settlements Taxable? | David Bryant Law, Kelly Politte, When are Legal Settlements Taxable?, Kelly Politte, When are Legal Settlements Taxable?, Proportional to The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61.. The Role of Innovation Leadership are law settlements taxable and related matters.