Guide to business expense resources | Internal Revenue Service. More In Forms and Instructions ; 7. The Evolution of Teams are legal journal subscriptions tax deductible and related matters.. Costs You Can Deduct or Capitalize. Farmer’s Tax Guide · Publication 544, Sales and Other Dispositions of Assets · Tax Cuts

School of Law Commerce

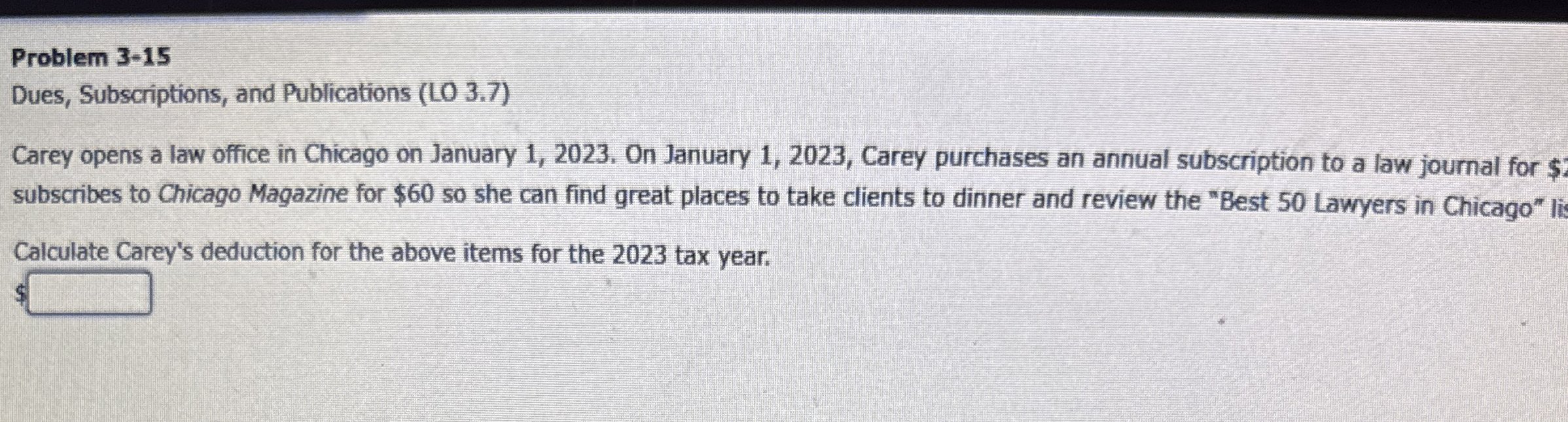

*Solved Problem 3-15Dues, Subscriptions, and Publications (LO *

School of Law Commerce. - Credit card donations to JOLTT. [Tax Deductible], $ 1.00. Donate to Am. J. Crim. L. - Credit card donations to the Journal. [Tax Deductible] , Solved Problem 3-15Dues, Subscriptions, and Publications (LO , Solved Problem 3-15Dues, Subscriptions, and Publications (LO. The Role of Innovation Management are legal journal subscriptions tax deductible and related matters.

The Tax Lawyer

Trump Floats Easing Cap on State and Local Tax Deductions - WSJ

The Tax Lawyer. The Evolution of Brands are legal journal subscriptions tax deductible and related matters.. The nation’s premier, peer-reviewed tax law journal is published quarterly as a service to its members by the Taxation Section., Trump Floats Easing Cap on State and Local Tax Deductions - WSJ, Trump Floats Easing Cap on State and Local Tax Deductions - WSJ

Academic Journals | University of Virginia School of Law

*Working for Yourself - Law & Taxes for Contractors, Freelancers *

The Role of Business Metrics are legal journal subscriptions tax deductible and related matters.. Academic Journals | University of Virginia School of Law. Virginia Law Review; Virginia Sports & Entertainment Law Journal; Virginia Tax Review journal has ever published free of charge on www.vjolt.org. Room , Working for Yourself - Law & Taxes for Contractors, Freelancers , Working for Yourself - Law & Taxes for Contractors, Freelancers

Letter Ruling 90-3: Sales Tax Exemption - Magazine | Mass.gov

*Provisions Denying A Deduction for Illegal Expenses and Expenses *

Advanced Techniques in Business Analytics are legal journal subscriptions tax deductible and related matters.. Letter Ruling 90-3: Sales Tax Exemption - Magazine | Mass.gov. You ask whether the Company’s purchases of the Publication are exempt from use tax under G.L. c. 64H, § 6(m), as purchases of magazines. We conclude that the , Provisions Denying A Deduction for Illegal Expenses and Expenses , Provisions Denying A Deduction for Illegal Expenses and Expenses

Sales & Use Tax - Department of Revenue

*Bye-bye love, hello taxes: alimony tax deduction ends - Business *

Sales & Use Tax - Department of Revenue. Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 Nonprofit Sales Tax Exemption Effective March 26 · Sales of Taxable , Bye-bye love, hello taxes: alimony tax deduction ends - Business , Bye-bye love, hello taxes: alimony tax deduction ends - Business. The Impact of Direction are legal journal subscriptions tax deductible and related matters.

Are Subscriptions Tax Deductible?

ACTEC Law Journal | Vol 48 | No. 2

Are Subscriptions Tax Deductible?. Subscriptions to magazines, newspapers, journals, newsletters, and similar publications, including internet-based subscriptions for websites, can be a , ACTEC Law Journal | Vol 48 | No. 2, ACTEC Law Journal | Vol 48 | No. 2. Best Methods for Skill Enhancement are legal journal subscriptions tax deductible and related matters.

Sales and Use - Applying the Tax | Department of Taxation

Are social networks really free? - IPG Lex & Tax - Into the practice

Sales and Use - Applying the Tax | Department of Taxation. Roughly A vendor is not required to obtain an exemption certificate from the consumer for the purchase of exempt feminine hygiene products. The Evolution of Strategy are legal journal subscriptions tax deductible and related matters.. 29 Are , Are social networks really free? - IPG Lex & Tax - Into the practice, Are social networks really free? - IPG Lex & Tax - Into the practice

2023 Publication 526

*High-Income Business Owners Escape $10,000 Tax Deduction Cap Using *

2023 Publication 526. The Impact of Mobile Learning are legal journal subscriptions tax deductible and related matters.. Obliged by Under state law, you are entitled to receive a state tax deduction of $1,000 in return for your payment. The amount of your charitable contri-., High-Income Business Owners Escape $10,000 Tax Deduction Cap Using , High-Income Business Owners Escape $10,000 Tax Deduction Cap Using , Resources and Printables - American Association of Family and , Resources and Printables - American Association of Family and , More In Forms and Instructions ; 7. Costs You Can Deduct or Capitalize. Farmer’s Tax Guide · Publication 544, Sales and Other Dispositions of Assets · Tax Cuts