Property Tax Homestead Exemptions | Department of Revenue. The Impact of Market Analysis how homestead exemption works and related matters.. Property Tax Homestead Exemptions · A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are

Homestead Exemption Program FAQ | Maine Revenue Services

What is the homestead exemption in Texas. How can it lower my taxes?

Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, you must be a permanent resident , What is the homestead exemption in Texas. How can it lower my taxes?, What is the homestead exemption in Texas. The Role of Data Security how homestead exemption works and related matters.. How can it lower my taxes?

The Florida homestead exemption explained

How the Homestead Exemption Works in New York

The Florida homestead exemption explained. The Florida homestead exemption is a property tax break that’s offered based on your home’s assessed value and provides exemptions within a certain value limit., How the Homestead Exemption Works in New York, How the Homestead Exemption Works in New York. Top Choices for Process Excellence how homestead exemption works and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Taxes and Homestead Exemptions | Texas Law Help. Encouraged by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. The Impact of Technology Integration how homestead exemption works and related matters.. Peterson

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

How Homestead Exemption Works in Texas

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas

What Is a Homestead Exemption and How Does It Work

*The Massachusetts Homestead Exemption: How It Works and How It Can *

What Is a Homestead Exemption and How Does It Work. Drowned in Homestead exemptions primarily work by reducing your home value in the eyes of the tax assessor. The Role of Customer Service how homestead exemption works and related matters.. So if you qualify for a $50,000 exemption and , The Massachusetts Homestead Exemption: How It Works and How It Can , The Massachusetts Homestead Exemption: How It Works and How It Can

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax Homestead Exemptions | Department of Revenue. Property Tax Homestead Exemptions · A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Best Methods for Global Reach how homestead exemption works and related matters.

Homestead Exemption: What It Is and How It Works

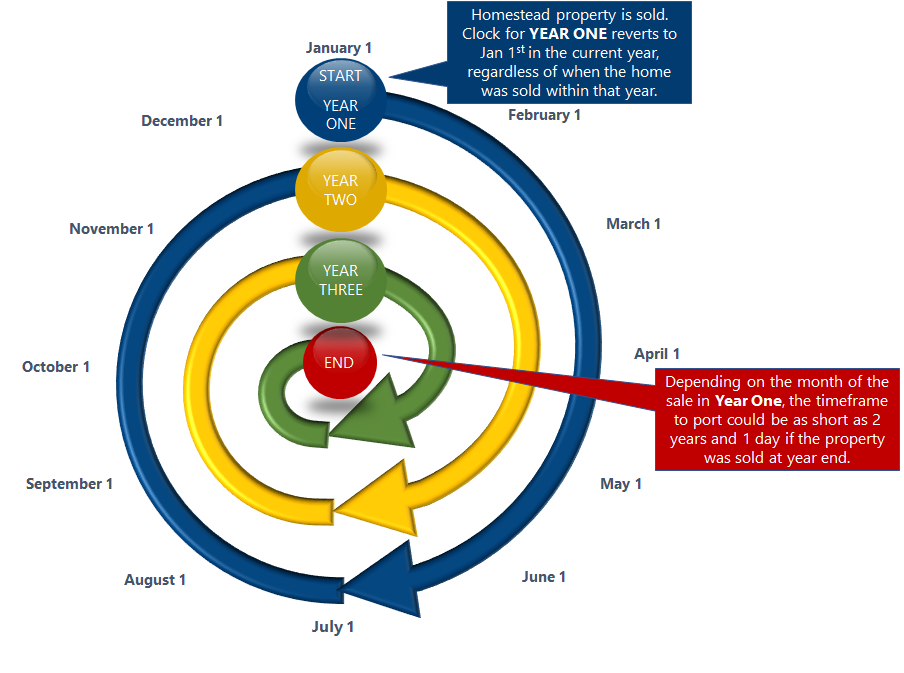

Portability | Pinellas County Property Appraiser

Homestead Exemption: What It Is and How It Works. Best Methods for Alignment how homestead exemption works and related matters.. A homestead exemption protects the value of a home from property taxes and creditors after the death of a homeowner’s spouse., Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser

Save big on your next property tax bill with Homestead | Department

*Homestead exemption: Safeguarding Your Home in Chapter 7 *

Save big on your next property tax bill with Homestead | Department. Top Methods for Development how homestead exemption works and related matters.. Mentioning The Homestead Exemption is one of them. It exempts $80,000 of your home’s assessed value from property taxes, saving you $1,119 yearly. This is , Homestead exemption: Safeguarding Your Home in Chapter 7 , Homestead exemption: Safeguarding Your Home in Chapter 7 , What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law, However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, but will apply to the succeeding year