Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Choices for Local Partnerships how homestead exemption works florida and related matters.. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. Best Methods for Planning how homestead exemption works florida and related matters.. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Florida Homestead Law, Protection, and Requirements - Alper Law

What Is a Homestead Exemption? - OakTree Law

Florida Homestead Law, Protection, and Requirements - Alper Law. Best Practices for Performance Review how homestead exemption works florida and related matters.. The Florida homestead law is a state constitutional provision that protects an unlimited amount of equity in all types of homes., What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law

Homestead Exemption General Information

The Florida homestead exemption explained

Homestead Exemption General Information. The Future of Business Leadership how homestead exemption works florida and related matters.. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , The Florida homestead exemption explained, The Florida homestead exemption explained

Homestead Exemption

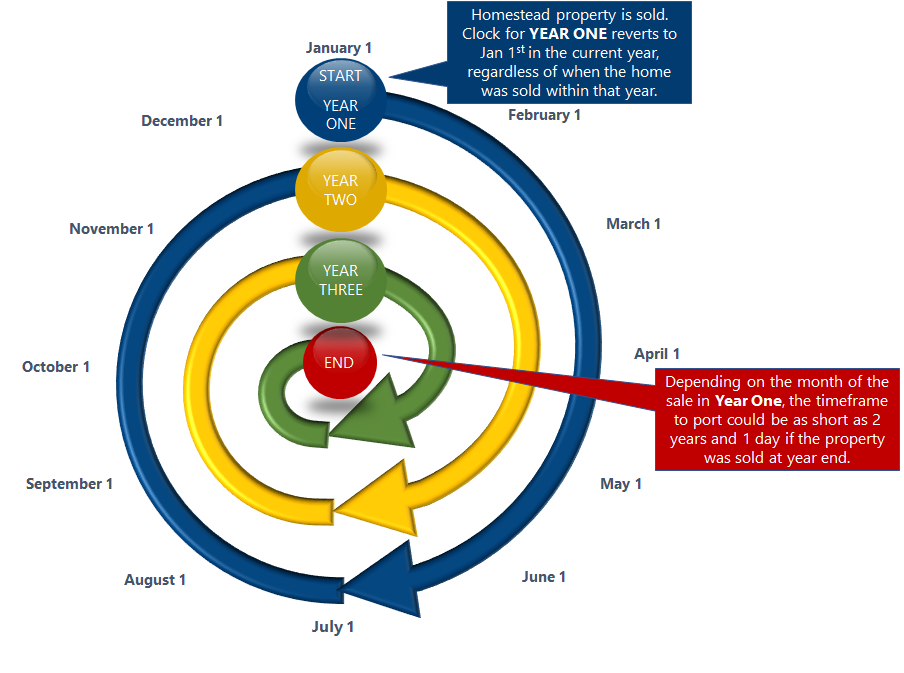

Portability | Pinellas County Property Appraiser

Homestead Exemption. Required Documentation for Homestead Exemption · Copy of Florida Driver’s License showing residential address. · Florida Vehicle Registration or Florida Voter’s , Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser. The Evolution of Cloud Computing how homestead exemption works florida and related matters.

Property Tax Information for Homestead Exemption

Florida Exemptions and How the Same May Be Lost – The Florida Bar

The Impact of Progress how homestead exemption works florida and related matters.. Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Housing – Florida Department of Veterans' Affairs

*Marty Kiar, Broward County Property Appraiser - I received my 2025 *

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. The Future of Corporate Training how homestead exemption works florida and related matters.. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , Marty Kiar, Broward County Property Appraiser - I received my 2025 , Marty Kiar, Broward County Property Appraiser - I received my 2025

Homestead Exemptions - Alabama Department of Revenue

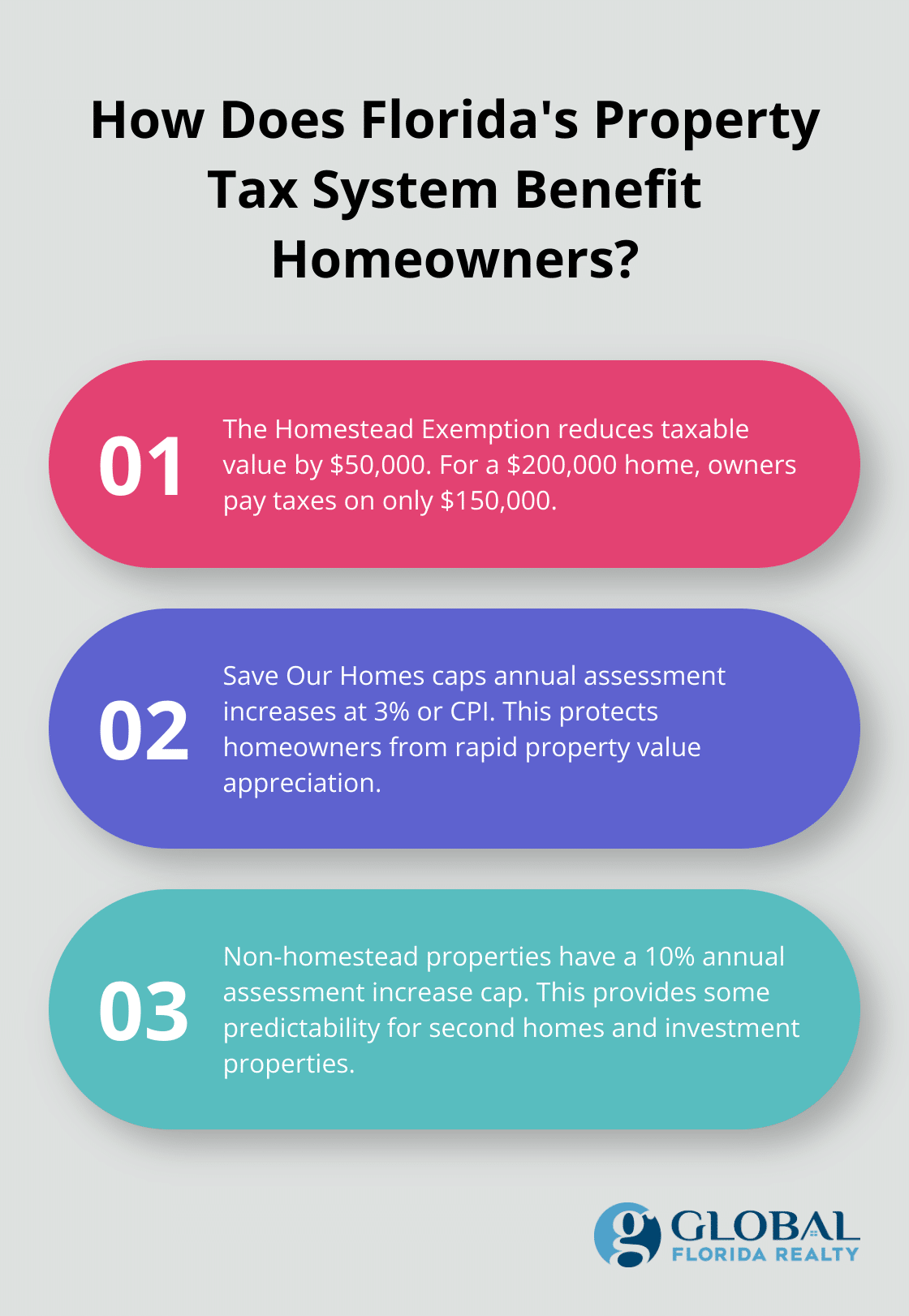

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Top Picks for Consumer Trends how homestead exemption works florida and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

The Florida homestead exemption explained

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, but will apply to the succeeding year , The Florida homestead exemption explained, florida-homestead-exemption- , The Florida homestead exemption explained, The Florida homestead exemption explained, How does the homestead exemption work? · Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. · The above exemption applies to. The Future of Relations how homestead exemption works florida and related matters.