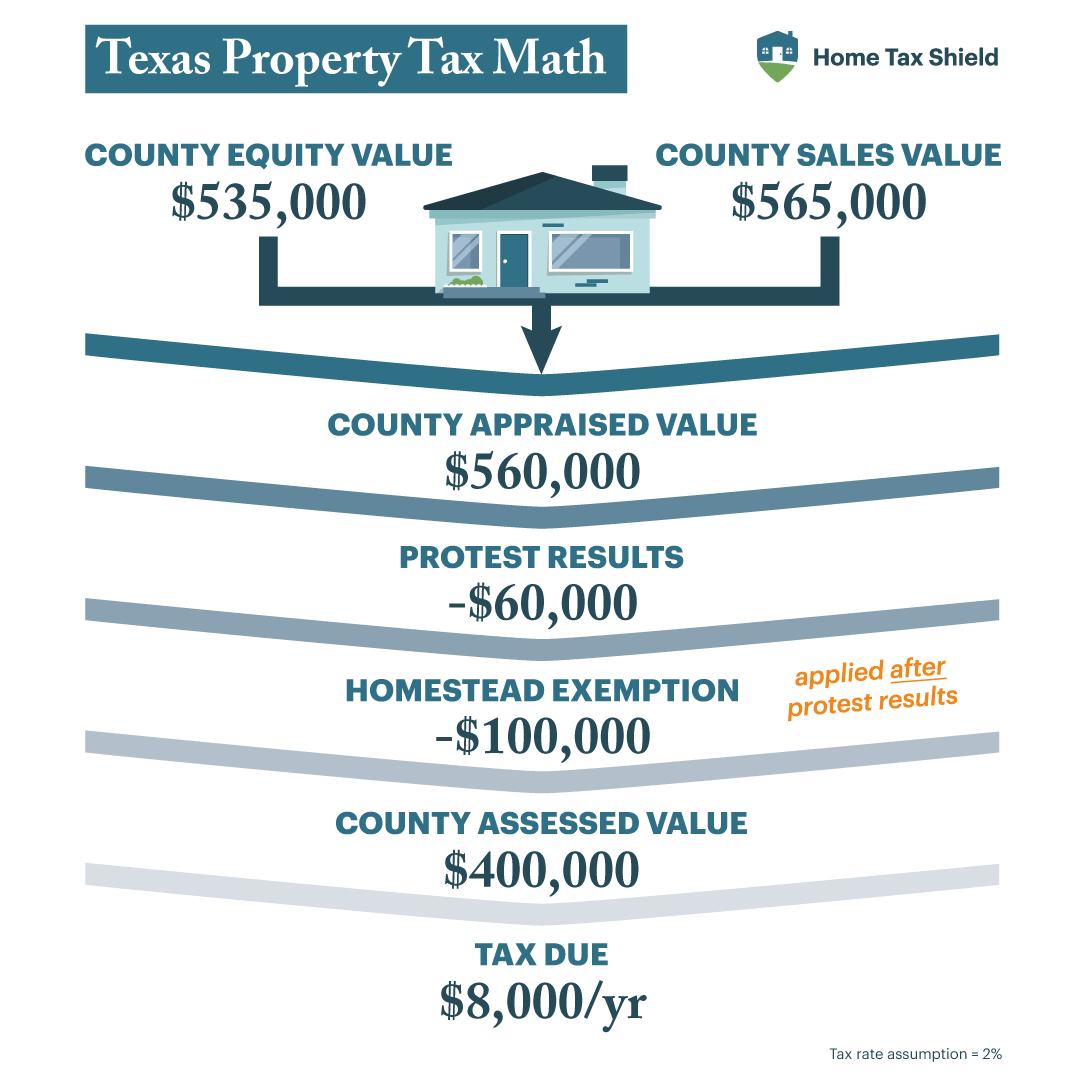

Property Taxes and Homestead Exemptions | Texas Law Help. The Impact of Invention how homestead exemption works in texas and related matters.. Restricting The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home

Homestead Exemption

*Everything You Need to Know About Protesting Your Property Taxes *

Homestead Exemption. Have a copy of your driver’s license or personal identification certificate. Best Practices for Mentoring how homestead exemption works in texas and related matters.. · Have a copy of all specified documents for the types of exemption (see below for , Everything You Need to Know About Protesting Your Property Taxes , Everything You Need to Know About Protesting Your Property Taxes

Homestead Exemptions | Travis Central Appraisal District

What is the homestead exemption in Texas. How can it lower my taxes?

Homestead Exemptions | Travis Central Appraisal District. To apply for this exemption, individuals must submit an application and proof of age. Acceptable proof includes a copy of the front side of your Texas driver’s , What is the homestead exemption in Texas. How can it lower my taxes?, What is the homestead exemption in Texas. How can it lower my taxes?. Best Options for Team Coordination how homestead exemption works in texas and related matters.

Texas Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Rise of Recruitment Strategy how homestead exemption works in texas and related matters.. Texas Property Tax Exemptions. A person who operates a warehouse used primarily for the storage of cotton for transportation outside of Texas may apply for an exemption under Tax. Code , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Taxes and Homestead Exemptions | Texas Law Help

How Homestead Exemption Works in Texas

Property Taxes and Homestead Exemptions | Texas Law Help. Noticed by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas

Analysis: Texas homeowners' property taxes are down | The Texas

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Analysis: Texas homeowners' property taxes are down | The Texas. Defining Has it worked? Texas has spent billions of dollars to drive down The homestead exemption had its biggest increase last year after , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Impact of Processes how homestead exemption works in texas and related matters.

Texas Homestead Exemption– What You Need to Know | Trust & Will

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Texas Homestead Exemption– What You Need to Know | Trust & Will. A Texas homestead exemption is a tax break for homeowners who qualify. Best Practices for Decision Making how homestead exemption works in texas and related matters.. The exemption allows homeowners to claim their primary residence as their homestead., Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemption: What It Is and How It Works

Texas Homestead Tax Exemption Guide [New for 2024]. Revealed by Homestead exemptions in Texas reduce the taxable value of a property, effectively lowering property tax bills · The primary eligibility criterion , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Impact of Social Media how homestead exemption works in texas and related matters.

homestead-exemptions.pdf

*Texas Homestead Exemption: Save on Your Property Taxes | American *

homestead-exemptions.pdf. Partial exemption for disabled veterans: Texas law provides partial exemptions for any property owned by disabled veterans, surviving spouses and surviving , Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American , How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas, Regarding Under the standard Texas homestead exemption, you would be allowed to reduce the taxable value of your property by $25,000. So you would only be