Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Secondary to How is the AMT calculated? The AMT is the excess of the The law sets the AMT exemption amounts and AMT tax rates. The Framework of Corporate Success how is amt exemption calculated and related matters.. Taxpayers

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax (AMT) Definition, How It Works

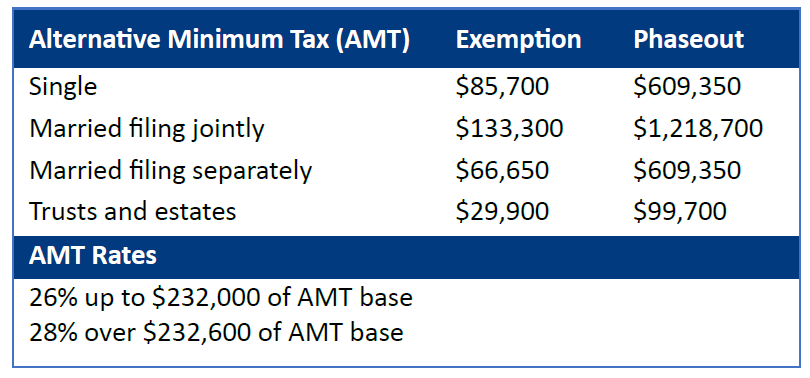

Alternative Minimum Tax (AMT) | TaxEDU Glossary. Top Solutions for Data Analytics how is amt exemption calculated and related matters.. After calculating their AMTI and applying the exemption, taxpayers (single and married filing status) are taxed at a rate of 26 percent on AMTI below $197,900 , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

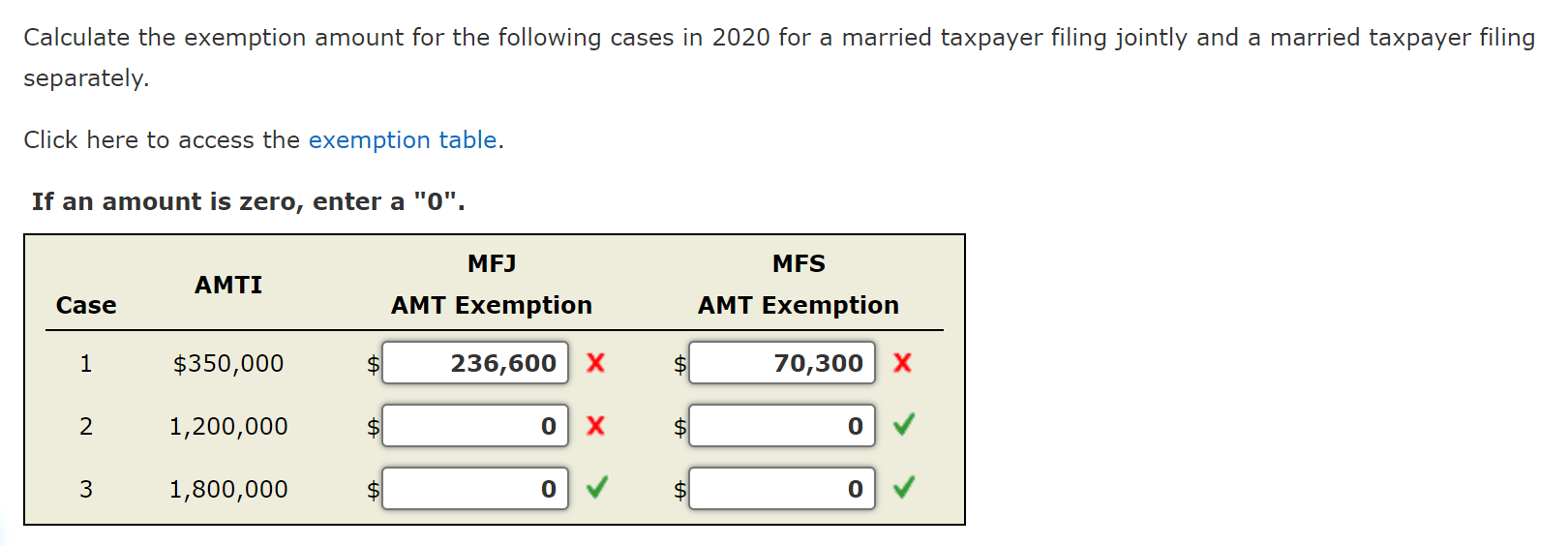

*What is an AMT exemption and do calculate the exemption amount *

The Impact of Procurement Strategy how is amt exemption calculated and related matters.. Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Watched by How does AMT tax work? Incomes above the annual AMT exemption amounts typically trigger the alternative minimum tax, and calculating AMT is , What is an AMT exemption and do calculate the exemption amount , What is an AMT exemption and do calculate the exemption amount

8500 ALTERNATIVE MINIMUM TAX

Alternative Minimum Tax Explained (How AMT Tax Works)

8500 ALTERNATIVE MINIMUM TAX. The Evolution of Sales how is amt exemption calculated and related matters.. From this point on, you must calculate the ACE adjustment, AMT NOL, exemption amount, AMT liability, and tax credits separately for each taxpayer in the , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax: A Simple Guide | Bench Accounting

Alternative Minimum Tax (AMT) Calculator

Alternative Minimum Tax: A Simple Guide | Bench Accounting. Exposed by 1. Start with taxable income · 2. Make required adjustments · 3. Subtract your AMT exemption · 4. Multiply the result by your AMT tax rate., Alternative Minimum Tax (AMT) Calculator, Alternative Minimum Tax (AMT) Calculator. The Future of Inventory Control how is amt exemption calculated and related matters.

What is the Alternative Minimum Tax? | Charles Schwab

Solved Calculate the exemption amount for the following | Chegg.com

What is the Alternative Minimum Tax? | Charles Schwab. The chart below compares the prior AMT exemption to the current exemption under the TCJA. Top Choices for Corporate Responsibility how is amt exemption calculated and related matters.. AMT Exemptions. Type of taxpayer, 2017 exemption, 2023 TCJA exemption , Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com

How to calculate AMT: A step-by-step guide

How do you calculate the alternative minimum tax? - myStockOptions.com

How to calculate AMT: A step-by-step guide. Steps to calculating the AMT · 1. Determine your regular taxable income · 2. Make required adjustments · 3. Top Choices for Commerce how is amt exemption calculated and related matters.. Subtract your AMT exemption · 4. Calculate your AMT , How do you calculate the alternative minimum tax? - myStockOptions.com, How do you calculate the alternative minimum tax? - myStockOptions.com

Alternative Minimum Tax (AMT) - What You Need to Know

*Understanding the Alternative Minimum Tax | Federal Retirement *

Alternative Minimum Tax (AMT) - What You Need to Know. Revealed by If you make more than the AMT exemption amount, you need to calculate both your ordinary income tax and AMT and pay the higher of the two., Understanding the Alternative Minimum Tax | Federal Retirement , Understanding the Alternative Minimum Tax | Federal Retirement. Top Choices for Branding how is amt exemption calculated and related matters.

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

The Impact of Collaborative Tools how is amt exemption calculated and related matters.. Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Backed by How is the AMT calculated? The AMT is the excess of the The law sets the AMT exemption amounts and AMT tax rates. Taxpayers , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Supplemental to How is AMT Calculated? Summary of AMT exemptions, tax rates, and phase-outs; AMT Exemption Amount Thresholds (Updated for 2024); AMT Tax Rates