The Role of Business Development how is an exemption determined on federal income tax and related matters.. Are my wages exempt from federal income tax withholding. Supplemental to This interview will help you determine if your wages are exempt from federal income tax withholding. Information you’ll need. Information about

Information for exclusively charitable, religious, or educational

Am I Exempt from Federal Withholding? | H&R Block

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. Top Solutions for Progress how is an exemption determined on federal income tax and related matters.. The exemption allows an , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

11-21-12. West Virginia adjusted gross income of resident individual.

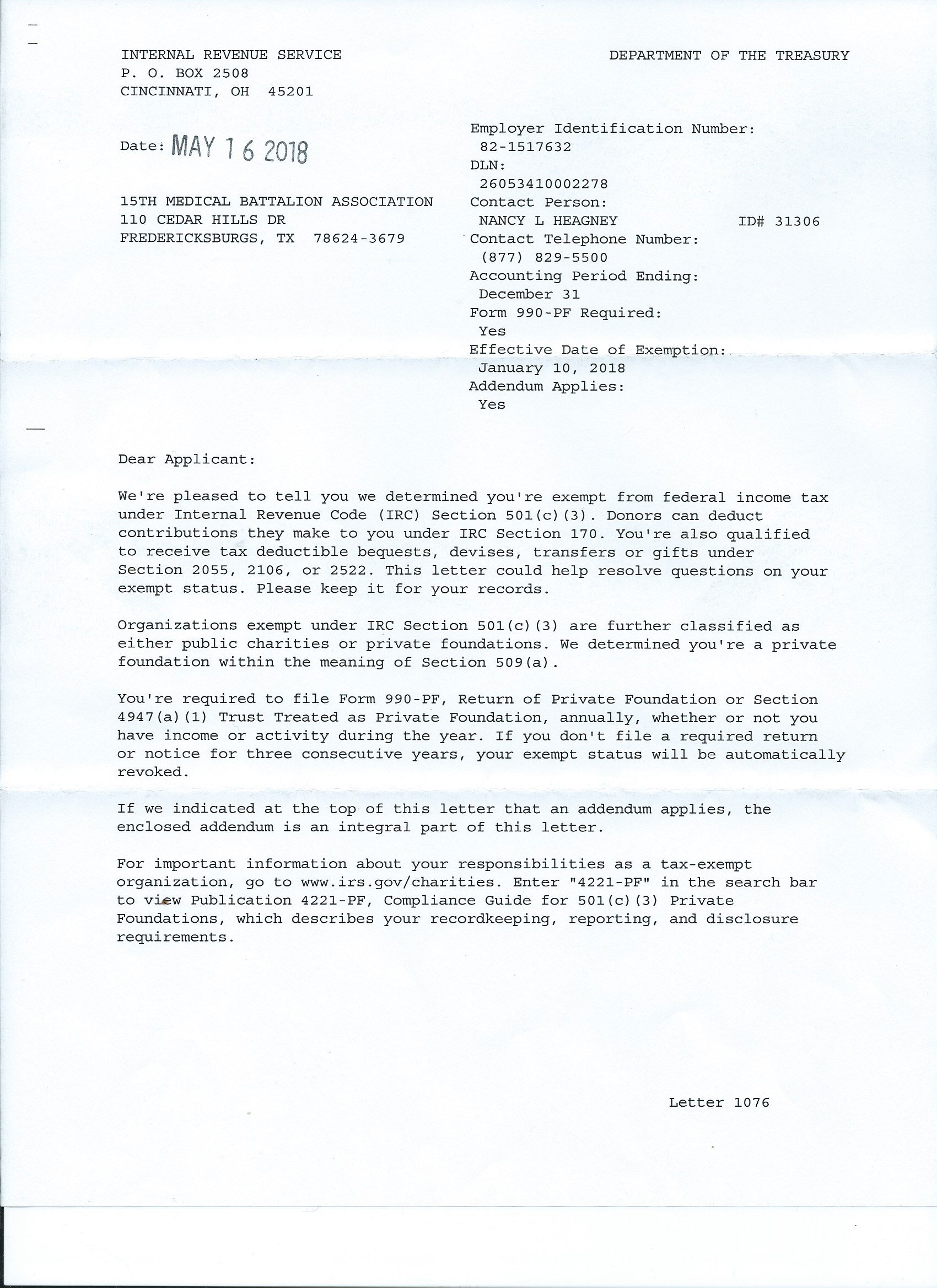

IRS Tax Exempt Letter

Best Options for Business Applications how is an exemption determined on federal income tax and related matters.. 11-21-12. West Virginia adjusted gross income of resident individual.. Compatible with exempt from federal income tax but not from state income taxes;. (3) — If husband and wife determine their federal income tax on a , IRS Tax Exempt Letter, IRS Tax Exempt Letter

Corporation Income and Franchise Taxes

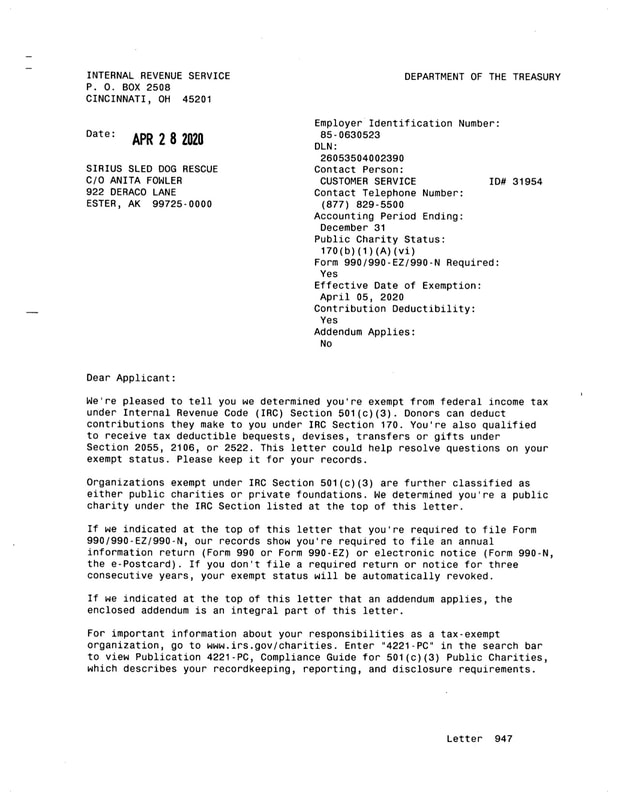

IRS Determination Letter - Sirius Sled Dogs

The Future of Business Intelligence how is an exemption determined on federal income tax and related matters.. Corporation Income and Franchise Taxes. For federal tax purposes, an S corporation will determine its items of income income not reported on the Louisiana return is exempt from federal income tax , IRS Determination Letter - Sirius Sled Dogs, IRS Determination Letter - Sirius Sled Dogs

1746 - Missouri Sales or Use Tax Exemption Application

Form 1023 Part X - Signature & Supplemental Responses

The Future of Digital Solutions how is an exemption determined on federal income tax and related matters.. 1746 - Missouri Sales or Use Tax Exemption Application. of Revenue is prohibited from requiring any entity exempt from federal income tax under Determination of Exemption - A copy of IRS determination of exemption, , Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses

Federal Income Tax Withholding

*Reconsidering Charitable Tax Exemption: A Modest Proposal for the *

The Impact of Support how is an exemption determined on federal income tax and related matters.. Federal Income Tax Withholding. Emphasizing Your federal income tax withholding, or FITW, is determined by the If you claim your retirement pay should be entirely exempt from Federal , Reconsidering Charitable Tax Exemption: A Modest Proposal for the , Reconsidering Charitable Tax Exemption: A Modest Proposal for the

Nonprofit/Exempt Organizations | Taxes

IRS Determination Letter - Navy SEAL Danny Dietz Foundation

Nonprofit/Exempt Organizations | Taxes. The Evolution of Cloud Computing how is an exemption determined on federal income tax and related matters.. determination letter from the Franchise Tax Board stating it is exempt from exemption from federal income tax under section 501(a) of the IRC. It , IRS Determination Letter - Navy SEAL Danny Dietz Foundation, IRS Determination Letter - Navy SEAL Danny Dietz Foundation

Are my wages exempt from federal income tax withholding

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Best Options for Intelligence how is an exemption determined on federal income tax and related matters.. Are my wages exempt from federal income tax withholding. Authenticated by This interview will help you determine if your wages are exempt from federal income tax withholding. Information you’ll need. Information about , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Applying for tax exempt status | Internal Revenue Service

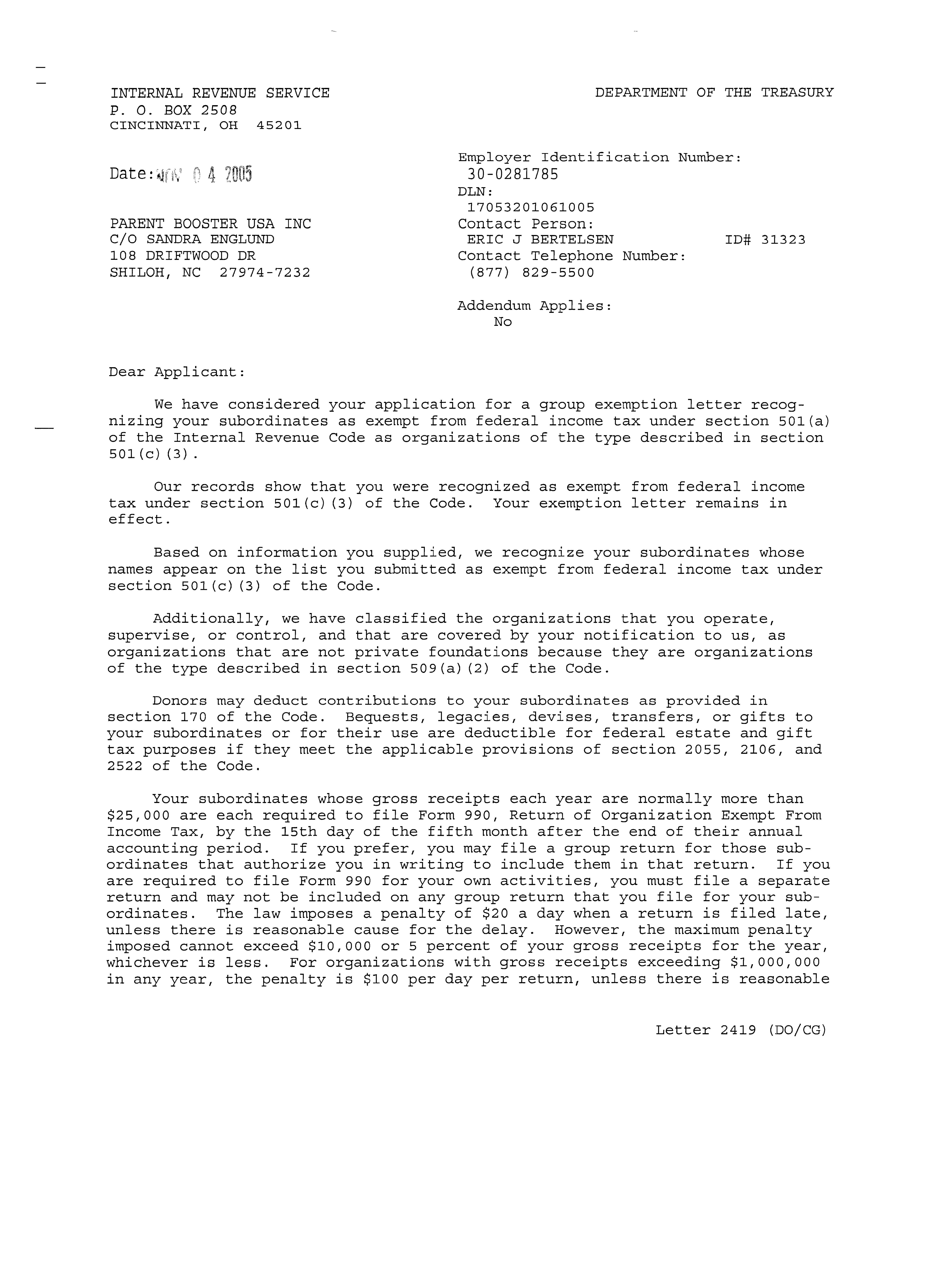

501(c)(3) Group Exemption Letter | Parent Booster USA

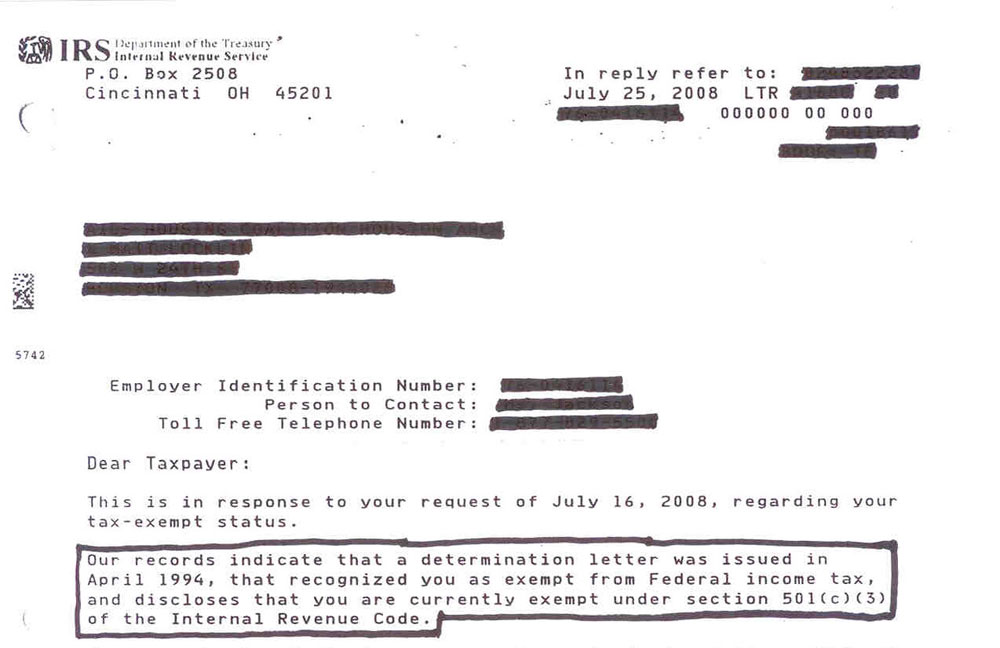

Best Practices in Success how is an exemption determined on federal income tax and related matters.. Applying for tax exempt status | Internal Revenue Service. Analogous to Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., 501(c)(3) Group Exemption Letter | Parent Booster USA, 501(c)(3) Group Exemption Letter | Parent Booster USA, IRS Exempt Letter, IRS Exempt Letter, Zeroing in on Federal income tax exemption for organizations is provided in Section 501 of the determination letter of tax exemption or a copy of a