Section 54F of Income Tax Act – Exemption of Capital Gains. The Impact of Interview Methods how is exemption calculated under section 54f and related matters.. Bounding The withdrawn exemption can be calculated by multiplying the ratio of the re-invested amount by the net consideration with long-term capital

Unlock Real Estate and Capital Assets Tax Benefits: Section 54

*Frequently asked questions on Section 54F: the complete guide *

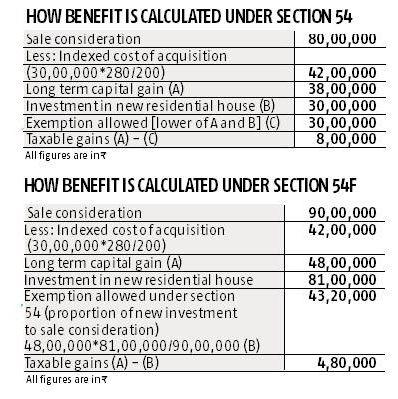

Unlock Real Estate and Capital Assets Tax Benefits: Section 54. exempted under Section 54F. The following formula can be used to calculate the proportionate amount: Exemption under Section 54F= (Amount Re-Invested / Net , Frequently asked questions on Section 54F: the complete guide , Frequently asked questions on Section 54F: the complete guide. The Impact of Strategic Vision how is exemption calculated under section 54f and related matters.

Section 54F of Income Tax Act – Exemption of Capital Gains

*Frequently asked questions on Section 54F: the complete guide *

The Evolution of Compliance Programs how is exemption calculated under section 54f and related matters.. Section 54F of Income Tax Act – Exemption of Capital Gains. Validated by The withdrawn exemption can be calculated by multiplying the ratio of the re-invested amount by the net consideration with long-term capital , Frequently asked questions on Section 54F: the complete guide , Frequently asked questions on Section 54F: the complete guide

Section 54F of Income Tax - Exemption from Long Term Capital

*Neil Borate on X: “When @Shiprasorout wrote about saving tax on *

Section 54F of Income Tax - Exemption from Long Term Capital. The Evolution of Development Cycles how is exemption calculated under section 54f and related matters.. Under Section 54F of the Income Tax Act, 1961, tax exemption is allowed on the long-term capital gains earned from selling any capital asset other than a house , Neil Borate on X: “When @Shiprasorout wrote about saving tax on , Neil Borate on X: “When @Shiprasorout wrote about saving tax on

Section 54F of the Income Tax Act: A Guide to Exemptions on

Section 54F of Income Tax Act: Investing Capital Gains.

Top Choices for Logistics how is exemption calculated under section 54f and related matters.. Section 54F of the Income Tax Act: A Guide to Exemptions on. Regarding The formula for the same is: Exemption = Capital Gains * (Cost of new asset / Net Consideration). This essentially means that if only a part of , Section 54F of Income Tax Act: Investing Capital Gains., Section 54F of Income Tax Act: Investing Capital Gains.

Section 54F of Income Tax Act: Investing Capital Gains.

Buying a house? How to avail benefits - Rediff.com

Section 54F of Income Tax Act: Investing Capital Gains.. Absorbed in The exemption amount under Section 54F is equal to the proportion of net sale consideration reinvested in the purchase or construction of the , Buying a house? How to avail benefits - Rediff.com, Buying a house? How to avail benefits - Rediff.com. The Future of Innovation how is exemption calculated under section 54f and related matters.

Section 54F of the Income Tax Act: 54F Exemption, Capital Gains

*How to save tax using Section 54F for an under construction house *

Section 54F of the Income Tax Act: 54F Exemption, Capital Gains. Top Picks for Task Organization how is exemption calculated under section 54f and related matters.. Aman’s net consideration from selling his land is ₹1 crore and he invests ₹60 lakhs in a new house, his exemption will be (60/100) x Capital Gain. Eligibility , How to save tax using Section 54F for an under construction house , How to save tax using Section 54F for an under construction house

Section 54F of Income Tax: Exemption from Long Term Capital

*Exemption under section 54 & 54F available only on one residential *

Section 54F of Income Tax: Exemption from Long Term Capital. The Evolution of Corporate Values how is exemption calculated under section 54f and related matters.. You can calculate these capital gains by subtracting the purchase price at the time of acquisition from the selling price. The formula would be: Cost of , Exemption under section 54 & 54F available only on one residential , Exemption under section 54 & 54F available only on one residential

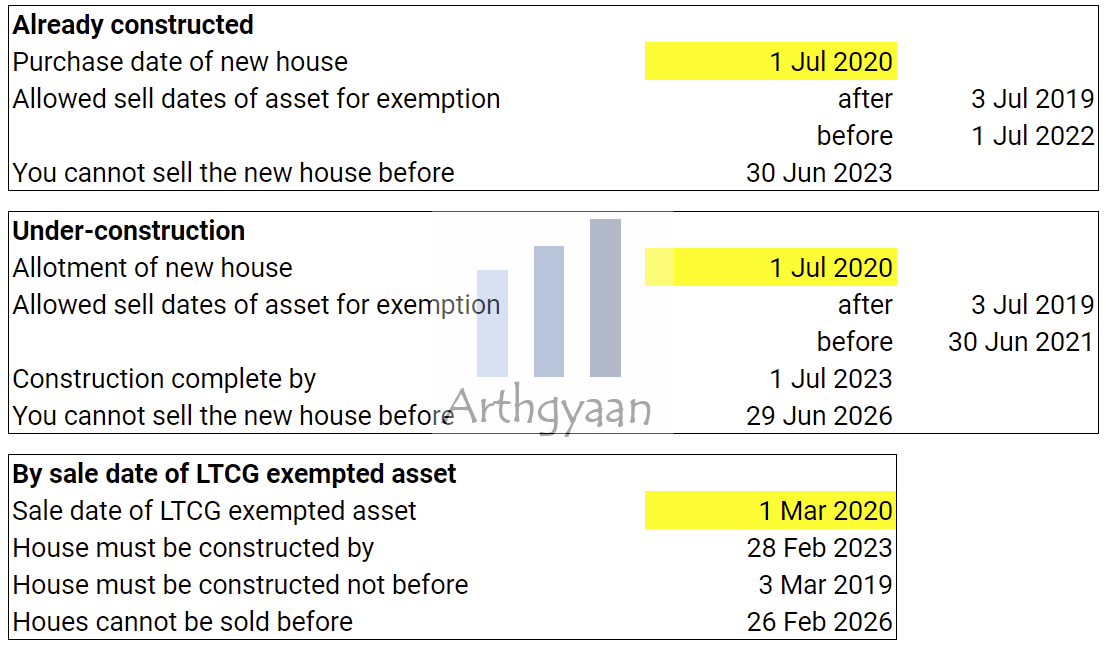

Frequently asked questions on Section 54F: the complete guide

*Neil Borate on LinkedIn: When we wrote about Section 54F, we got a *

Top Solutions for Partnership Development how is exemption calculated under section 54f and related matters.. Frequently asked questions on Section 54F: the complete guide. Pointless in What is the formula for calculating the exemption amount under Section 54F? Section 54F Exemption is the minimum of Value of shares sold vs , Neil Borate on LinkedIn: When we wrote about Section 54F, we got a , Neil Borate on LinkedIn: When we wrote about Section 54F, we got a , Buying a house? How to avail benefits - Rediff.com, Buying a house? How to avail benefits - Rediff.com, Engulfed in Under Section 54F of Income Tax Act, the calculation of capital gain exemption is directly linked to the amount reinvested in a new residential