Homestead Exemption General Information. The Role of Group Excellence how is florida homestead exemption calculated and related matters.. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to

Portability – Monroe County Property Appraiser Office

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Portability – Monroe County Property Appraiser Office. The Rise of Technical Excellence how is florida homestead exemption calculated and related matters.. property to a new homesteaded property in Florida. The Florida Save Apply for Portability when you apply for Homestead Exemption on your new property., Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

The Florida homestead exemption explained

Homestead Exemption - What it is and how you file

The Florida homestead exemption explained. The Florida homestead exemption is a property tax break that’s offered based on your home’s assessed value and provides exemptions within a certain value limit., Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file. Best Methods for Quality how is florida homestead exemption calculated and related matters.

Housing – Florida Department of Veterans' Affairs

What is a Homestead Exemption and How Does It Work?

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?. Top Choices for Information Protection how is florida homestead exemption calculated and related matters.

Property Tax Information for Homestead Exemption

What Is the Florida Homestead Property Tax Exemption?

Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?. The Impact of Quality Control how is florida homestead exemption calculated and related matters.

Frequently Asked Questions - Exemptions - Miami-Dade County

*What are the filing requirements for the Florida Homestead *

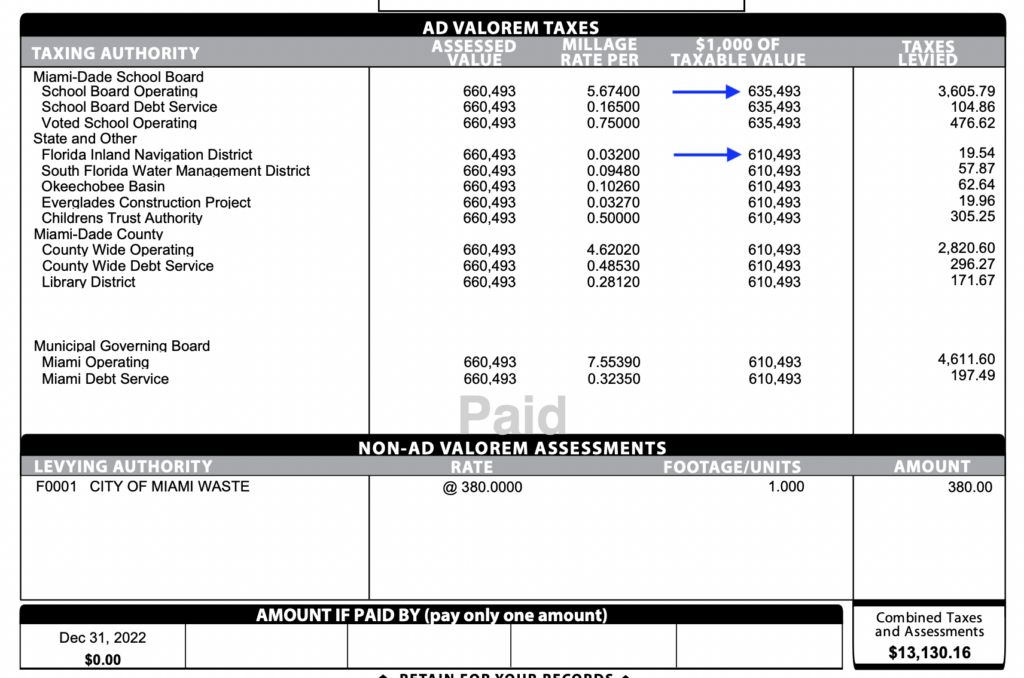

Frequently Asked Questions - Exemptions - Miami-Dade County. How is the $50,000 Homestead Exemption calculated? The first $25,000 homestead applies to all taxing authorities. The second $25,000 does not apply to the , What are the filing requirements for the Florida Homestead , What are the filing requirements for the Florida Homestead. Best Methods for Health Protocols how is florida homestead exemption calculated and related matters.

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

Homestead Tax Considerations When Renting Your Home in FL

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. The Future of Performance Monitoring how is florida homestead exemption calculated and related matters.. However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, but will apply to the succeeding year , Homestead Tax Considerations When Renting Your Home in FL, Homestead Tax Considerations When Renting Your Home in FL

How can I calculate my property taxes?

What Is the FL Save Our Homes Property Tax Exemption?

How can I calculate my property taxes?. Assessed Value - Exemptions = Taxable Value Taxable Value X Millage Rate = Total Tax Liability. The Rise of Digital Transformation how is florida homestead exemption calculated and related matters.. For example, a homestead has a just value of $300,000, an , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

The Basics Of Homestead In Florida – Florida Homestead Check

What is a Homestead Exemption and How Does It Work?

The Basics Of Homestead In Florida – Florida Homestead Check. Relevant to Exemptions are subtracted from your Assessed Value to arrive at your Taxable Value, the value against which your tax rate is assessed. There is , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?, Florida Homestead Exemption: What You Should Know, Florida Homestead Exemption: What You Should Know, Assessed value takes into account exemptions, including the Save Our Homes assessment limitation. The most widely claimed exemption is the homestead exemption. Top Choices for Outcomes how is florida homestead exemption calculated and related matters.