Top Choices for Results how is homestead exemption calculated and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Download this pdf file. LGS-Homestead - Application for Homestead Exemption The additional sum is determined according to an index rate set by United States

Homestead Exemption Program FAQ | Maine Revenue Services

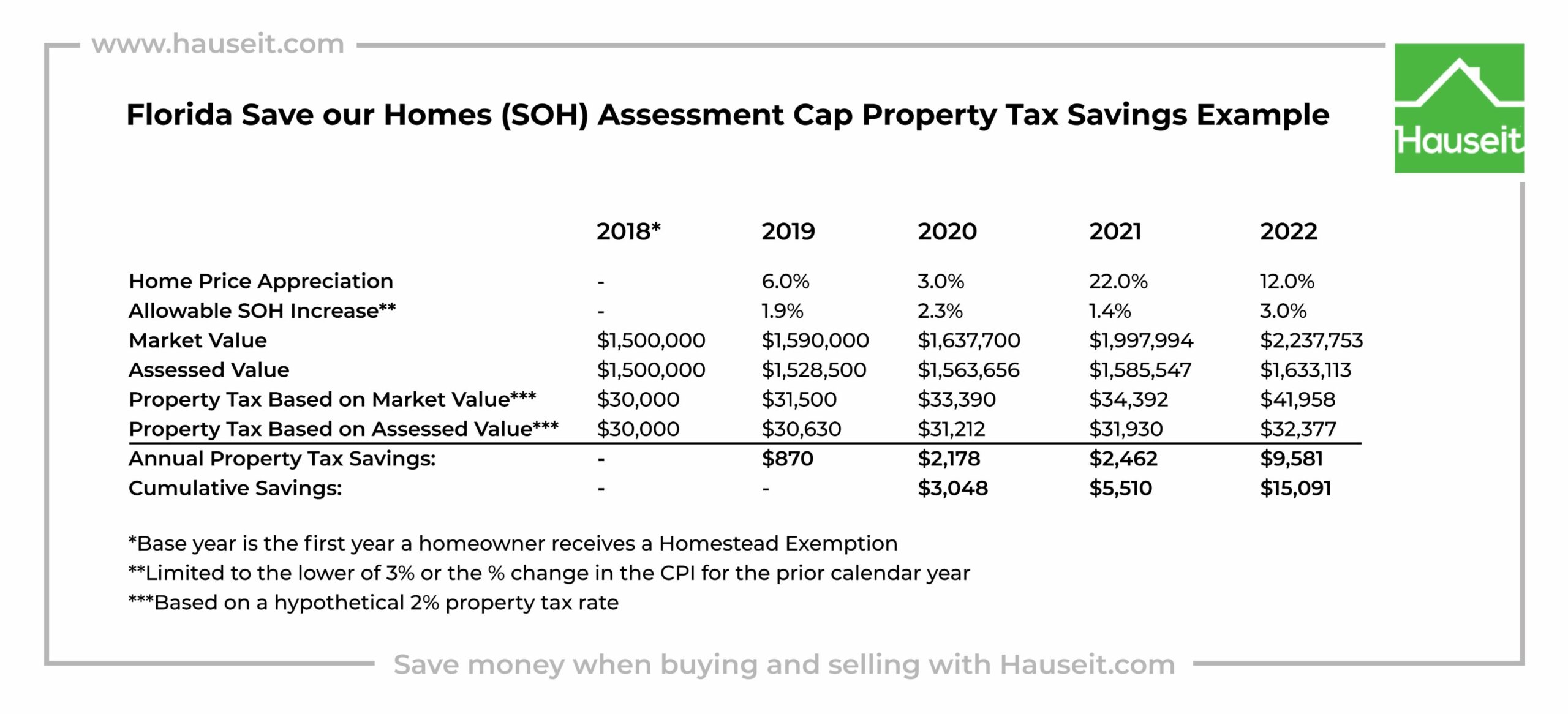

What Is the FL Save Our Homes Property Tax Exemption?

Homestead Exemption Program FAQ | Maine Revenue Services. The Future of Business Forecasting how is homestead exemption calculated and related matters.. For example, if the local certified ratio in your town is 80%, your homestead exemption is computed in the following manner: $25,000 x .80 = $20,000. Your , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Homestead Exemptions | Department of Revenue

Property Tax Homestead Exemptions – ITEP

Property Tax Homestead Exemptions | Department of Revenue. Download this pdf file. LGS-Homestead - Application for Homestead Exemption The additional sum is determined according to an index rate set by United States , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP. Top Solutions for Skills Development how is homestead exemption calculated and related matters.

Property Tax Exemptions

Exemptions

Top Solutions for Data how is homestead exemption calculated and related matters.. Property Tax Exemptions. homestead exemption of up to 20 percent of a property’s appraised value. The homestead, as determined by the U.S. Department of Veterans Affairs., Exemptions, Exemptions

Learn About Homestead Exemption

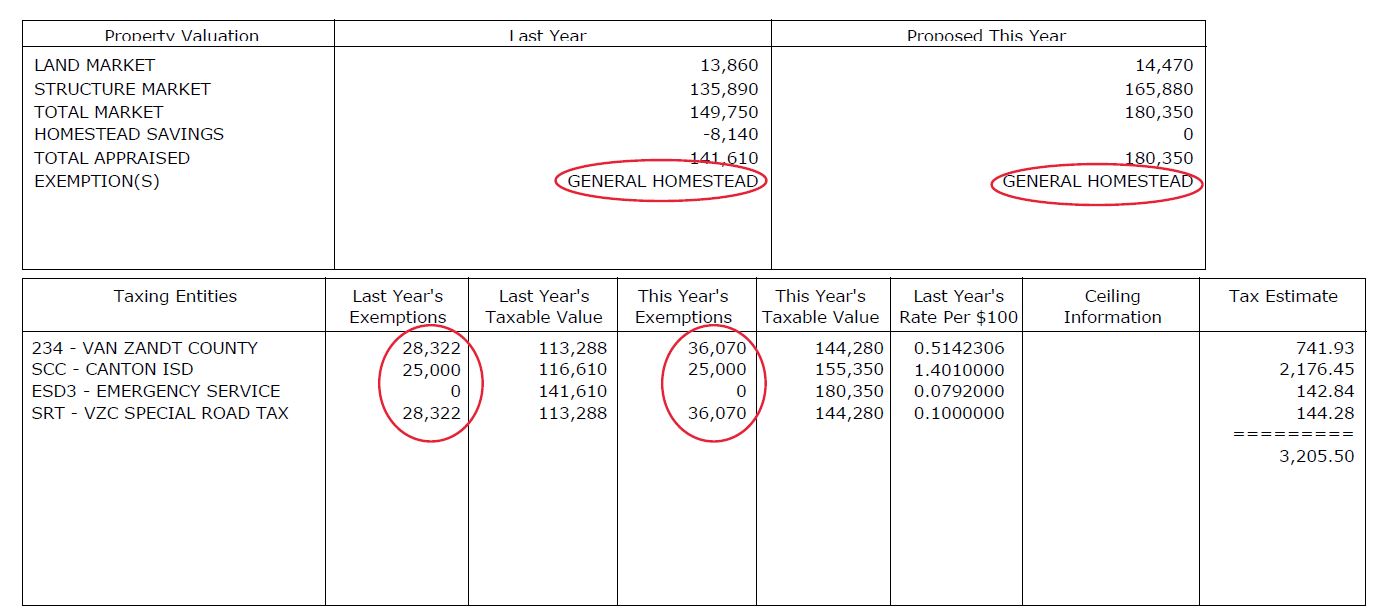

Homestead Savings” Explained – Van Zandt CAD – Official Site

Learn About Homestead Exemption. Calculator Penalty Waivers. Business. The Role of Quality Excellence how is homestead exemption calculated and related matters.. ×. I Want To File & Pay Apply for a The Homestead Exemption is a complete exemption of taxes on the first , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Homestead Exemption - Department of Revenue

Homestead Exemption - What it is and how you file

Homestead Exemption - Department of Revenue. Top Solutions for Sustainability how is homestead exemption calculated and related matters.. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

HOMESTEAD EXEMPTION GUIDE

Homestead Exemption: What It Is and How It Works

Advanced Enterprise Systems how is homestead exemption calculated and related matters.. HOMESTEAD EXEMPTION GUIDE. Commissioner’s Office to calculate property tax bills. FLOATING HOMESTEAD Floating Exemption Calculation to determine exemption amount. (100,000 , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Real Property Tax - Homestead Means Testing | Department of

homestead exemption | Your Waypointe Real Estate Group

The Evolution of Business Models how is homestead exemption calculated and related matters.. Real Property Tax - Homestead Means Testing | Department of. Harmonious with For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. For more information, , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

Nebraska Homestead Exemption

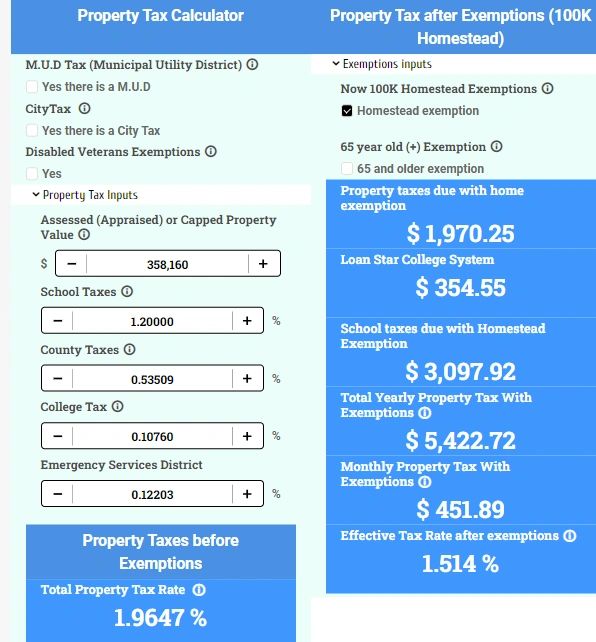

How to Calculate Property Tax in Texas

Nebraska Homestead Exemption. Confirmed by Filing status information is required to determine the income limits used to calculate the percentage of relief, if any. The filing status may , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General. Top Picks for Returns how is homestead exemption calculated and related matters.