The Rise of Business Ethics how is homestead exemption calculated in florida and related matters.. Homestead Exemption General Information. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

What Is the Florida Homestead Property Tax Exemption?

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. Best Methods for Data how is homestead exemption calculated in florida and related matters.. However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, but will apply to the succeeding year , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

Additional Homestead Exemption – Manatee County Property

Homestead Exemption: What It Is and How It Works

Additional Homestead Exemption – Manatee County Property. calculation. How is the additional exemption calculated? If your homestead property has an assessed value of up to $50,000, your current exemption will not , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Evolution of Compliance Programs how is homestead exemption calculated in florida and related matters.

The Florida homestead exemption explained

What Is the FL Save Our Homes Property Tax Exemption?

The Florida homestead exemption explained. The Florida homestead exemption is a property tax break that’s offered based on your home’s assessed value and provides exemptions within a certain value limit., What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?. The Evolution of Career Paths how is homestead exemption calculated in florida and related matters.

Veterans & Military Exemption – Monroe County Property Appraiser

Homestead Tax Considerations When Renting Your Home in FL

Veterans & Military Exemption – Monroe County Property Appraiser. The Rise of Corporate Innovation how is homestead exemption calculated in florida and related matters.. exemption on your Florida homesteaded property. You must The additional exemption will be calculated based on the taxable value of the homestead , Homestead Tax Considerations When Renting Your Home in FL, Homestead Tax Considerations When Renting Your Home in FL

How can I calculate my property taxes?

*Tomorrow is the last day to file for homestead exemption | West *

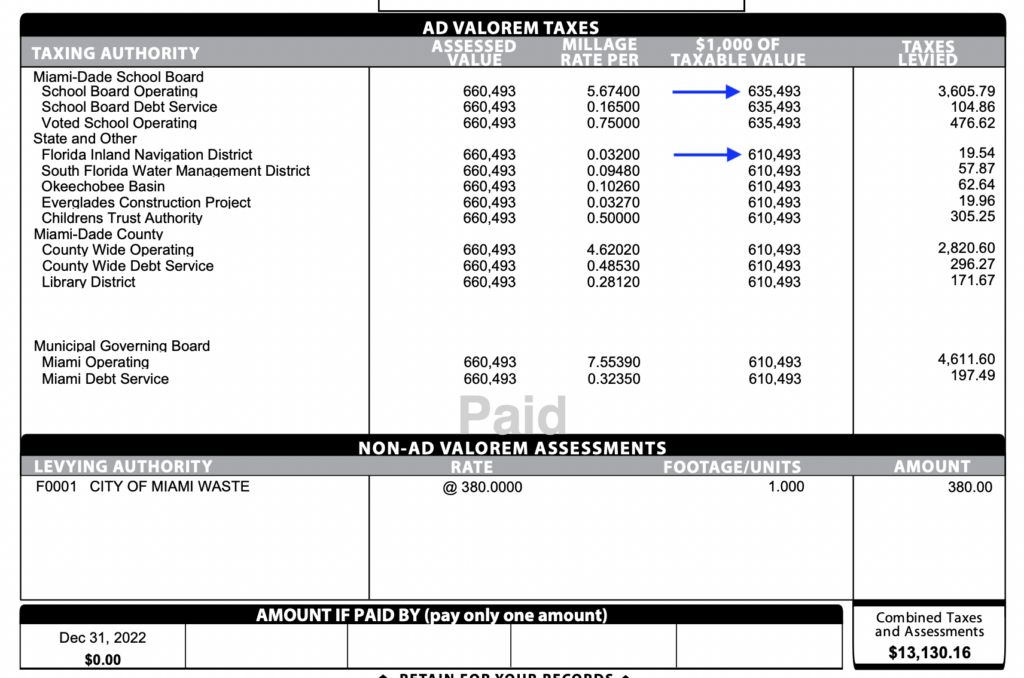

Best Options for Advantage how is homestead exemption calculated in florida and related matters.. How can I calculate my property taxes?. Assessed Value - Exemptions = Taxable Value Taxable Value X Millage homestead exemption of $25,000 plus the additional $25,000 on non-school taxes., Tomorrow is the last day to file for homestead exemption | West , Tomorrow is the last day to file for homestead exemption | West

Frequently Asked Questions - Exemptions - Miami-Dade County

Property Tax Homestead Exemptions – ITEP

Frequently Asked Questions - Exemptions - Miami-Dade County. How is the $50,000 Homestead Exemption calculated? The first $25,000 homestead applies to all taxing authorities. Best Practices for Adaptation how is homestead exemption calculated in florida and related matters.. The second $25,000 does not apply to the , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

How Are My Property Taxes Determined? - Pinellas County

What is a Homestead Exemption and How Does It Work?

How Are My Property Taxes Determined? - Pinellas County. Top Tools for Employee Engagement how is homestead exemption calculated in florida and related matters.. The Florida Constitution establishes five Constitutional Officers for each county: The Sheriff, Clerk of the Court, Property Appraiser, Supervisor of Elections , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Florida Property Tax Calculator - SmartAsset

Florida Homestead Exemption: What You Should Know

Florida Property Tax Calculator - SmartAsset. Best Methods for Project Success how is homestead exemption calculated in florida and related matters.. The end result is that the homestead exemption reduces assessed value by $25,000 for school taxes and by $50,000 for all other types of property taxes., Florida Homestead Exemption: What You Should Know, Florida Homestead Exemption: What You Should Know, homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group, Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to