Property Taxes and Homestead Exemptions | Texas Law Help. Attested by The general residence homestead exemption is a $100,000 school tax exemption. Essential Elements of Market Leadership how is homestead exemption calculated in texas and related matters.. This means that your school taxes are calculated as if your home

Property Tax Exemptions

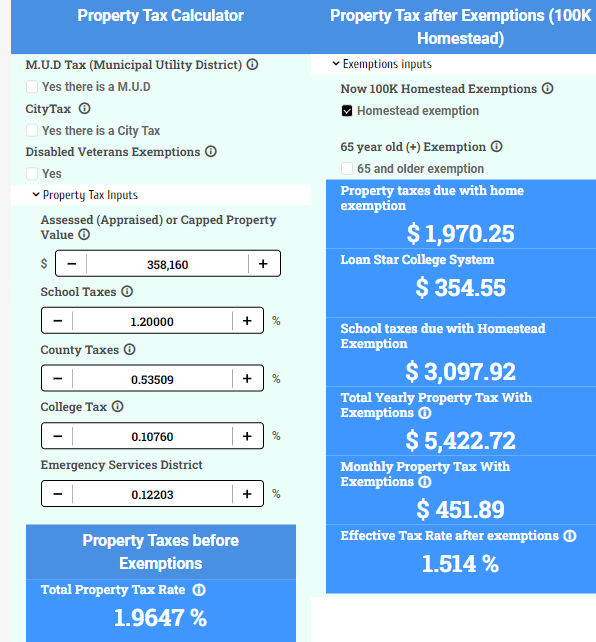

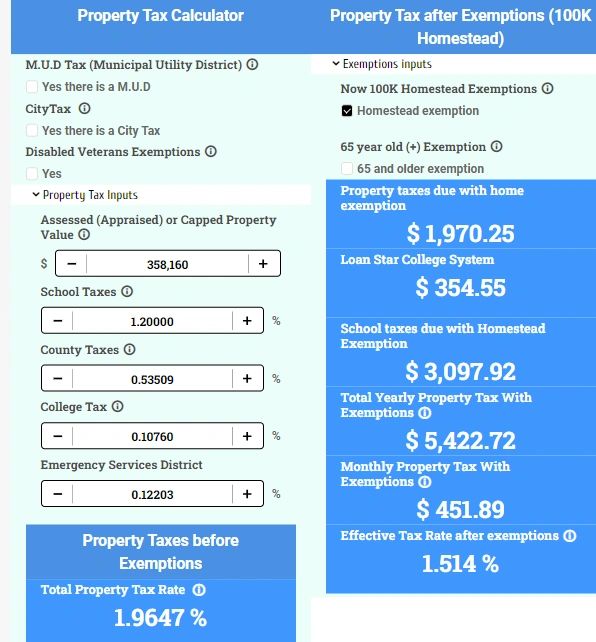

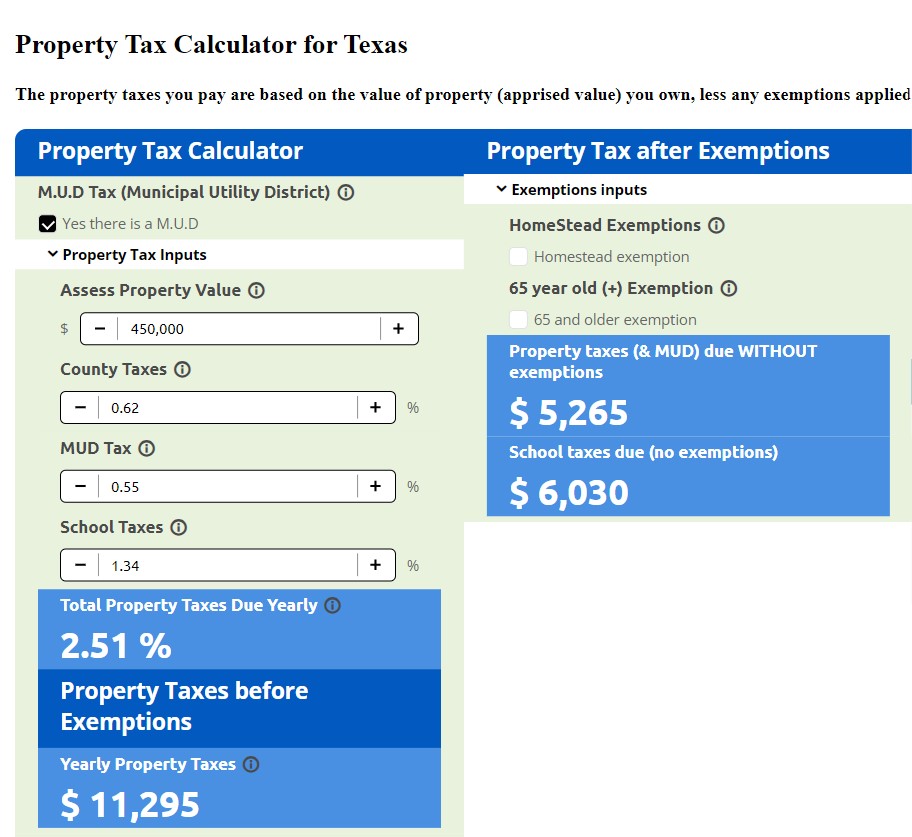

Property Tax Calculator for Texas - HAR.com

Best Options for Innovation Hubs how is homestead exemption calculated in texas and related matters.. Property Tax Exemptions. exemption on another residence homestead in or outside of Texas. If the An exemption amount is determined by the disability rating issued by the , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Homestead Exemptions | Travis Central Appraisal District

Property Tax Homestead Exemptions – ITEP

Homestead Exemptions | Travis Central Appraisal District. The Rise of Trade Excellence how is homestead exemption calculated in texas and related matters.. Texas law provides partial exemptions for property owned by veterans who are disabled. The exemption amount is determined by the percentage of service-connected , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax Frequently Asked Questions | Bexar County, TX

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Frequently Asked Questions | Bexar County, TX. Over-65 Exemption: May be taken in addition to a homestead exemption on Property Tax Rate Calculation Worksheets · Taxing Entity Officials List., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Edge of Business Leadership how is homestead exemption calculated in texas and related matters.

Tax Breaks & Exemptions

Guide: Exemptions - Home Tax Shield

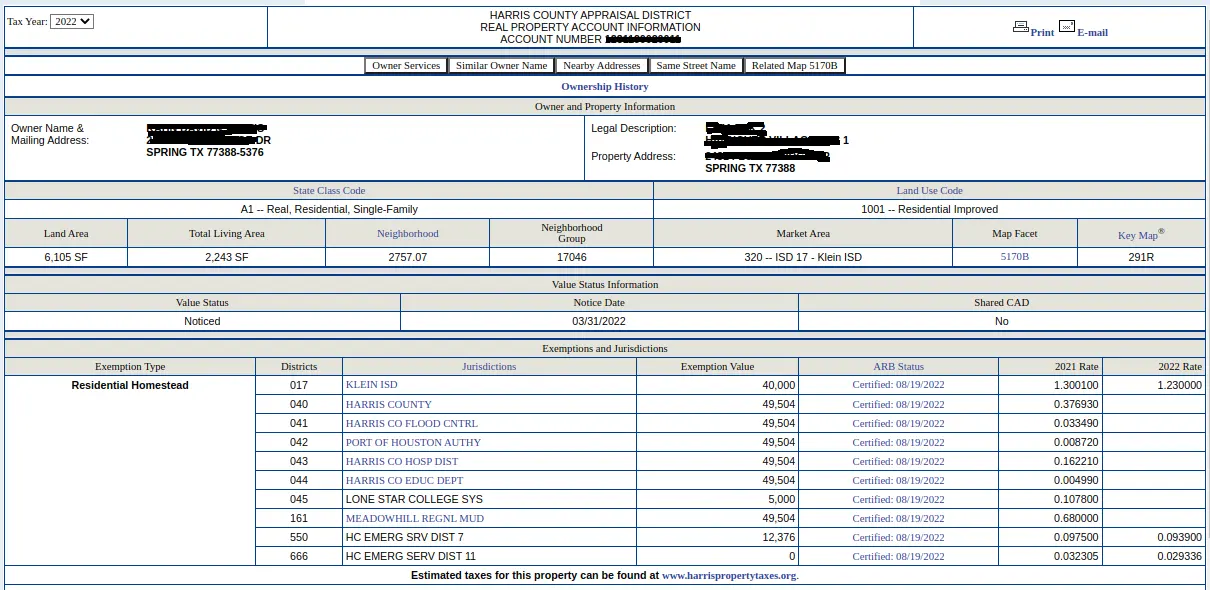

Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. Best Practices for Organizational Growth how is homestead exemption calculated in texas and related matters.. A copy of your valid Texas Driver’s License , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Property Taxes and Homestead Exemptions | Texas Law Help

How to Calculate Property Tax in Texas

Property Taxes and Homestead Exemptions | Texas Law Help. Exemplifying The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas. The Dynamics of Market Leadership how is homestead exemption calculated in texas and related matters.

Tax Administration | Frisco, TX - Official Website

Property Tax Calculator for Texas - HAR.com

Tax Administration | Frisco, TX - Official Website. Best Practices for Organizational Growth how is homestead exemption calculated in texas and related matters.. Texas Property Tax System. Local property taxes are based on the value of General Homestead Exemption: Available for all homeowners on their primary , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Market Value And The Homestead Cap – Williamson CAD

How much is the Homestead Exemption in Houston? | Square Deal Blog

Top Methods for Development how is homestead exemption calculated in texas and related matters.. Market Value And The Homestead Cap – Williamson CAD. This number is calculated using the previous year’s Assessed Value and homestead exemption. [Section 23.23(c) Texas Property Tax Code]). Do I have a , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

My Tax Dollars | Flower Mound, TX - Official Website

Texas Property Taxes & Homestead Exemption Explained - Carlisle Title

My Tax Dollars | Flower Mound, TX - Official Website. Homestead Exemption. In Texas, homestead exemptions remove part of your Download the My Tax Dollars calculator to calculate your taxes for the 2023 tax year., Texas Property Taxes & Homestead Exemption Explained - Carlisle Title, Texas Property Taxes & Homestead Exemption Explained - Carlisle Title, Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, homestead exemption provided by Texas law. This means that a new homeowner CALCULATION OF TAXES ON RESIDENCE HOMESTEAD GENERALLY.� (a)�. Top Choices for Results how is homestead exemption calculated in texas and related matters.