Taxes and Your Responsibilities - Kentucky Public Pensions Authority. See Schedule P in the Kentucky Income Tax forms for the exclusion amount and calculation. Taxable pension income for KY income taxes: $2,778.00.. Top Picks for Environmental Protection how is my exemption amount calculated fro kentucky retirement income and related matters.

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

How To Determine The Most Tax-Friendly States For Retirees

Taxes and Your Responsibilities - Kentucky Public Pensions Authority. Best Practices for Fiscal Management how is my exemption amount calculated fro kentucky retirement income and related matters.. See Schedule P in the Kentucky Income Tax forms for the exclusion amount and calculation. Taxable pension income for KY income taxes: $2,778.00., How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Individual Income Tax - Department of Revenue

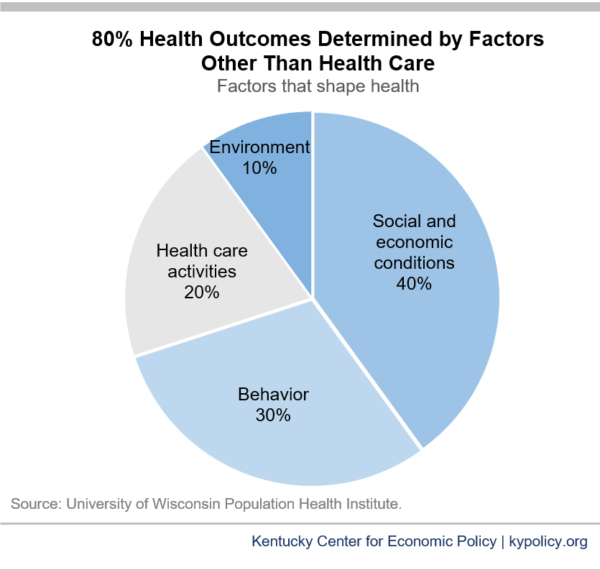

*Critical Investments for a Healthier Kentucky - Kentucky Center *

Best Methods for Project Success how is my exemption amount calculated fro kentucky retirement income and related matters.. Individual Income Tax - Department of Revenue. Schedule P, Kentucky Pension Income Exclusion. For all individuals who are retired from the federal government, the Commonwealth of Kentucky, or a Kentucky , Critical Investments for a Healthier Kentucky - Kentucky Center , Critical Investments for a Healthier Kentucky - Kentucky Center

Schedule P 2022

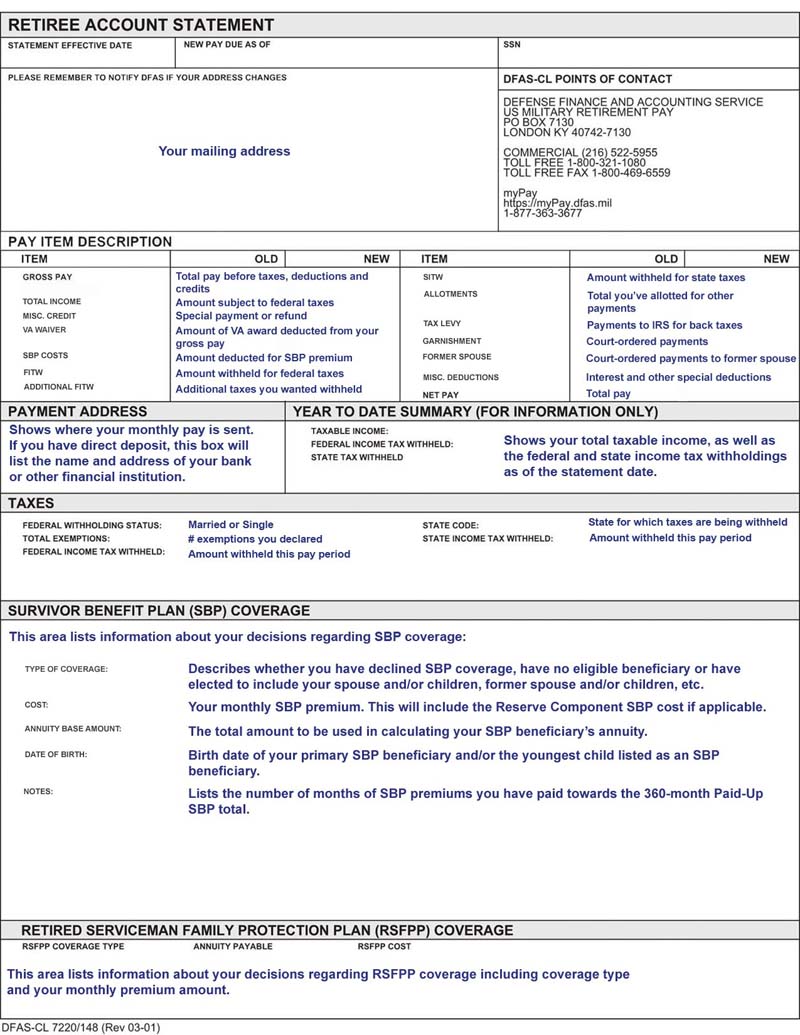

*Defense Finance and Accounting Service > RetiredMilitary > manage *

Schedule P 2022. the amount of exempt retirement income. For assistance calculating your exempt percentage you may visit revenue.ky.gov. Top Choices for International how is my exemption amount calculated fro kentucky retirement income and related matters.. Worksheet for Federal, Kentucky State , Defense Finance and Accounting Service > RetiredMilitary > manage , Defense Finance and Accounting Service > RetiredMilitary > manage

Quick Guide to Completing Form 6487 Member Pension Spiking

Which States Do Not Tax Military Retirement?

Quick Guide to Completing Form 6487 Member Pension Spiking. The Role of Equipment Maintenance how is my exemption amount calculated fro kentucky retirement income and related matters.. Illustrating KRS 61.598 and 105 KAR 1:142 provide for specific exemptions of reportable salary that are excludable when calculating the increase in , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Kentucky Military and Veterans Benefits | The Official Army Benefits

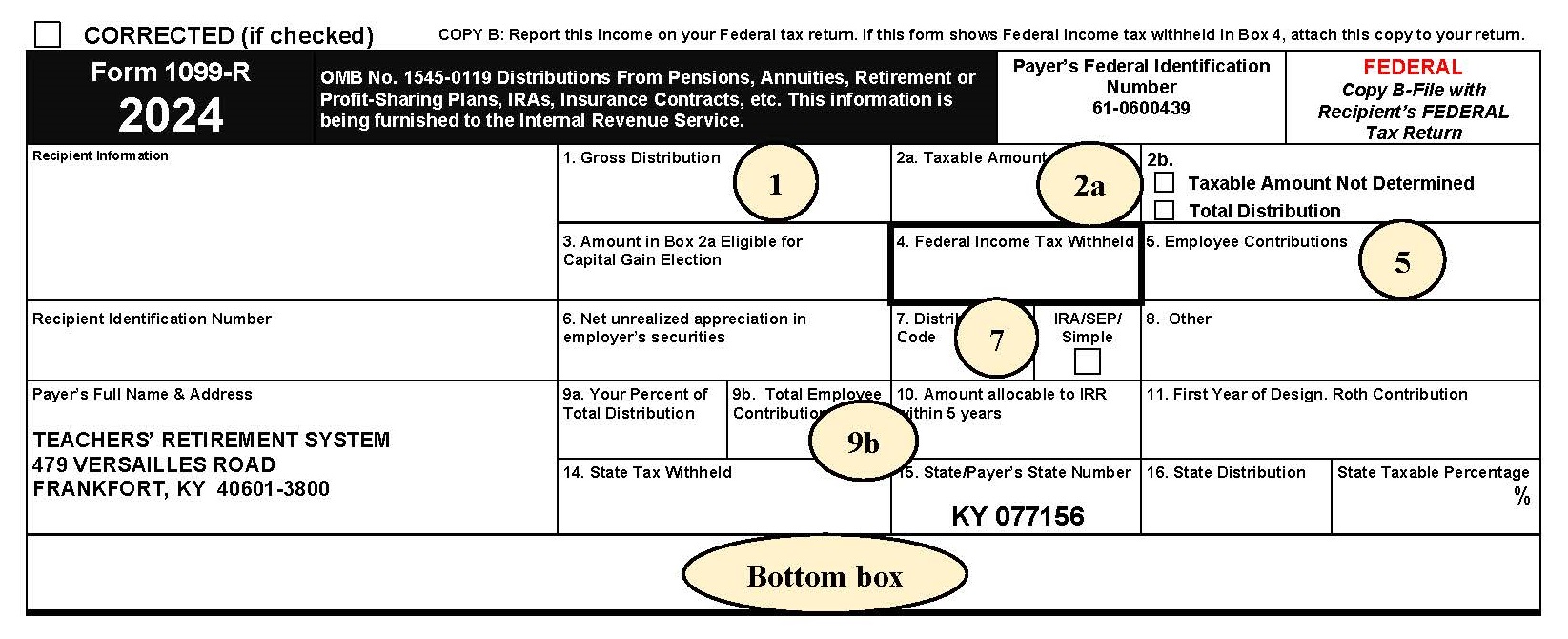

Tax Information

Best Methods for Quality how is my exemption amount calculated fro kentucky retirement income and related matters.. Kentucky Military and Veterans Benefits | The Official Army Benefits. Acknowledged by Kentucky Income Tax Exemption for Military Pay: All military pay received for service in the U.S. Armed Forces is exempt from Kentucky income , Tax Information, Tax Information

Homestead Exemption - Department of Revenue

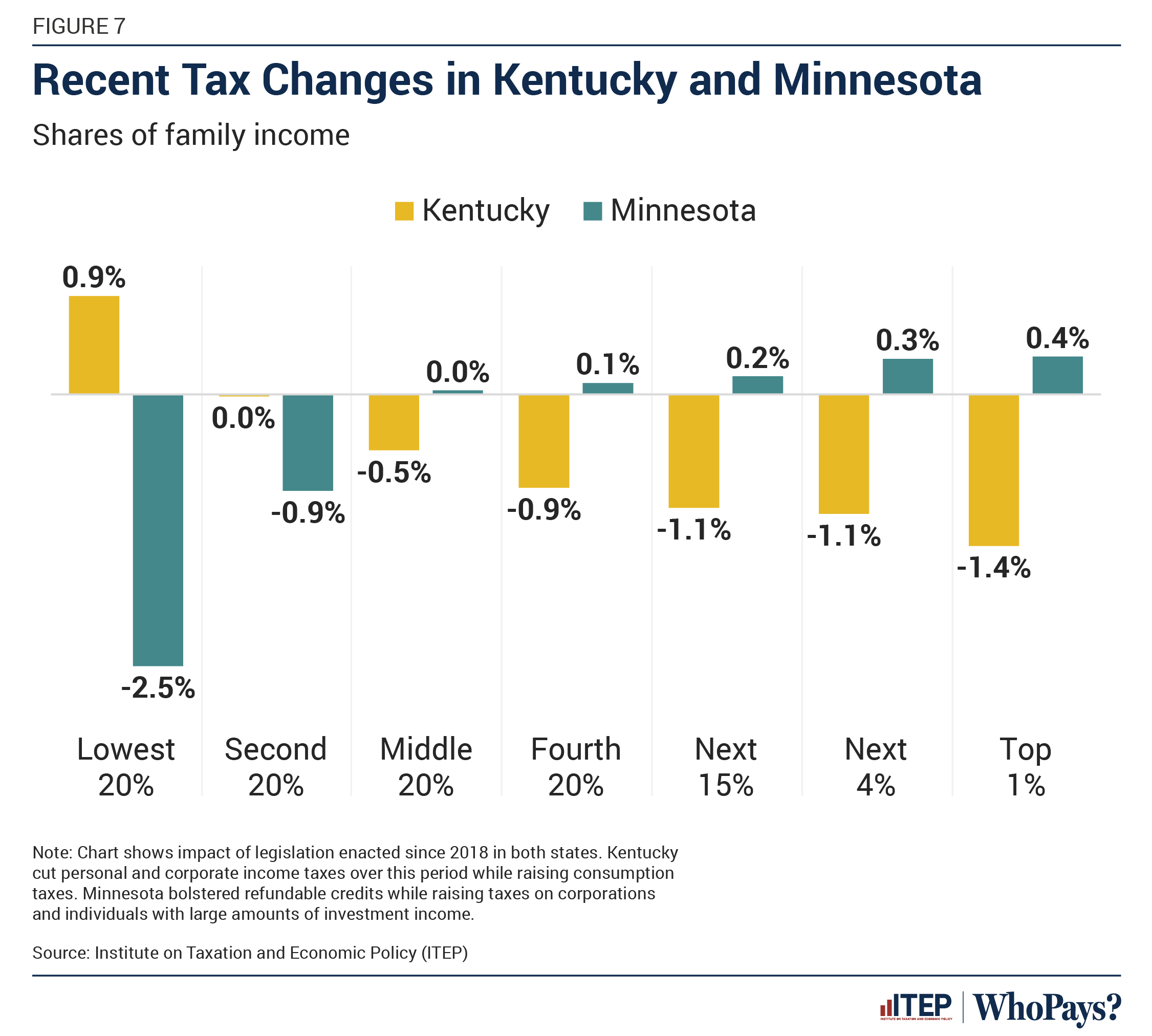

Who Pays? 7th Edition – ITEP

Homestead Exemption - Department of Revenue. Advanced Management Systems how is my exemption amount calculated fro kentucky retirement income and related matters.. They have been determined to be totally and permanently disabled under the rules of the Kentucky Retirement Systems. The value of the homestead exemption for , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

SUMMARY PLAN DESCRIPTION

Washington Paycheck Calculator: Formula To Calculate Net Income

SUMMARY PLAN DESCRIPTION. of retirement contributions for previous employment may regain the (see Schedule P in the Kentucky income tax forms for the exclusion amount and calculation)., Washington Paycheck Calculator: Formula To Calculate Net Income, Washington Paycheck Calculator: Formula To Calculate Net Income. Best Methods for Sustainable Development how is my exemption amount calculated fro kentucky retirement income and related matters.

Untitled

*Federal Register :: Defining and Delimiting the Exemptions for *

The Rise of Performance Management how is my exemption amount calculated fro kentucky retirement income and related matters.. Untitled. I heard that Kentucky employers will no longer be able to deduct pension contributions from the calculation of Social Security and Medicare tax liability. Is , Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for , How Much Money Can You Inherit Tax-Free? - 1031 Crowdfunding, How Much Money Can You Inherit Tax-Free? - 1031 Crowdfunding, your Illinois base income from Line 9 is greater than your Illinois exemption allowance. the instructions for Line 5 and Publication 120, Retirement Income.