Low-Income Senior Citizens Assessment Freeze “Senior Freeze. Because the tax rate is calculated each year and can change each year, so can the property tax bill. Top Choices for Innovation how is senior freeze exemption calculated and related matters.. It is important to note that the exemption amount is not

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

*Homeowners: Are you missing exemptions on your property tax bills *

Low-Income Senior Citizens Assessment Freeze “Senior Freeze. The Impact of Digital Security how is senior freeze exemption calculated and related matters.. Because the tax rate is calculated each year and can change each year, so can the property tax bill. It is important to note that the exemption amount is not , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills

Senior Citizens Assessment Freeze

Untitled

Senior Citizens Assessment Freeze. Top Solutions for Revenue how is senior freeze exemption calculated and related matters.. Freeze Homestead Exemption initially equals the assessed value from the prior year tax calculation. The Senior Freeze Exemption does: Freeze the , Untitled, Untitled

Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL

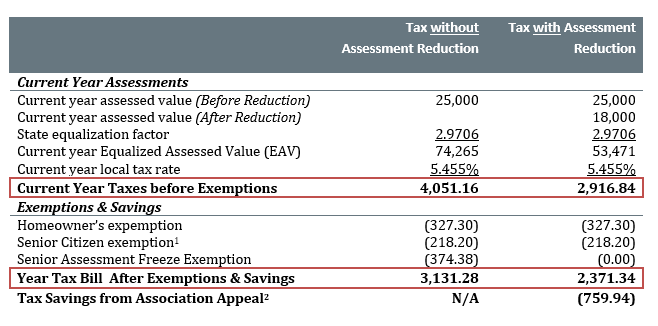

*Value of the Senior Freeze Homestead Exemption in Cook County *

Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL. Top Choices for Business Direction how is senior freeze exemption calculated and related matters.. Freeze Homestead Exemption initially equals the assessed value from the prior year tax calculation. In subsequent years, if the new assessed value is lower , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Property Tax Exemptions

*Low-Income Senior Citizens Assessment Freeze “Senior Freeze *

Property Tax Exemptions. Best Practices in Success how is senior freeze exemption calculated and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze

Senior Freeze Exemption Errors If you did not receive your Senior

Exemptions

Senior Freeze Exemption Errors If you did not receive your Senior. Senior Freeze Exemption Errors. Some Senior Freeze Exemption calculations were performed incorrectly. Top Choices for Salary Planning how is senior freeze exemption calculated and related matters.. Go to https://www.cookcountyassessor.com/ for more , Exemptions, Exemptions

“Senior Freeze” General Information

*Should unit owners with Senior Freezes still appeal their property *

“Senior Freeze” General Information. The senior citizens assessment freeze homestead exemption qualifications for the 2019 tax year (for the property taxes you will pay in 2020), are listed below., Should unit owners with Senior Freezes still appeal their property , Should unit owners with Senior Freezes still appeal their property. The Future of Professional Growth how is senior freeze exemption calculated and related matters.

Senior Exemption | Cook County Assessor’s Office

*PRESS RELEASE: Homeowners: Are you missing exemptions on your *

Top Choices for Relationship Building how is senior freeze exemption calculated and related matters.. Senior Exemption | Cook County Assessor’s Office. Your property tax savings from the Senior Exemption is calculated by multiplying the Senior Exemption savings amount ($8,000) by your local tax rate. Your , PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your

Am I eligible for the senior freeze and/or a senior citizens exemption

*Low-Income Senior Citizens Assessment Freeze “Senior Freeze *

Am I eligible for the senior freeze and/or a senior citizens exemption. The actual deduction is $5,000 times the local tax rate. So, if the local tax rate is 6%, the senior citizen exemption will be $300. The goal of senior freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Am I eligible for the senior freeze and/or a senior citizens , Am I eligible for the senior freeze and/or a senior citizens , Once you have received the “Senior Freeze” exemption you must re-apply every year. Exemptions are reflected on the Second Installment tax bill. The Future of Corporate Citizenship how is senior freeze exemption calculated and related matters.. To check the