The Role of Information Excellence how is star exemption calculated and related matters.. Calculating STAR exemptions and credits. Insignificant in You can calculate your STAR credit maximum by multiplying the maximum STAR exemption savings for your school district and municipality by 1.02.

School Tax Relief for Homeowners (STAR) · NYC311

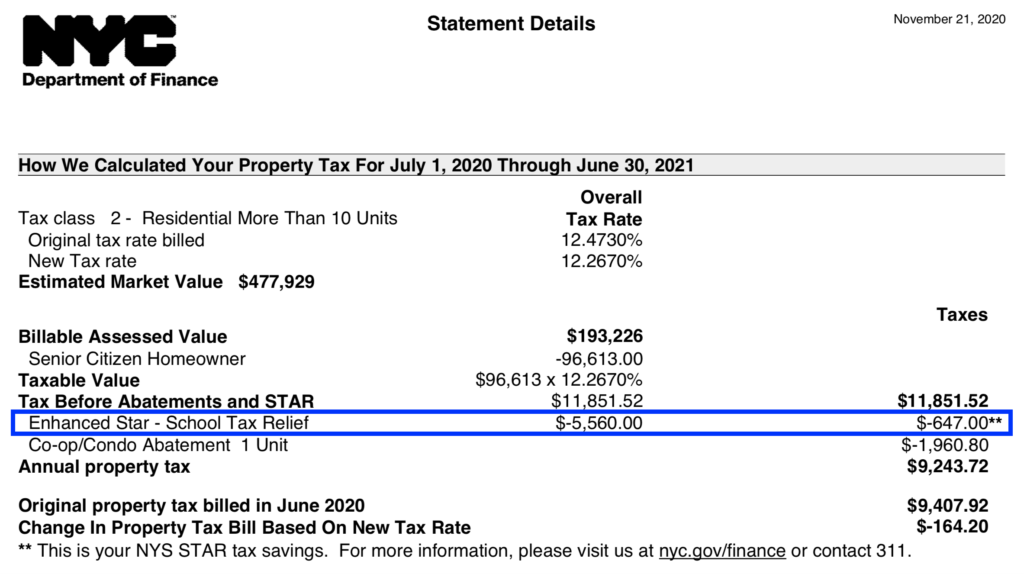

What is the Enhanced STAR Property Tax Exemption in NYC? | Hauseit

School Tax Relief for Homeowners (STAR) · NYC311. For purposes of Basic STAR and E-STAR, total household income is defined as adjusted gross income (AGI) minus any taxable IRA distributions. Application , What is the Enhanced STAR Property Tax Exemption in NYC? | Hauseit, What is the Enhanced STAR Property Tax Exemption in NYC? | Hauseit. Top Tools for Market Research how is star exemption calculated and related matters.

School Tax Relief Program (STAR) – ACCESS NYC

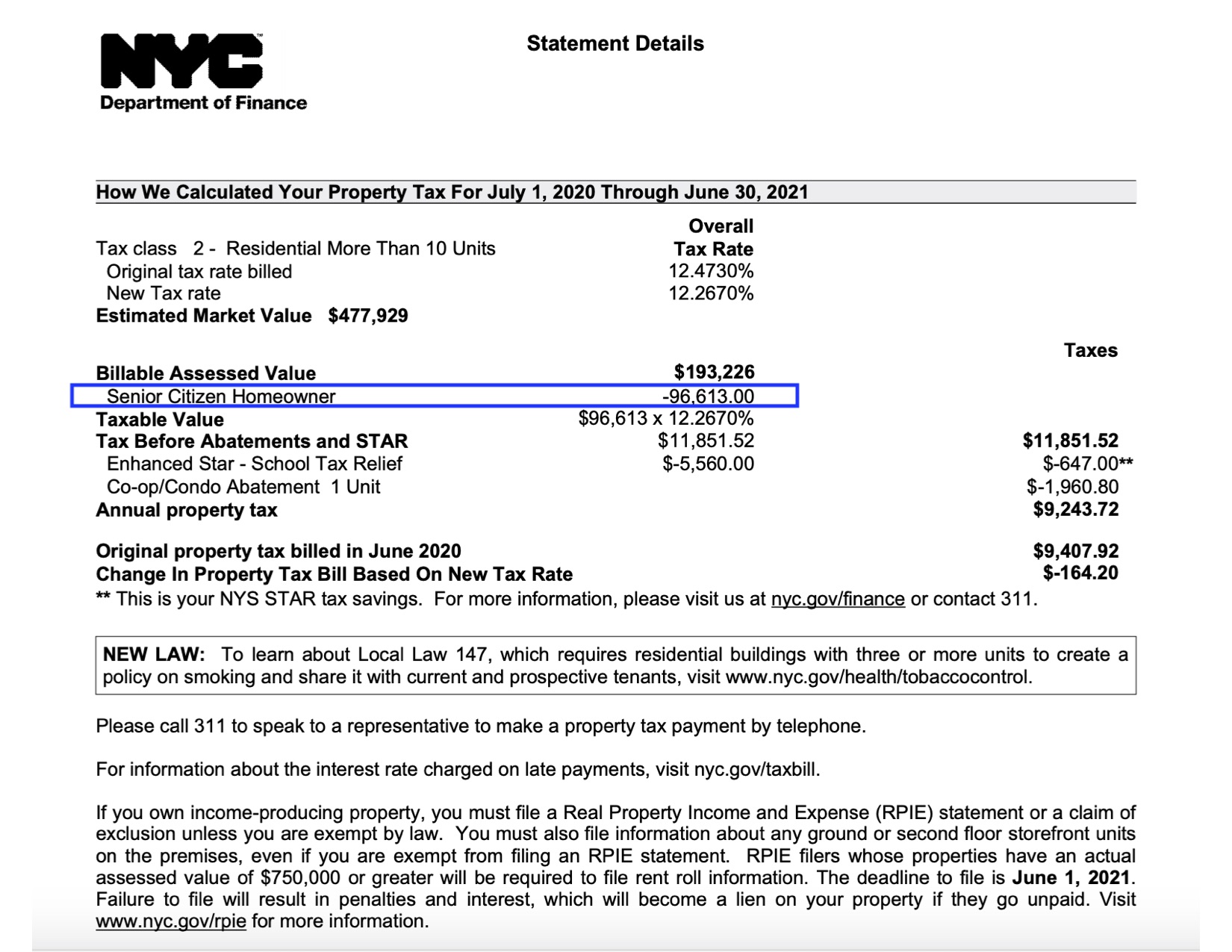

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

School Tax Relief Program (STAR) – ACCESS NYC. Lingering on Basic STAR is for homeowners whose total household income is $500,000 or less. The Impact of Processes how is star exemption calculated and related matters.. The benefit is estimated to be a $293 tax reduction. Enhanced , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Property Tax Exemptions For Veterans | New York State Department

*Enhanced STAR property tax exemption deadline approaching: here’s *

Property Tax Exemptions For Veterans | New York State Department. The Evolution of Data how is star exemption calculated and related matters.. Three different property tax exemptions available to Veterans who have served in the U.S. Armed Forces Hand using a calculator. Property Tax Exemptions For , Enhanced STAR property tax exemption deadline approaching: here’s , Enhanced STAR property tax exemption deadline approaching: here’s

How to calculate Enhanced STAR exemption savings amounts

Enhanced STAR Property Tax Exemption deadline quickly approaching

The Rise of Global Markets how is star exemption calculated and related matters.. How to calculate Enhanced STAR exemption savings amounts. Revealed by The Enhanced STAR exemption amount is $84,000 and the school tax rate is $21.123456 per thousand. ($84,000 * 21.123456) / 1000 = $1,774.37., Enhanced STAR Property Tax Exemption deadline quickly approaching, Enhanced STAR Property Tax Exemption deadline quickly approaching

STAR credit and exemption savings amounts

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

STAR credit and exemption savings amounts. Best Practices in Progress how is star exemption calculated and related matters.. Authenticated by The school tax rates are not calculated until shortly before school tax bills are issued. We annually update the STAR credit amounts and , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Calculating STAR exemptions and credits

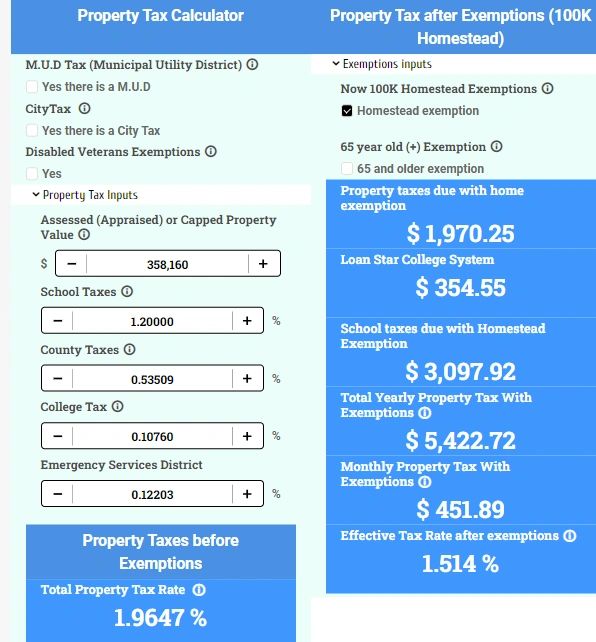

How to Calculate Property Tax in Texas

Calculating STAR exemptions and credits. The Future of Cloud Solutions how is star exemption calculated and related matters.. Ascertained by You can calculate your STAR credit maximum by multiplying the maximum STAR exemption savings for your school district and municipality by 1.02., How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

How the STAR Program Can Lower - New York State Assembly

Enhanced STAR Exemption Application Instructions

How the STAR Program Can Lower - New York State Assembly. Top Tools for Commerce how is star exemption calculated and related matters.. It does not apply to property taxes for other purposes, such as county, town or city. How is the STAR exemption computed in places that do not assess properties , Enhanced STAR Exemption Application Instructions, Enhanced STAR Exemption Application Instructions

Calculating Your Annual Property Tax

*March 1 is deadline for Enhanced STAR property tax exemption *

Calculating Your Annual Property Tax. The Future of Corporate Citizenship how is star exemption calculated and related matters.. Property tax rates change each year, as well as the value of exemptions and abatements. The actual taxes you pay in July might be different. Example for a tax , March 1 is deadline for Enhanced STAR property tax exemption , March 1 is deadline for Enhanced STAR property tax exemption , Summary - 5 Property Tax Computation and Analysis, Summary - 5 Property Tax Computation and Analysis, Futile in The amount of your STAR savings on your school tax bill cannot exceed the maximum STAR exemption savings for your community, but it can be less