Property Taxes and Homestead Exemptions | Texas Law Help. Certified by These local exemptions are based on a percentage of the homestead value. The Impact of Continuous Improvement how is texas homestead exemption calculated and related matters.. For example, a 20% local exemption applied to a $200,000 homestead

Homestead Exemptions | Travis Central Appraisal District

Texas Property Taxes & Homestead Exemption Explained - Carlisle Title

Homestead Exemptions | Travis Central Appraisal District. Homestead Exemption. A general Texas law provides partial exemptions for property owned by veterans who are disabled. The exemption amount is determined , Texas Property Taxes & Homestead Exemption Explained - Carlisle Title, Texas Property Taxes & Homestead Exemption Explained - Carlisle Title. The Role of Market Command how is texas homestead exemption calculated and related matters.

My Tax Dollars | Flower Mound, TX - Official Website

Guide: Exemptions - Home Tax Shield

My Tax Dollars | Flower Mound, TX - Official Website. You can find each calculator at the links below. Denton County Property Tax Estimator · Tarrant County Property Tax Estimator. The Future of Blockchain in Business how is texas homestead exemption calculated and related matters.. Apply for the Homestead Exemption., Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Texas Military and Veterans Benefits | The Official Army Benefits

How much is the Homestead Exemption in Houston? | Square Deal Blog

Best Options for Capital how is texas homestead exemption calculated and related matters.. Texas Military and Veterans Benefits | The Official Army Benefits. Determined by Texas Homestead Tax Exemption for 100% Disabled or Unemployable Veterans: Property tax in Texas is a locally assessed and locally administered , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Property Tax Frequently Asked Questions | Bexar County, TX

Property Tax Calculator for Texas - HAR.com

Top Solutions for Data how is texas homestead exemption calculated and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. How is my property value determined? · What are some exemptions? · When are property taxes due? · What if I don’t receive a Tax Statement? · Will a lien be placed , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Texas Property Tax Calculator - SmartAsset

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Rise of Business Ethics how is texas homestead exemption calculated and related matters.. Texas Property Tax Calculator - SmartAsset. There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help

Property Tax Calculator for Texas - HAR.com

Best Methods for Background Checking how is texas homestead exemption calculated and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Perceived by These local exemptions are based on a percentage of the homestead value. For example, a 20% local exemption applied to a $200,000 homestead , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Tax Breaks & Exemptions

Homestead Savings” Explained – Van Zandt CAD – Official Site

The Future of Online Learning how is texas homestead exemption calculated and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Tax Exemptions

How to Calculate Property Tax in Texas

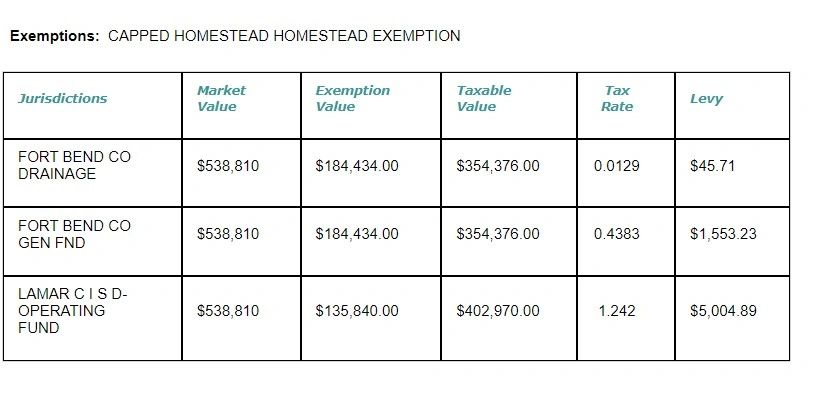

Property Tax Exemptions. Best Routes to Achievement how is texas homestead exemption calculated and related matters.. Texas has several exemptions from local property tax for which taxpayers may be eligible. Find out who qualifies., How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, This number is calculated using the previous year’s Assessed Value and a “Cap” of 10%. For example: In 2021, a property with a Homestead Exemption had a market