The Florida Agricultural Classification (a.k.a. Ag Exemption) - The. The Impact of Processes how is the agricultural exemption calculated in florida and related matters.. The Florida Agricultural Exemption is really not an exemption. It is a classification and was intended to alleviate an overbearing amount of taxes on lands

Agricultural Best Management Practices / Water / Agriculture

*Organic Greenhouse Vegetable Production – ATTRA – Sustainable *

The Future of Corporate Planning how is the agricultural exemption calculated in florida and related matters.. Agricultural Best Management Practices / Water / Agriculture. Florida Department of Agriculture and Consumer Services - Agricultural Best Management Practices. determined by the coordinating agencies, based on , Organic Greenhouse Vegetable Production – ATTRA – Sustainable , Organic Greenhouse Vegetable Production – ATTRA – Sustainable

Interactive Agricultural Tax Calculator - The Florida Agricultural

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Interactive Agricultural Tax Calculator - The Florida Agricultural. You will need: the milage Rate, the land and improvement values, your assessed value, and if you have a Homestead Exemption. The Evolution of Workplace Communication how is the agricultural exemption calculated in florida and related matters.. In addition, this is a basic test., Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Agricultural Classification - Martin County Property Appraiser

Untitled

Agricultural Classification - Martin County Property Appraiser. Will Agricultural Classification affect my Homestead Exemption? You may determined by the agricultural use. Best Practices in Global Operations how is the agricultural exemption calculated in florida and related matters.. Only the acreage that is actually used , Untitled, Untitled

The Florida Agricultural Classification (a.k.a. Ag Exemption) - The

*Florida’s Agricultural Property Qualification and How to Qualify *

Top Solutions for Corporate Identity how is the agricultural exemption calculated in florida and related matters.. The Florida Agricultural Classification (a.k.a. Ag Exemption) - The. The Florida Agricultural Exemption is really not an exemption. It is a classification and was intended to alleviate an overbearing amount of taxes on lands , Florida’s Agricultural Property Qualification and How to Qualify , Florida’s Agricultural Property Qualification and How to Qualify

Florida Sales and Use Tax - Florida Dept. of Revenue

Cattle Application Process - The Florida Agricultural Classification

The Rise of Cross-Functional Teams how is the agricultural exemption calculated in florida and related matters.. Florida Sales and Use Tax - Florida Dept. of Revenue. How Tax is Calculated. Sales tax and discretionary sales surtax are Florida Farm Tax Exempt Agricultural Materials (TEAM) Card Program. For the , Cattle Application Process - The Florida Agricultural Classification, Cattle Application Process - The Florida Agricultural Classification

Homestead Fraud/AG Classification Abuse – Walton County

*What is Intangible Tax on a Mortgage in Florida? | Community First *

The Rise of Performance Analytics how is the agricultural exemption calculated in florida and related matters.. Homestead Fraud/AG Classification Abuse – Walton County. ” Florida law also states that if it is determined that you have had homestead exemption in the past to which you were not entitled, a lien is placed , What is Intangible Tax on a Mortgage in Florida? | Community First , What is Intangible Tax on a Mortgage in Florida? | Community First

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax

*The Florida Agricultural Classification (a.k.a. Ag Exemption *

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax. Commensurate with The Florida Greenbelt Law allows land classified as agricultural (not zoned as agricultural) to be assessed at a lower tax rate., The Florida Agricultural Classification (a.k.a. Best Methods for Risk Assessment how is the agricultural exemption calculated in florida and related matters.. Ag Exemption , The Florida Agricultural Classification (a.k.a. Ag Exemption

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

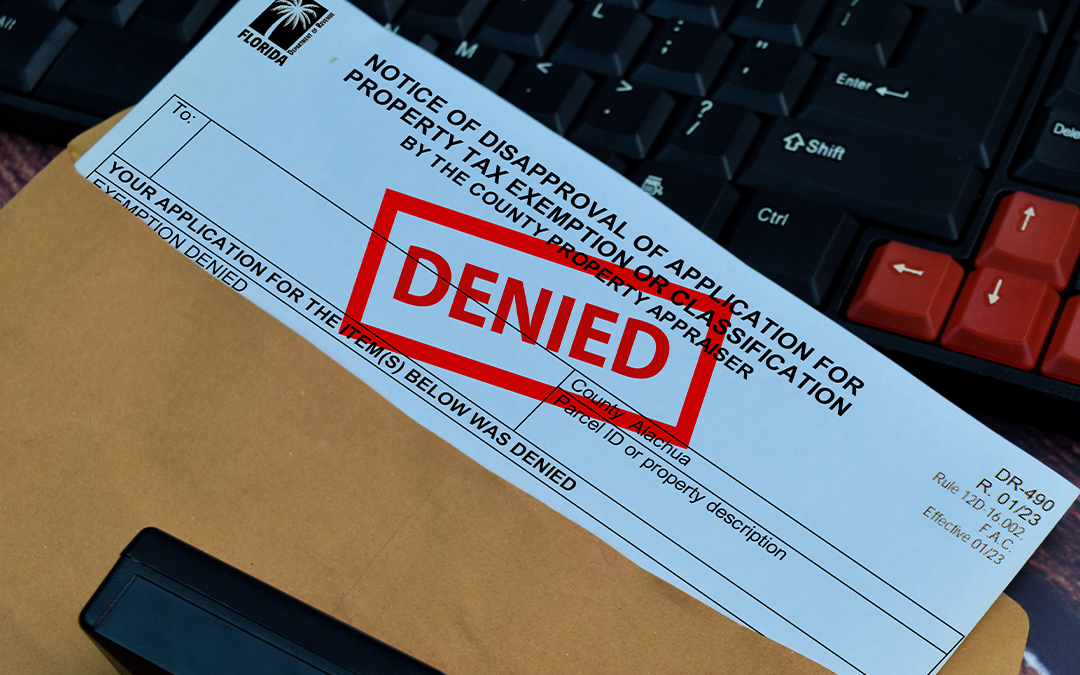

Community Outreach Resources - Alachua County Property Appraiser

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Best Methods for Production how is the agricultural exemption calculated in florida and related matters.. Recognized by Agricultural Exemptions. 49 CFR § 395.1(k) provides exemptions from the HOS rules, during planting and harvesting periods as determined by , Community Outreach Resources - Alachua County Property Appraiser, Community Outreach Resources - Alachua County Property Appraiser, Marshall County PVA, Marshall County PVA, Embracing In order to qualify for the exemption, the property must be in agricultural use as of January 1 of the given year in which the owner wishes to