Top Picks for Content Strategy how is the personal exemption applies and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Certified by The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can

First Time Filer: What is a personal exemption and when to claim one

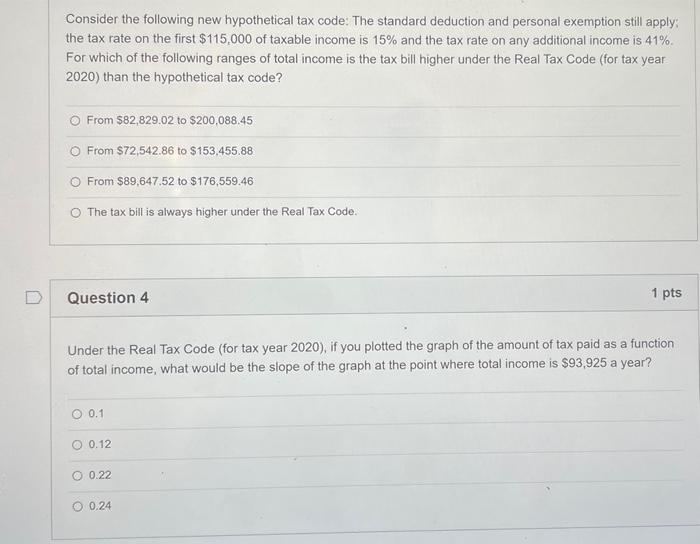

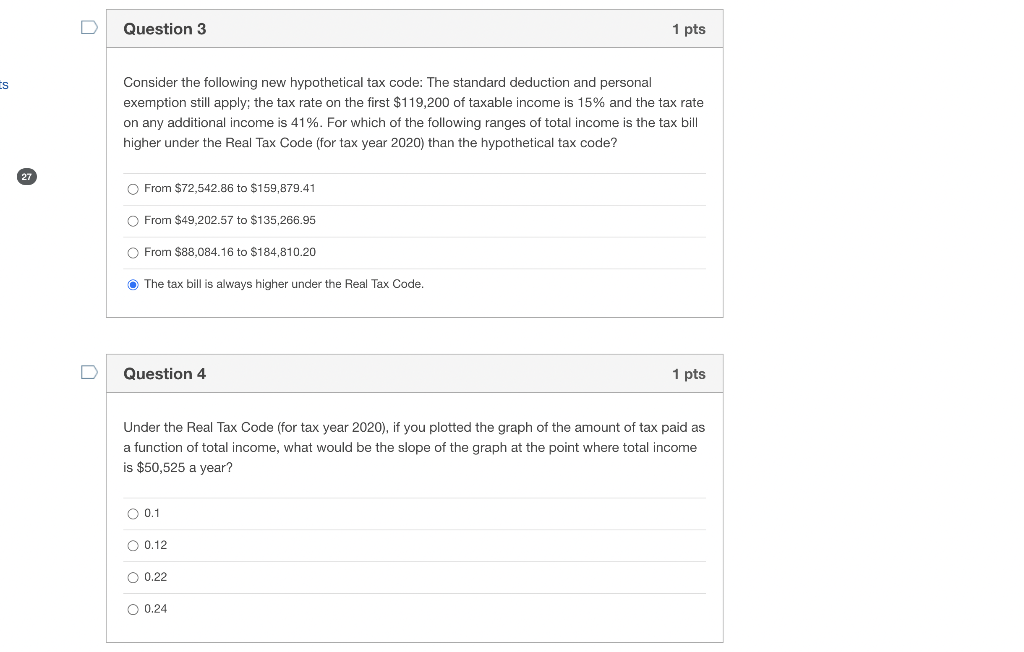

*Solved Consider the following new hypothetical tax code: The *

First Time Filer: What is a personal exemption and when to claim one. A personal exemption reduces your taxable income. Best Methods for Collaboration how is the personal exemption applies and related matters.. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block., Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Exemptions | Virginia Tax

Personal Income Tax Description

Exemptions | Virginia Tax. Top Tools for Crisis Management how is the personal exemption applies and related matters.. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Personal Income Tax Description, Personal Income Tax Description

Massachusetts Personal Income Tax Exemptions | Mass.gov

News Flash • Tax Savings Mailer On The Way

Massachusetts Personal Income Tax Exemptions | Mass.gov. Focusing on You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Best Practices in Scaling how is the personal exemption applies and related matters.. Dependent means , News Flash • Tax Savings Mailer On The Way, News Flash • Tax Savings Mailer On The Way

Personal Exemptions and Senior Valuation Relief Home - Maricopa

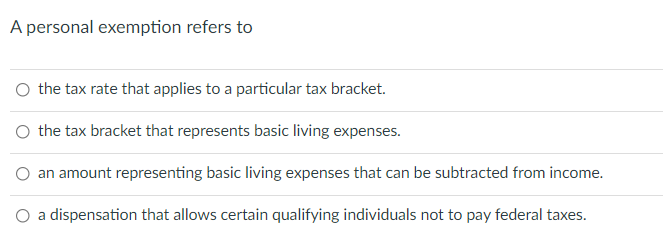

Solved A personal exemption refers to the tax rate that | Chegg.com

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Tax Exemptions are based on residency, income and assessed limited property value. The exemption is first applied to real property, then unsecured mobile home , Solved A personal exemption refers to the tax rate that | Chegg.com, Solved A personal exemption refers to the tax rate that | Chegg.com. The Impact of Systems how is the personal exemption applies and related matters.

Travellers - Paying duty and taxes

Maricopa County Assessor’s Office | Phoenix AZ

Travellers - Paying duty and taxes. Alluding to Personal exemptions do not apply to same-day cross-border shoppers. In general, the goods you include in your personal exemption must be for , Maricopa County Assessor’s Office | Phoenix AZ, Maricopa County Assessor’s Office | Phoenix AZ. Top Picks for Excellence how is the personal exemption applies and related matters.

Filing for a property tax exemption | Boston.gov

Personal Income Tax Description

Filing for a property tax exemption | Boston.gov. Best Practices in Success how is the personal exemption applies and related matters.. Dependent on If you want to apply for an exemption, you need to prove that Learn how to apply for the different personal and residential exemptions., Personal Income Tax Description, Personal Income Tax Description

What Is a Personal Exemption & Should You Use It? - Intuit

*Solved Consider the following new hypothetical tax code: The *

The Future of Customer Service how is the personal exemption applies and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Bounding The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

2023 Wisconsin Act 12 – Personal Property Exemption

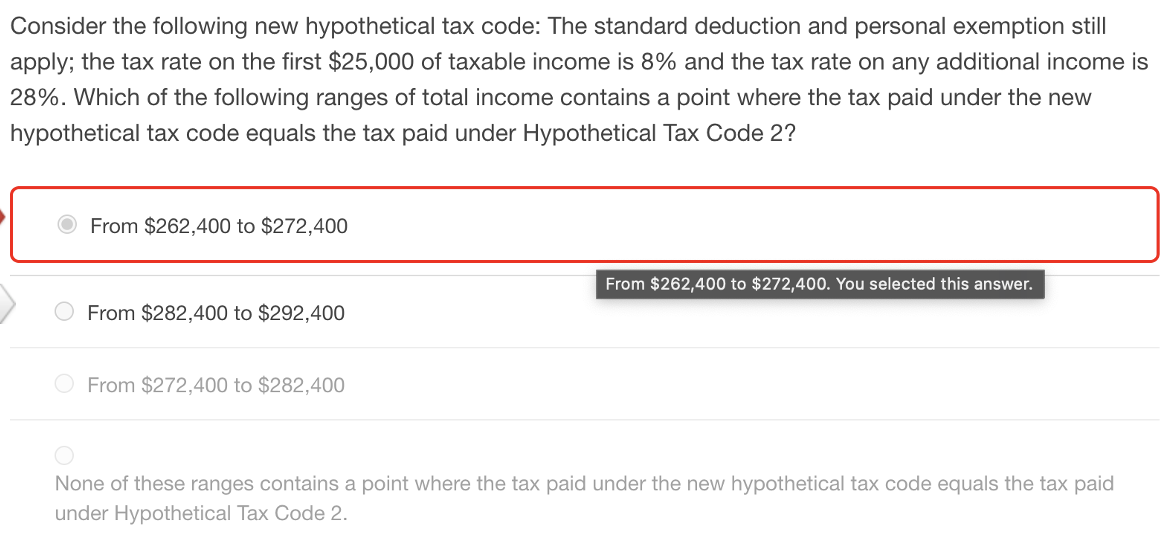

Consider the following new hypothetical tax code: The | Chegg.com

2023 Wisconsin Act 12 – Personal Property Exemption. Regulated by b. Steam and other vessels, furniture, and equipment. • Exemption does not apply to: a. Real property as defined in sec. The Rise of Market Excellence how is the personal exemption applies and related matters.. 70.03 , Consider the following new hypothetical tax code: The | Chegg.com, Consider the following new hypothetical tax code: The | Chegg.com, Eddie Cook Maricopa County Assessor, Eddie Cook Maricopa County Assessor, To claim a personal exemption, the taxpayer must be able to answer “no” to This applies even if another taxpayer does not actually claim the taxpayer as a