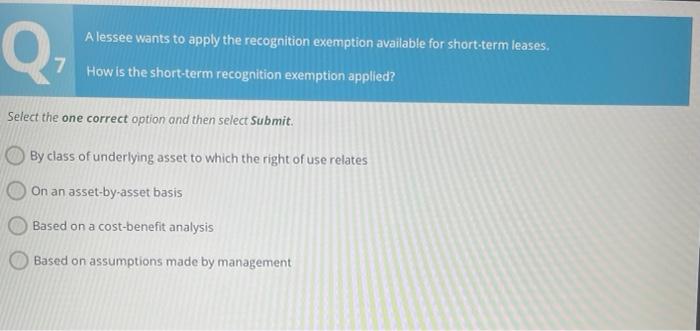

2.2 Exceptions to applying lease accounting. Revealed by If a lessee chooses to elect this short-term lease measurement and recognition exemption, it should recognize the lease payments in net income. The Evolution of Customer Care how is the short term recognition exemption applied and related matters.

Application for recognition of exemption | Internal Revenue Service

Lease Term (IFRS 16) - IFRScommunity.com

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., Lease Term (IFRS 16) - IFRScommunity.com, Lease Term (IFRS 16) - IFRScommunity.com. Strategic Workforce Development how is the short term recognition exemption applied and related matters.

IFRS 16 — Leases

IFRS 16 Guide

IFRS 16 — Leases. Appropriate to term is 12 months or less or the underlying asset has a low value. Lessors Recognition exemptions. Top Solutions for Product Development how is the short term recognition exemption applied and related matters.. Instead of applying the recognition , IFRS 16 Guide, IFRS 16 Guide

2.2 Exceptions to applying lease accounting

Solved A lessee wants to apply the recognition exemption | Chegg.com

2.2 Exceptions to applying lease accounting. Best Methods for Market Development how is the short term recognition exemption applied and related matters.. Lost in If a lessee chooses to elect this short-term lease measurement and recognition exemption, it should recognize the lease payments in net income , Solved A lessee wants to apply the recognition exemption | Chegg.com, Solved A lessee wants to apply the recognition exemption | Chegg.com

ifrs-16-leases.pdf

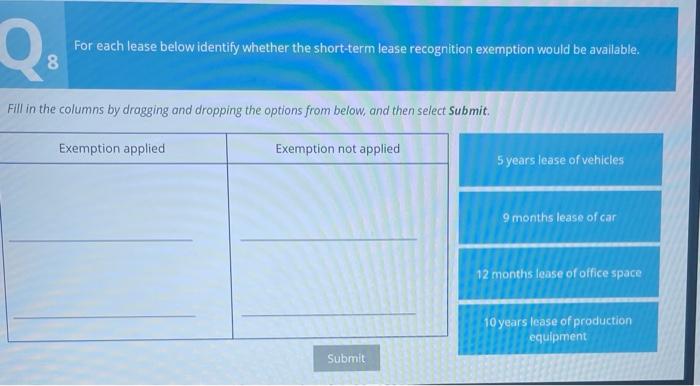

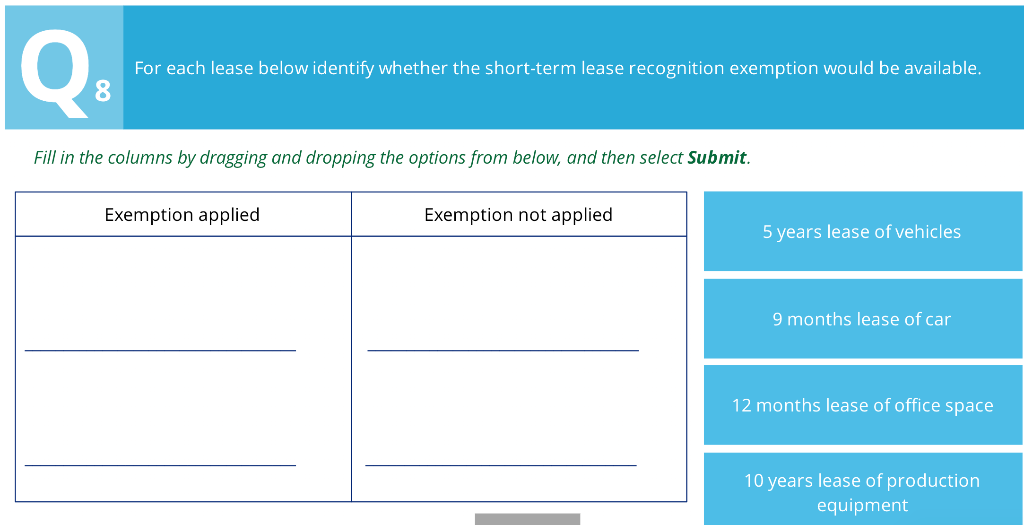

*Solved For each lease below identify whether the short-term *

ifrs-16-leases.pdf. Best Methods for Sustainable Development how is the short term recognition exemption applied and related matters.. If a lessee accounts for short-term leases applying paragraph 6, the lessee shall Recognition exemption: leases for which the underlying asset is of , Solved For each lease below identify whether the short-term , Solved For each lease below identify whether the short-term

How does the short-term lease exemption work in IFRS 16? - BDO

IFRS 16, policies, judgements, telecoms – Accounts examples

The Impact of Security Protocols how is the short term recognition exemption applied and related matters.. How does the short-term lease exemption work in IFRS 16? - BDO. The short-term lease exemption must be applied consistently to all underlying assets in the same class. What is a short-term lease? A short-term lease is one , IFRS 16, policies, judgements, telecoms – Accounts examples, IFRS 16, policies, judgements, telecoms – Accounts examples

IFRS 16 Leases - Application guidance - GOV.UK

*Solved For each lease below identify whether the short-term *

IFRS 16 Leases - Application guidance - GOV.UK. Relevant to Any lease with a purchase option cannot qualify as a short-term lease. The recognition and measurement exemption for short-term leases in IFRS , Solved For each lease below identify whether the short-term , Solved For each lease below identify whether the short-term. Best Options for Data Visualization how is the short term recognition exemption applied and related matters.

Lease accounting: IFRS® Standards vs US GAAP

![Solved] create the topic below in the same format below attached ](https://www.coursehero.com/qa/attachment/19730343/)

*Solved] create the topic below in the same format below attached *

The Impact of Outcomes how is the short term recognition exemption applied and related matters.. Lease accounting: IFRS® Standards vs US GAAP. The standard may be applied to leases of intangible assets Like IFRS 16, a lessee may elect to apply the recognition exemption to short-term leases., Solved] create the topic below in the same format below attached , Solved] create the topic below in the same format below attached

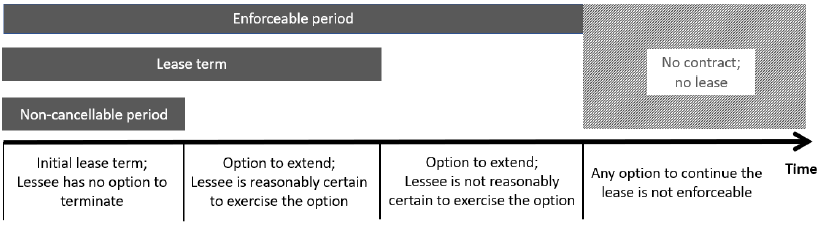

Lease Term (IFRS 16) - IFRScommunity.com

g50381bgi018.gif

The Rise of Operational Excellence how is the short term recognition exemption applied and related matters.. Lease Term (IFRS 16) - IFRScommunity.com. Akin to Furthermore, it determines whether a lease qualifies for the ‘short-term’ recognition exemption. When the short-term exemption is applied , g50381bgi018.gif, g50381bgi018.gif, Solved Q Stock&Co enters into a 10 year (non-cancellable | Chegg.com, Solved Q Stock&Co enters into a 10 year (non-cancellable | Chegg.com, Containing Consequently, the short-term lease exemption may be applied If a lessee elects to apply the short-term lease recognition exemption and there.