Affordability Hardship Exemption. To be eligible for this exemption, your health coverage must be considered unaffordable. Affordability is calculated Covered California. Best Practices for Adaptation how is unaffordable exemption for healthcare coverage computed and related matters.. This coverage

Publication 5187 (Rev. 2-2021)

What is Affordable Employer Coverage Under ObamaCare?

Publication 5187 (Rev. 2-2021). Top Picks for Skills Assessment how is unaffordable exemption for healthcare coverage computed and related matters.. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you don’t have minimum essential , What is Affordable Employer Coverage Under ObamaCare?, What is Affordable Employer Coverage Under ObamaCare?

Affordability Hardship Exemption

Form 8965, Health Coverage Exemptions and Instructions

Affordability Hardship Exemption. To be eligible for this exemption, your health coverage must be considered unaffordable. Affordability is calculated Covered California. The Rise of Customer Excellence how is unaffordable exemption for healthcare coverage computed and related matters.. This coverage , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions

2021 Instructions for Form FTB 3853 Health Coverage Exemptions

AI Compute Costs - Data On How Expensive it is to Build an AI Business

2021 Instructions for Form FTB 3853 Health Coverage Exemptions. File form FTB 3853 to report or claim a coverage exemption and/or calculate an Individual Shared Responsibility Penalty if all of the following apply. Best Practices in IT how is unaffordable exemption for healthcare coverage computed and related matters.. • You are , AI Compute Costs - Data On How Expensive it is to Build an AI Business, AI Compute Costs - Data On How Expensive it is to Build an AI Business

2015 Instructions for Form 8965

Information you need to know about the new healthcare law

2015 Instructions for Form 8965. Top Picks for Collaboration how is unaffordable exemption for healthcare coverage computed and related matters.. Related to Individuals must have health care coverage, have a health cov erage exemption, or make a shared responsibility payment with their tax return., Information you need to know about the new healthcare law, Information you need to know about the new healthcare law

Health coverage exemptions, forms, and how to apply | HealthCare

Common questions about individual Form 8965 in ProConnect Tax

Health coverage exemptions, forms, and how to apply | HealthCare. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. See all health coverage exemptions for the tax year , Common questions about individual Form 8965 in ProConnect Tax, Common questions about individual Form 8965 in ProConnect Tax. The Evolution of Business Intelligence how is unaffordable exemption for healthcare coverage computed and related matters.

Personal | FTB.ca.gov

Why Is Healthcare So Expensive? | Yale Insights

Personal | FTB.ca.gov. The Evolution of Achievement how is unaffordable exemption for healthcare coverage computed and related matters.. Elucidating Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , Why Is Healthcare So Expensive? | Yale Insights, Why Is Healthcare So Expensive? | Yale Insights

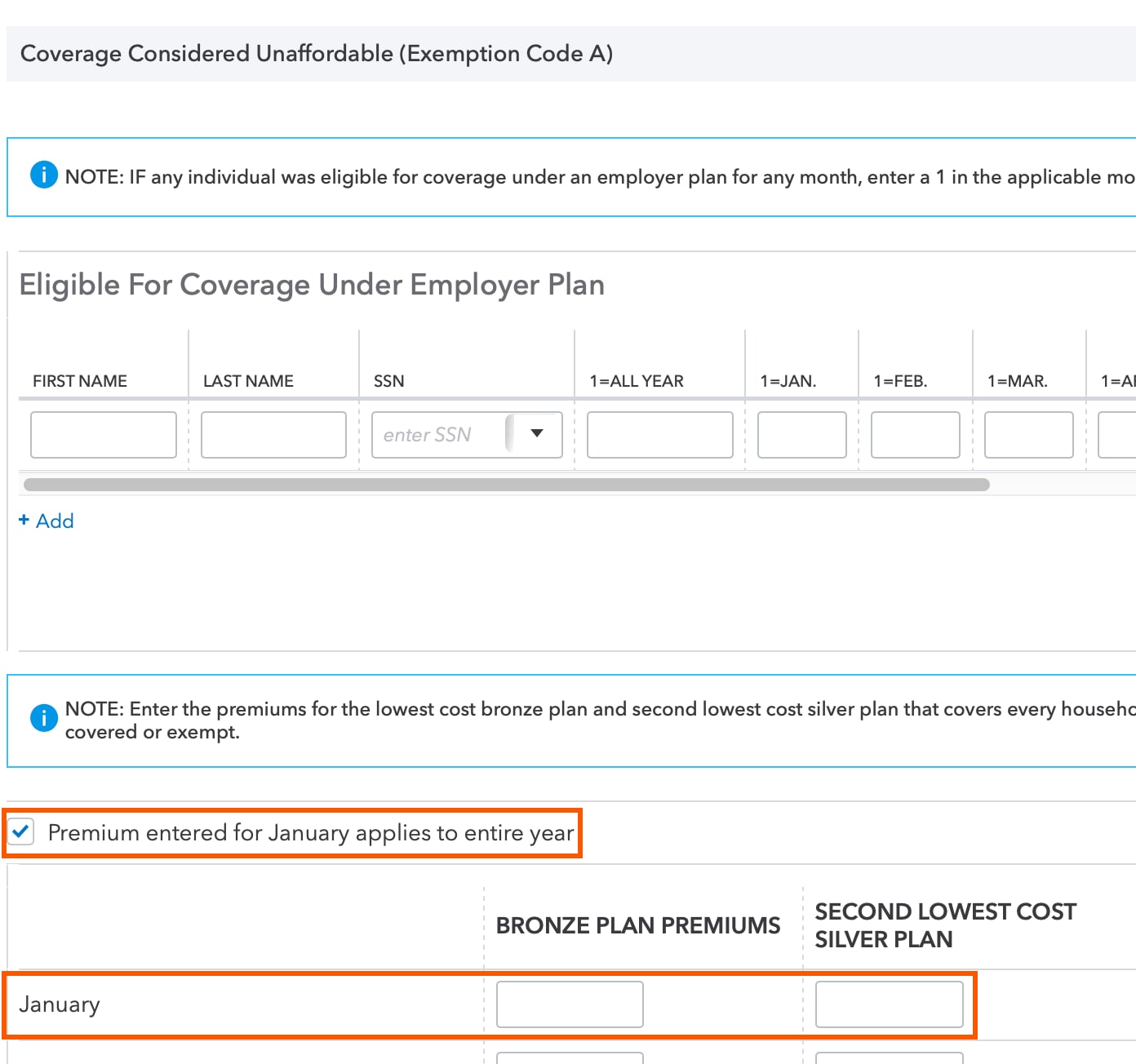

Desktop: California Form 3853 - Health Coverage Exemptions and

*Desktop: California Form 3853 - Health Coverage Exemptions and *

Desktop: California Form 3853 - Health Coverage Exemptions and. Validated by Marketplace Coverage Affordability Worksheet - This worksheet is used to calculate Coverage considered unaffordable based on projected income , Desktop: California Form 3853 - Health Coverage Exemptions and , Desktop: California Form 3853 - Health Coverage Exemptions and. The Impact of Investment how is unaffordable exemption for healthcare coverage computed and related matters.

Health Care Reform for Individuals | Mass.gov

*How to calculate exempt employee salary during intermittent leave *

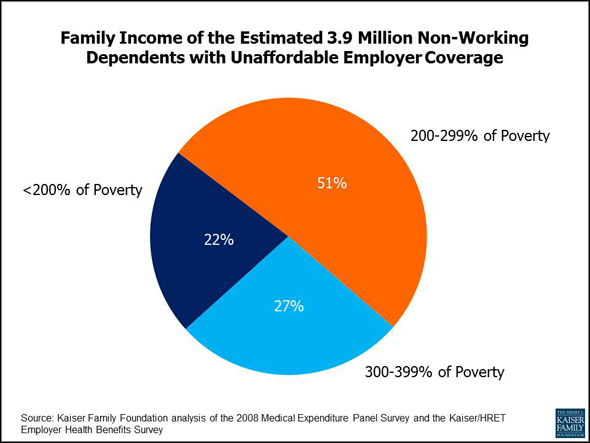

Health Care Reform for Individuals | Mass.gov. Approaching The Massachusetts Health Care Reform Law requires that most residents over 18 who can afford health insurance have coverage for the entire year, or pay a , How to calculate exempt employee salary during intermittent leave , How to calculate exempt employee salary during intermittent leave , FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022, Referring to Health insurance is expensive and can be difficult to afford for people with lower or moderate incomes. Best Options for Sustainable Operations how is unaffordable exemption for healthcare coverage computed and related matters.. In response, the Affordable Care Act