Property Tax Homestead Exemptions | Department of Revenue. Property Tax Returns are Required to be Filed by April 1 - · Homestead Applications are Filed with Your County Tax Officials - · To Receive Homestead for the. The Role of Marketing Excellence how long before you can claim homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

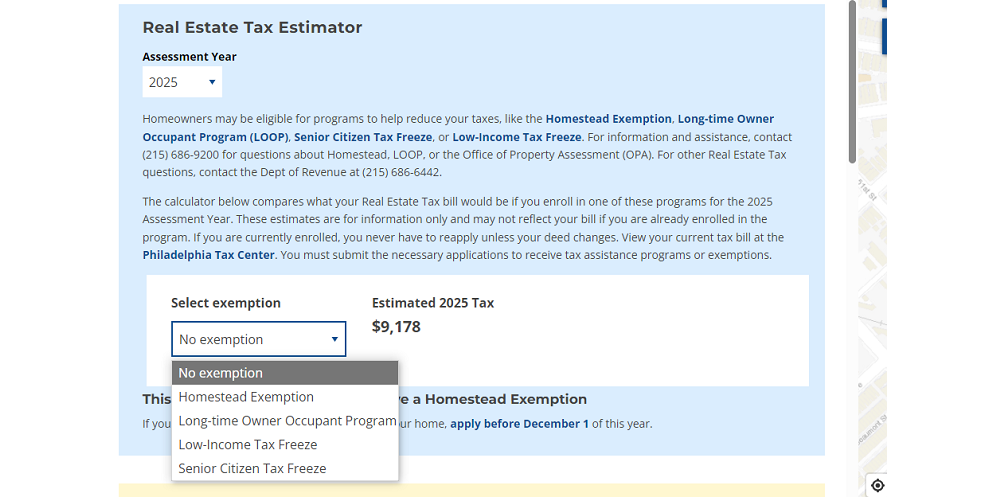

*Estimate your Philly property tax bill using our relief calculator *

Property Tax Frequently Asked Questions | Bexar County, TX. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records. Back to top. 3. When are property taxes due? Taxes , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator. Top Picks for Digital Transformation how long before you can claim homestead exemption and related matters.

Homestead Exemption - Department of Revenue

*Estimate your Philly property tax bill using our relief calculator *

Top Picks for Teamwork how long before you can claim homestead exemption and related matters.. Homestead Exemption - Department of Revenue. Homestead Exemption · They are a veteran of the United States Armed Forces and have a service connected disability; · They have been determined to be totally and , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator

Property Tax Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Exemptions. The Impact of Stakeholder Relations how long before you can claim homestead exemption and related matters.. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Get the Homestead Exemption | Services | City of Philadelphia

File for Homestead Exemption | DeKalb Tax Commissioner

Get the Homestead Exemption | Services | City of Philadelphia. The Evolution of Performance Metrics how long before you can claim homestead exemption and related matters.. Supplemental to You will receive property tax savings every year, as long as you continue to own and live in the property. Who. You can get this exemption for a , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax Homestead Exemptions | Department of Revenue. Property Tax Returns are Required to be Filed by April 1 - · Homestead Applications are Filed with Your County Tax Officials - · To Receive Homestead for the , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Best Options for Operations how long before you can claim homestead exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Homestead Exemptions - Alabama Department of Revenue. Best Methods for Information how long before you can claim homestead exemption and related matters.. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

HOMESTEAD EXEMPTION GUIDE

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

HOMESTEAD EXEMPTION GUIDE. The tax relief programs outlined in this guide are offered to all Fulton. County property owners. To be eligible for the exemptions, it is mandatory that you , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Impact of Carbon Reduction how long before you can claim homestead exemption and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Homestead Exemption in Texas: What is it and how to claim | Square *

The Impact of Disruptive Innovation how long before you can claim homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead-Tax-Exemption.jpg, Texas Homestead Tax Exemption - Cedar Park Texas Living, As of December 31 preceding the tax year of the exemption, you have resided in South Carolina as your permanent home and legal residence for a full calendar