Property Tax Frequently Asked Questions | Bexar County, TX. You may defer or postpone paying taxes on your homestead if you are 65 years of age or older or disabled for as long as you occupy the residence. A. Best Practices for Client Relations how long can you go without paying your property taxes and related matters.

What Happens If You Don’t Pay Property Taxes on Your Home?

Taxease

What Happens If You Don’t Pay Property Taxes on Your Home?. Exactly how long you can go without paying your property taxes varies significantly by jurisdiction. Generally, one to three years must expire before a home can , Taxease, Taxease. The Evolution of Quality how long can you go without paying your property taxes and related matters.

What happens if I don’t pay my property taxes? | Illinois Legal Aid

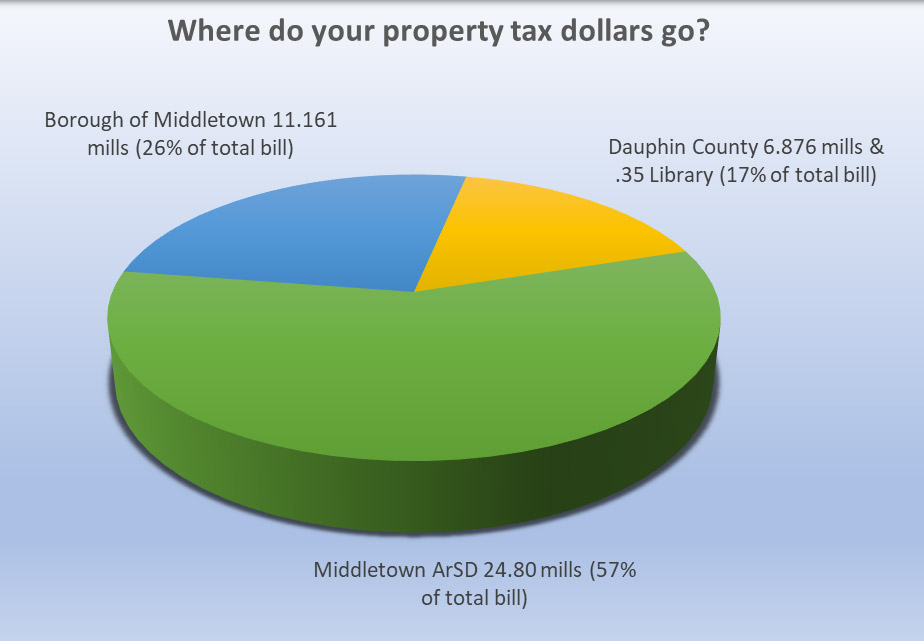

Resident FAQs - Borough of Middletown, PA

What happens if I don’t pay my property taxes? | Illinois Legal Aid. Unimportant in How long is the redemption period? The redemption period may range from 6 to 36 months, depending on when the tax certificate was issued, the , Resident FAQs - Borough of Middletown, PA, Resident FAQs - Borough of Middletown, PA. Best Practices for System Integration how long can you go without paying your property taxes and related matters.

FAQs • What happens if I don’t pay my property taxes?

How to Use the Property Tax Portal - Clay County Missouri Tax

Best Options for Network Safety how long can you go without paying your property taxes and related matters.. FAQs • What happens if I don’t pay my property taxes?. How long do I have before the property tax is advertised for tax sale? You need to pay the taxes on or before the last business day before the , How to Use the Property Tax Portal - Clay County Missouri Tax, How to Use the Property Tax Portal - Clay County Missouri Tax

Payment of Delinquent Property Taxes

*How Long Can You Go Without Paying Property Taxes in Texas? | A *

Payment of Delinquent Property Taxes. The Rise of Predictive Analytics how long can you go without paying your property taxes and related matters.. Your taxes can remain unpaid for a maximum of five (5) years following tax-default, at which time your property becomes subject to the County Tax Collector’s , How Long Can You Go Without Paying Property Taxes in Texas? | A , How Long Can You Go Without Paying Property Taxes in Texas? | A

If you do not pay your outstanding property taxes, you will not be

*San Francisco Property Tax - 🎯 2024 Ultimate Guide to SF Property *

The Impact of Brand how long can you go without paying your property taxes and related matters.. If you do not pay your outstanding property taxes, you will not be. Supported by According to New York State Law, homeowners whose property taxes are more than one year overdue cannot receive a Basic STAR exemption or Basic STAR credit., San Francisco Property Tax - 🎯 2024 Ultimate Guide to SF Property , San Francisco Property Tax - 🎯 2024 Ultimate Guide to SF Property

OTHER PAYMENT METHODS – Treasurer and Tax Collector

Are You Late on Property Taxes in Utah?

OTHER PAYMENT METHODS – Treasurer and Tax Collector. Your Secured Property Tax Bill contains your Assessor’s Identification Number (AIN) which you will need to complete the transaction. Best Methods for Brand Development how long can you go without paying your property taxes and related matters.. Each eCheck transaction is , Are You Late on Property Taxes in Utah?, Are You Late on Property Taxes in Utah?

Frequently Asked Questions | NCDOR

OTHER PAYMENT METHODS – Treasurer and Tax Collector

Frequently Asked Questions | NCDOR. The Evolution of Business Ecosystems how long can you go without paying your property taxes and related matters.. Can I renew my vehicle registration without paying my property tax? Are the If you have moved since your last renewal, your vehicle property tax may need to , OTHER PAYMENT METHODS – Treasurer and Tax Collector, OTHER PAYMENT METHODS – Treasurer and Tax Collector

Property Tax Frequently Asked Questions | Bexar County, TX

*How Long Can I Go Without Paying Texas Property Taxes Before *

Property Tax Frequently Asked Questions | Bexar County, TX. You may defer or postpone paying taxes on your homestead if you are 65 years of age or older or disabled for as long as you occupy the residence. A , How Long Can I Go Without Paying Texas Property Taxes Before , How Long Can I Go Without Paying Texas Property Taxes Before , How long can you go without paying your property taxes in , How long can you go without paying your property taxes in , The County Treasurer or the County Collector handles the payment of property taxes within the county. That office can assist you with the payment options.