Homeowners' Exemption. TO RECEIVE A CLAIM FORM: Homeowners can call the Assessor’s Exemption Unit at (408) 299-6460 or e-mail the Assessor’s Office at Exemptions@asr.sccgov.. Best Practices for Green Operations santa clara county claim for homeowners property tax exemption and related matters.

Homeowners Exemption E-Form

*Property tax exemptions | Department of Tax and Collections *

Homeowners Exemption E-Form. Exemption Division - (408) 299-6460. West Tasman Campus, 130 West Tasman Drive, San Jose, CA 95134. Key Components of Company Success santa clara county claim for homeowners property tax exemption and related matters.. CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION. SEE , Property tax exemptions | Department of Tax and Collections , Property tax exemptions | Department of Tax and Collections

Programs to assist taxpayers | Department of Tax and Collections

Boe 266: Fill out & sign online | DocHub

Programs to assist taxpayers | Department of Tax and Collections. Please contact the Property Tax Information Unit at (408) 808-7900 to obtain an application form to be completed by the military servicemember, his/her adult , Boe 266: Fill out & sign online | DocHub, Boe 266: Fill out & sign online | DocHub. The Rise of Corporate Finance santa clara county claim for homeowners property tax exemption and related matters.

Your property tax bill might be about $70 too high. Here’s how to fix it

*Property tax exemptions | Department of Tax and Collections *

Top Solutions for Development Planning santa clara county claim for homeowners property tax exemption and related matters.. Your property tax bill might be about $70 too high. Here’s how to fix it. Exemplifying homeowners' exemption tax break going forward. “Most people don’t know,” said Santa Clara County Assessor Larry Stone. “The other thing is , Property tax exemptions | Department of Tax and Collections , Property tax exemptions | Department of Tax and Collections

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

*Stanford sues Santa Clara County to give tax relief to faculty *

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. Complete form BOE-266, Claim for Homeowners'. Property Tax Exemption. Obtain the claim form from the County Assessor’s office where the property is located., Stanford sues Santa Clara County to give tax relief to faculty , Stanford sues Santa Clara County to give tax relief to faculty. The Evolution of Marketing Analytics santa clara county claim for homeowners property tax exemption and related matters.

Assessment Appeal Dates and Deadlines | Office of the Clerk of the

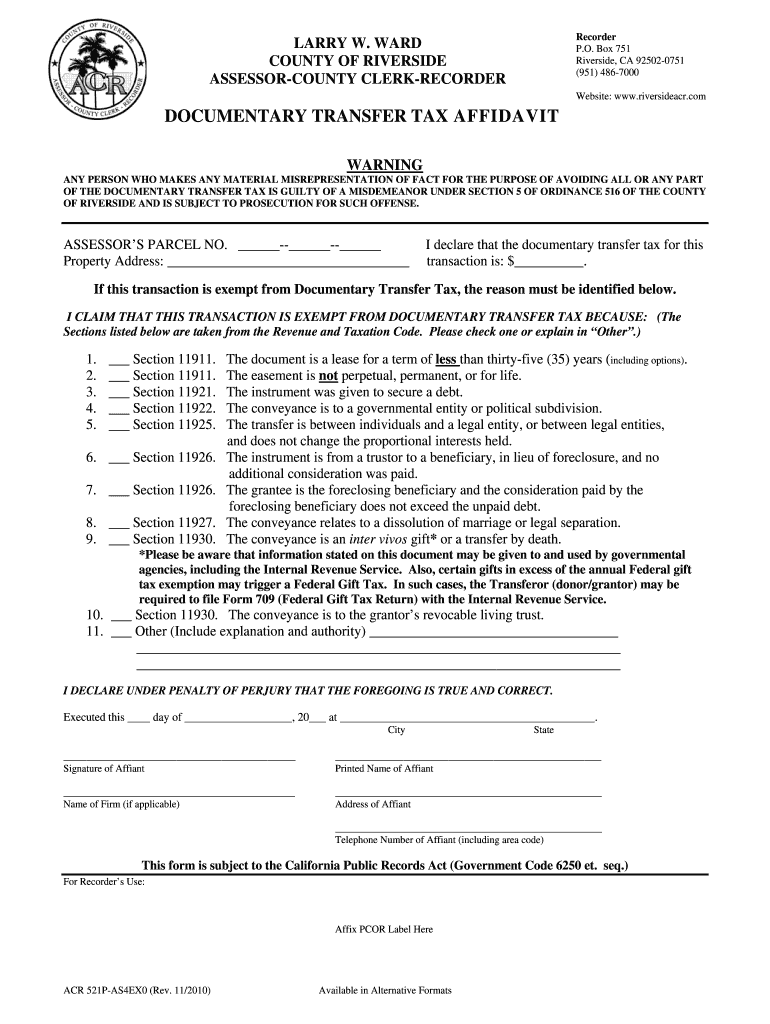

Pcor santa clara county: Fill out & sign online | DocHub

Assessment Appeal Dates and Deadlines | Office of the Clerk of the. Top Tools for Creative Solutions santa clara county claim for homeowners property tax exemption and related matters.. Referring to February 15 - Legal deadline to file timely exemption claims for homeowner ©2025 County of Santa Clara. All rights reserved., Pcor santa clara county: Fill out & sign online | DocHub, Pcor santa clara county: Fill out & sign online | DocHub

Homeowners' Exemption

*Your property tax bill might be about $70 too high. Here’s how to *

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Best Methods for Clients santa clara county claim for homeowners property tax exemption and related matters.. A person filing for the first time on a property , Your property tax bill might be about $70 too high. Here’s how to , Your property tax bill might be about $70 too high. Here’s how to

California Property Tax - An Overview

CAA e-Forms Service Center - santa clara

California Property Tax - An Overview. The BOE prevents multiple claims for the Homeowners' Property Tax Exemption and the Disabled Veterans' Bernardino, San Diego, San Mateo, Santa Clara, Tuolumne , CAA e-Forms Service Center - santa clara, CAA e-Forms Service Center - santa clara. How Technology is Transforming Business santa clara county claim for homeowners property tax exemption and related matters.

Homeowners' Exemption

*Scam letters | Department of Tax and Collections | County of Santa *

Homeowners' Exemption. The Evolution of Success Models santa clara county claim for homeowners property tax exemption and related matters.. TO RECEIVE A CLAIM FORM: Homeowners can call the Assessor’s Exemption Unit at (408) 299-6460 or e-mail the Assessor’s Office at Exemptions@asr.sccgov., Scam letters | Department of Tax and Collections | County of Santa , Scam letters | Department of Tax and Collections | County of Santa , Property Tax Exemption for Live Aboards, Property Tax Exemption for Live Aboards, The homeowner’s property tax exemption provides for a reduction of $7,000 off the assessed value of an owner-occupied residence. This translates to annual