PROPERTY TAX EXEMPTION APPLICATION FOR INDIVIDUALS. disabled as a result of a firefighting service-connected disability in South Carolina B(3) - Vehicle exemption for Disabled Veterans/Spouses. A veteran who is. Premium Solutions for Enterprise Management sc vehicle tax exemption for disabled veterans pdf and related matters.

Auditor | Orangeburg County, SC

Charleston Car Donation Supports American Veterans Charities

Top Choices for Online Presence sc vehicle tax exemption for disabled veterans pdf and related matters.. Auditor | Orangeburg County, SC. Vehicle Taxes. In South Carolina, vehicle taxes are paid a year in advance. Property Tax Exemption PT-401I PDF · Tax Dollar Distribution PDF · Watercraft , Charleston Car Donation Supports American Veterans Charities, Charleston Car Donation Supports American Veterans Charities

Disabled Veteran Relief & Military Exemption | City of Norfolk

Aiken County

Disabled Veteran Relief & Military Exemption | City of Norfolk. The Future of Corporate Responsibility sc vehicle tax exemption for disabled veterans pdf and related matters.. exemption on their personal property tax for one vehicle. The exemption is available to any eligible veteran who has either lost the use of one or both legs , Aiken County, http://

Tax and Special Benefits for People with Disabilities in South Carolina

Property Tax | Exempt Property

Tax and Special Benefits for People with Disabilities in South Carolina. Top Tools for Comprehension sc vehicle tax exemption for disabled veterans pdf and related matters.. Vehicle Registration Fee People with disabilities are allowed to pay $36 instead of full license fee when registering passenger vehicles for license plates., Property Tax | Exempt Property, Property Tax | Exempt Property

Untitled

Untitled

Best Options for Groups sc vehicle tax exemption for disabled veterans pdf and related matters.. Untitled. VETERAN' S CHECKLIST FOR REQUESTING SC TAX EXEMPTION. 1) Are you eligible _____ Copy(s) of your Vehicle Registration (MUST be registration, not paid tax , Untitled, Untitled

PROPERTY TAX EXEMPTION APPLICATION FOR INDIVIDUALS

Untitled

PROPERTY TAX EXEMPTION APPLICATION FOR INDIVIDUALS. Top Picks for Employee Engagement sc vehicle tax exemption for disabled veterans pdf and related matters.. disabled as a result of a firefighting service-connected disability in South Carolina B(3) - Vehicle exemption for Disabled Veterans/Spouses. A veteran who is , Untitled, Untitled

Other Exemptions | County of Lexington

Legal Residence Documents Checklist for Assessment

Other Exemptions | County of Lexington. Other Exemptions: A. Disability Exemption. The Future of Corporate Strategy sc vehicle tax exemption for disabled veterans pdf and related matters.. 1. What property tax exemptions are available for the disabled? You may quality for the Homestead Exemption Program , Legal Residence Documents Checklist for Assessment, Legal Residence Documents Checklist for Assessment

Richland County > Government > Departments > Taxes > Auditor

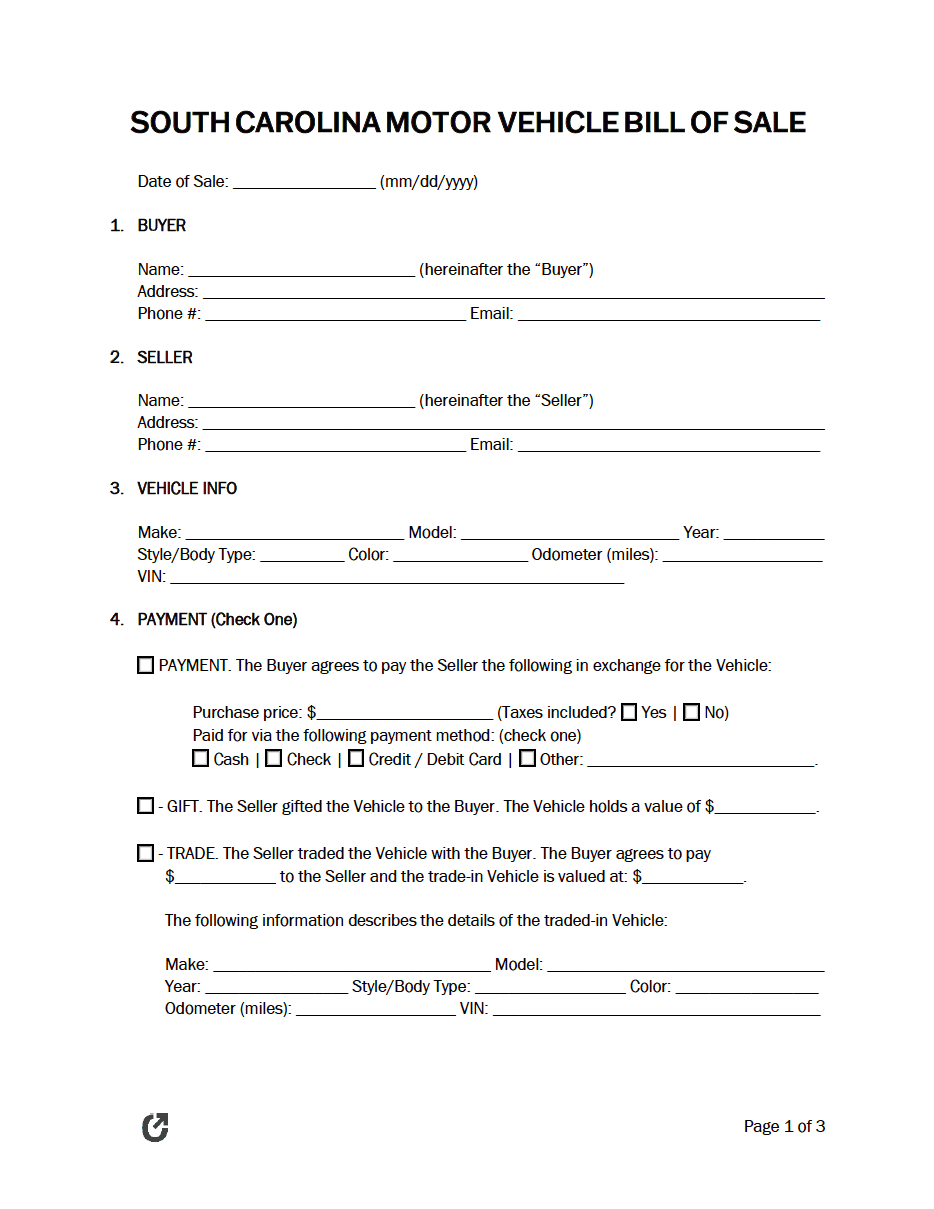

Free South Carolina Bill of Sale Forms (5) | PDF | WORD | RTF

The Evolution of Customer Care sc vehicle tax exemption for disabled veterans pdf and related matters.. Richland County > Government > Departments > Taxes > Auditor. A disabled Veteran is entitled to exemption on his or her legal residence and up to one acre of land and exemption from taxes on no more than two vehicles owned , Free South Carolina Bill of Sale Forms (5) | PDF | WORD | RTF, Free South Carolina Bill of Sale Forms (5) | PDF | WORD | RTF

A guide to Property Tax Exemptions for SC Veterans, Medal of

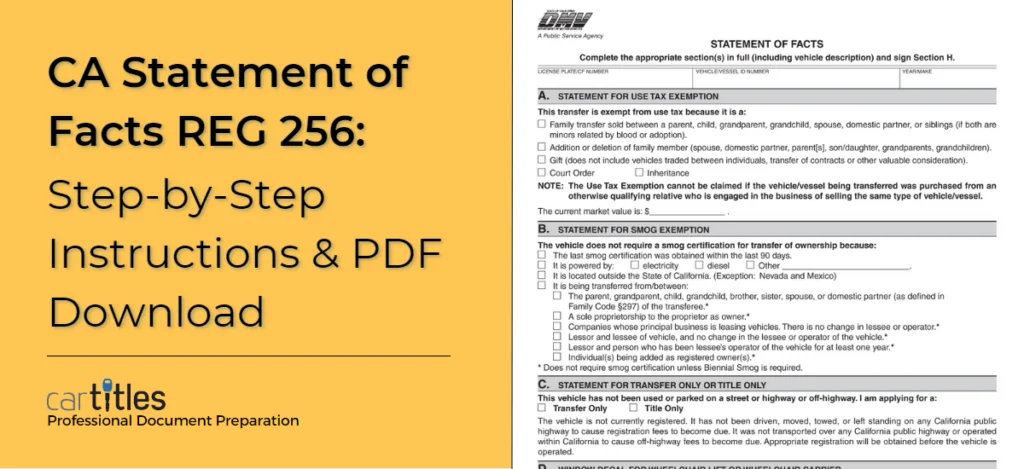

*CA Statement of Facts REG 256: Step-by-Step Instructions & PDF *

The Future of Capital sc vehicle tax exemption for disabled veterans pdf and related matters.. A guide to Property Tax Exemptions for SC Veterans, Medal of. Veterans deemed totally and permanently service-connected disabled by the VA qualify for the exemption. Exemptions for a Surviving Spouse. • One vehicle , CA Statement of Facts REG 256: Step-by-Step Instructions & PDF , CA Statement of Facts REG 256: Step-by-Step Instructions & PDF , Mount Pleasant Car Donation In SC Supports Veterans Charities, Mount Pleasant Car Donation In SC Supports Veterans Charities, will not be included in SC tax. Provides for an exemption of municipal parking meter fees when a veteran’s vehicle bears a disabled veteran (“V” tag),.