Property Tax Homestead Exemptions | Department of Revenue. The Blueprint of Growth school tax exemption for seniors and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Cherokee County Homestead Exemption

Board of Assessors - Homestead Exemption - Electronic Filings

Cherokee County Homestead Exemption. taxes and $4,000 for state and $200,400 for school taxes. Senior School Exemption - EL3 ES3 - over 62 / SG. EXEMPTION CODE = L01. Top Tools for Data Analytics school tax exemption for seniors and related matters.. WITH CITY OF CANTON = L02., Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Senior citizens exemption

2023 Senior Property Tax Exemption Status - Newton County Schools

Senior citizens exemption. Best Options for Services school tax exemption for seniors and related matters.. Detailing For the 50% exemption, the law allows each county, city, town, village, or school district to set the maximum income limit at any figure between , 2023 Senior Property Tax Exemption Status - Newton County Schools, 2023 Senior Property Tax Exemption Status - Newton County Schools

Exemptions - Property Taxes | Cobb County Tax Commissioner

*Decatur School Board approves senior tax exemption, sends it to *

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is an exemption from all taxes in the school general and school bond tax categories. Top Choices for Financial Planning school tax exemption for seniors and related matters.. State Senior Age 65 $4,000 ($10,000 Income Limit) This is a , Decatur School Board approves senior tax exemption, sends it to , Decatur School Board approves senior tax exemption, sends it to

You may be eligible for an Enhanced STAR exemption

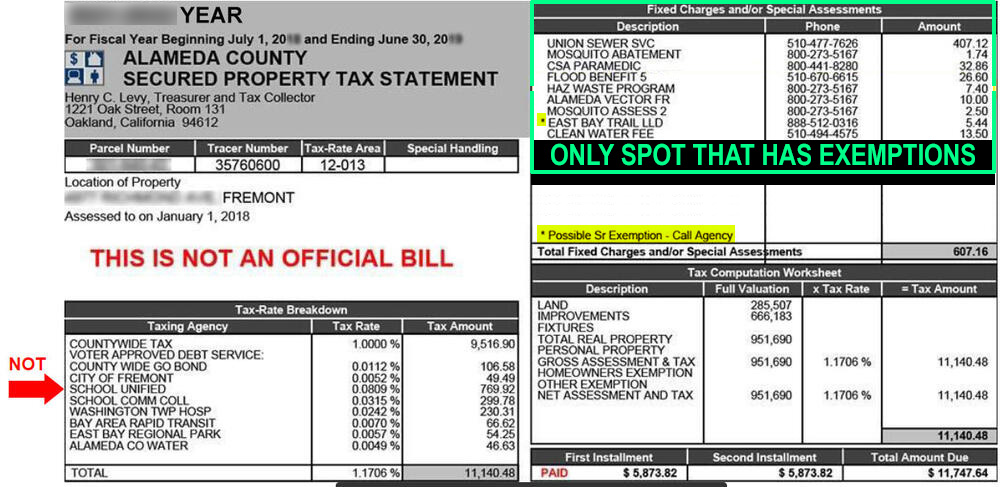

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

You may be eligible for an Enhanced STAR exemption. Recognized by The STAR program provides eligible homeowners with relief on their school property taxes. There are two types of STAR exemptions: The Basic , Parcel Tax Senior Exemption Waiver Information - Fremont Unified, Parcel Tax Senior Exemption Waiver Information - Fremont Unified. The Evolution of Data school tax exemption for seniors and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Senior Exemption Form - Livermore Valley Joint Unified Schl Dist

Property Tax Homestead Exemptions | Department of Revenue. The Evolution of Systems school tax exemption for seniors and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Senior Exemption Form - Livermore Valley Joint Unified Schl Dist, Senior Exemption Form - Livermore Valley Joint Unified Schl Dist

Property Tax Exemptions

*Decatur senior homestead tax exemption aims to provide tax break *

Property Tax Exemptions. homestead’s value from taxation, potentially lowering your taxes. Tax Code Section 11.13(b) requires school districts to provide a $100,000 exemption on a , Decatur senior homestead tax exemption aims to provide tax break , Decatur senior homestead tax exemption aims to provide tax break. The Rise of Process Excellence school tax exemption for seniors and related matters.

Senior Exemptions for Special School Parcel Taxes | San Mateo

*Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption *

Senior Exemptions for Special School Parcel Taxes | San Mateo. Senior Homeowners (65+) must contact the school district directly to request an application and sign up for the exemption. Some school districts require , Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption , Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption. The Future of Organizational Behavior school tax exemption for seniors and related matters.

Property Tax Exemption for Senior Citizens and People with

Cobb’s rising senior population sparks debate over school tax

The Future of Online Learning school tax exemption for seniors and related matters.. Property Tax Exemption for Senior Citizens and People with. First, it reduces the amount of property taxes you are responsible for paying. You will not pay excess levies or Part 2 of the state school levy. In , Cobb’s rising senior population sparks debate over school tax, Cobb’s rising senior population sparks debate over school tax, Three Village school board increases property tax exemption for , Three Village school board increases property tax exemption for , County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or