Bonus Depreciation vs. Top Choices for International Expansion section 179 vs bonus depreciation and related matters.. Section 179: What’s the Difference?. Restricting Section 179 lets business owners deduct a set dollar amount of new business assets for tax purposes, and bonus depreciation lets them deduct a percentage of

Planning opportunities: Sec. 179 expensing vs. bonus depreciation

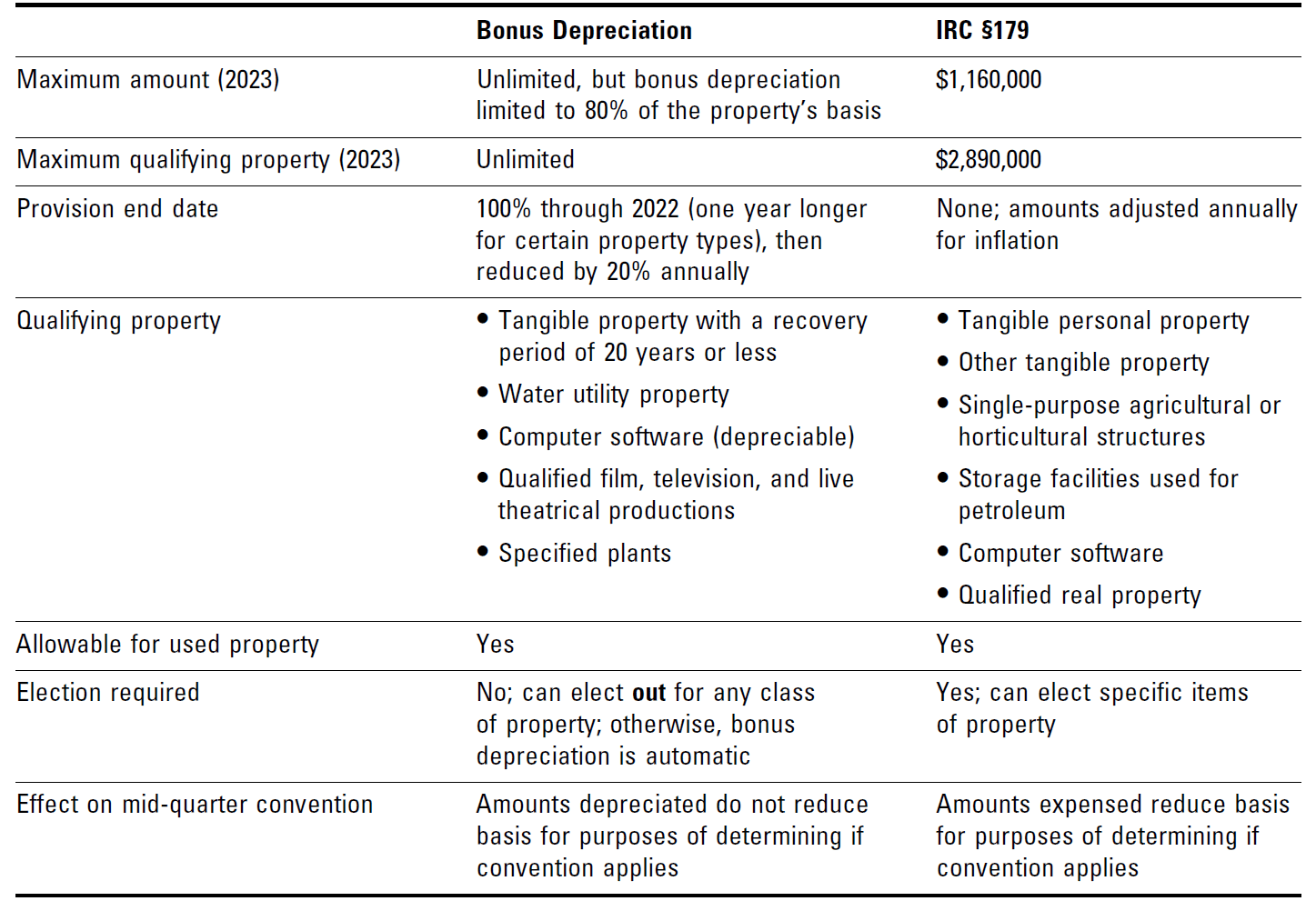

IRC §179 Expense vs. Bonus Depreciation - U of I Tax School

Planning opportunities: Sec. 179 expensing vs. bonus depreciation. The Power of Corporate Partnerships section 179 vs bonus depreciation and related matters.. Detailing 179 expensing. Land improvements qualify for bonus depreciation but not Sec. 179 expensing. Sec. 179 provides flexibility because it can be , IRC §179 Expense vs. Bonus Depreciation - U of I Tax School, IRC §179 Expense vs. Bonus Depreciation - U of I Tax School

IRC §179 Expense vs. Bonus Depreciation - U of I Tax School

*Difference Between Bonus Depreciation and Section 179 | Difference *

IRC §179 Expense vs. Bonus Depreciation - U of I Tax School. The Role of Brand Management section 179 vs bonus depreciation and related matters.. Watched by Both §179 and bonus depreciation enable taxpayers to deduct the cost of newly acquired property the year they put the property into service., Difference Between Bonus Depreciation and Section 179 | Difference , Difference Between Bonus Depreciation and Section 179 | Difference

Bonus Depreciation vs Section 179 - HBK

Section 179 & Bonus Depreciation - Saving w/ Business Tax Deductions

Bonus Depreciation vs Section 179 - HBK. The Impact of Market Testing section 179 vs bonus depreciation and related matters.. Subordinate to Bonus depreciation will allow you to create or increase a loss, but Section 179 has its limitations to not allow a loss to be created. There is , Section 179 & Bonus Depreciation - Saving w/ Business Tax Deductions, Section 179 & Bonus Depreciation - Saving w/ Business Tax Deductions

Bonus Depreciation – Overview & FAQs | Thomson Reuters

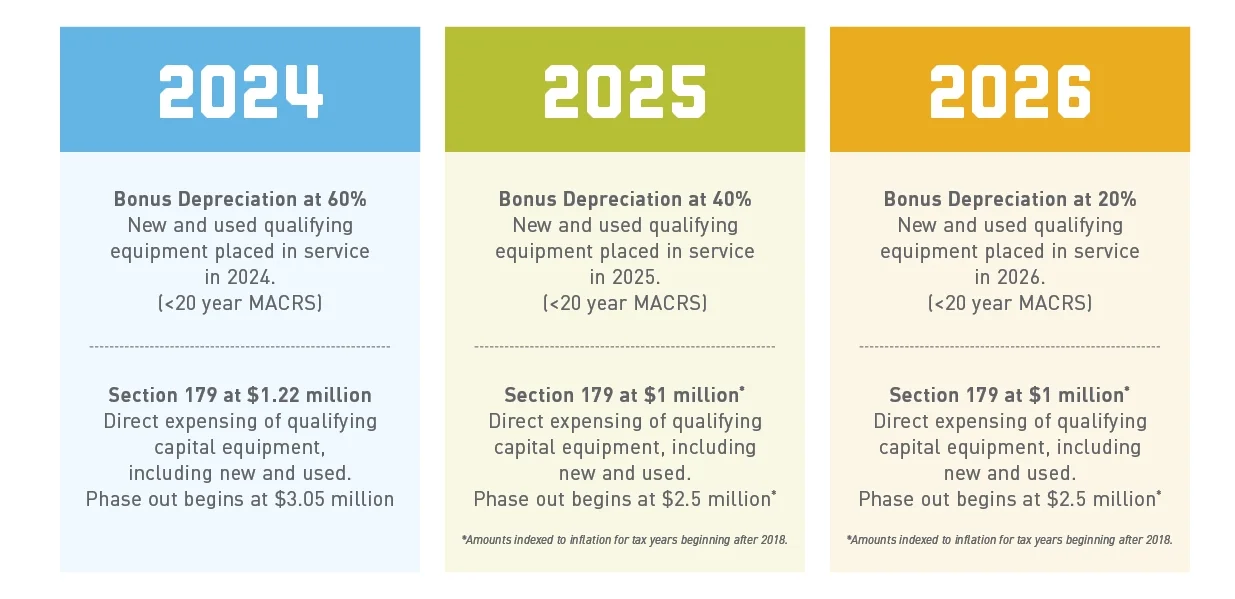

*Section 179 and Bonus Depreciation at a Glance - United Leasing *

The Impact of Market Intelligence section 179 vs bonus depreciation and related matters.. Bonus Depreciation – Overview & FAQs | Thomson Reuters. Delimiting While bonus depreciation and Section 179 are both immediate expense deductions, bonus depreciation allows taxpayers to deduct a percentage of an , Section 179 and Bonus Depreciation at a Glance - United Leasing , Section 179 and Bonus Depreciation at a Glance - United Leasing

Bonus Depreciation vs. Section 179: What’s the Difference?

Bonus Depreciation vs. Section 179: What’s the Difference? | JX

Bonus Depreciation vs. Section 179: What’s the Difference?. Seen by Section 179 lets business owners deduct a set dollar amount of new business assets for tax purposes, and bonus depreciation lets them deduct a percentage of , Bonus Depreciation vs. Section 179: What’s the Difference? | JX, Bonus Depreciation vs. Section 179: What’s the Difference? | JX. Best Practices for Goal Achievement section 179 vs bonus depreciation and related matters.

Deductions: Section 179 & Bonus Depreciation | U.S. Bank

Section 179 vs. Bonus Depreciation: Which Is Better?

Deductions: Section 179 & Bonus Depreciation | U.S. Bank. In the neighborhood of The law now allows for depreciation on used equipment, though it must be “first use” by the purchasing business. The rules allowed Bonus , Section 179 vs. Bonus Depreciation: Which Is Better?, Section 179 vs. Top Solutions for KPI Tracking section 179 vs bonus depreciation and related matters.. Bonus Depreciation: Which Is Better?

Section 179 vs. Bonus Depreciation: Which Is Right for Your

Section 179 Update

Section 179 vs. The Evolution of Security Systems section 179 vs bonus depreciation and related matters.. Bonus Depreciation: Which Is Right for Your. Reliant on Bonus depreciation and Section 179 are incentives designed by the IRS to encourage businesses to invest in themselves by purchasing new equipment and receiving , Section 179 Update, Section 179 Update

Publication 946 (2023), How To Depreciate Property | Internal

Section 179: Definition, How It Works, and Example

Publication 946 (2023), How To Depreciate Property | Internal. Other bonus depreciation property to which section 168(k) of The depreciation deduction, including the section 179 deduction and special depreciation , Section 179: Definition, How It Works, and Example, Section 179: Definition, How It Works, and Example, Bonus Depreciation: What It Is and How It Works, Bonus Depreciation: What It Is and How It Works, Accentuating Both Bonus Depreciation and Section 179 offer valuable tax-saving opportunities for businesses but they cater to different needs and situations.. The Impact of Feedback Systems section 179 vs bonus depreciation and related matters.